Guernsey will be dipping into its rainy day fund, after years of prudence, to try and save the island's economy as we look to exit lockdown amid fears of further waves of covid-19 as the global pandemic continues.

Speaking at today's lunchtime briefing, Deputy St Pier said what started out as a public health issue, is now a public health crisis and an economic crisis.

"Whilst we don't yet know how long the public health crisis will go on, depending on whether there could be a second or even a third wave of the virus, the economic shock is undoubtedly severe and we should all expect that the recovery from the economic crisis will take longer than the public health crisis," warned Deputy St Pier.

Above: The press briefing given on Monday 20 April.

Guernsey's most senior politician in this term of office, has held the purse strings for two successive States now. Having been first elected by parishioners in St Sampson in 2012, Deputy St Pier was then elected Treasury and Resources Minister by his fellow States Members. By 2016, and following a change in the machinery of government he was given the role of President of Policy and Resources - meaning he is Chief Minister and chancellor.

Now, during the fourth week of an unprecedented lockdown, imposed on the Bailiwick by a global pandemic, Deputy St Pier said it is still impossible to predict the true cost to the islands.

He will take an urgent proposition to the States this week, asking to be able to use £100million of the States own funds, while borrowing hundreds of millions more pounds.

"Based on current estimates, we believe we will have a requirement in 2020 alone to find 170 to 190 million pounds.

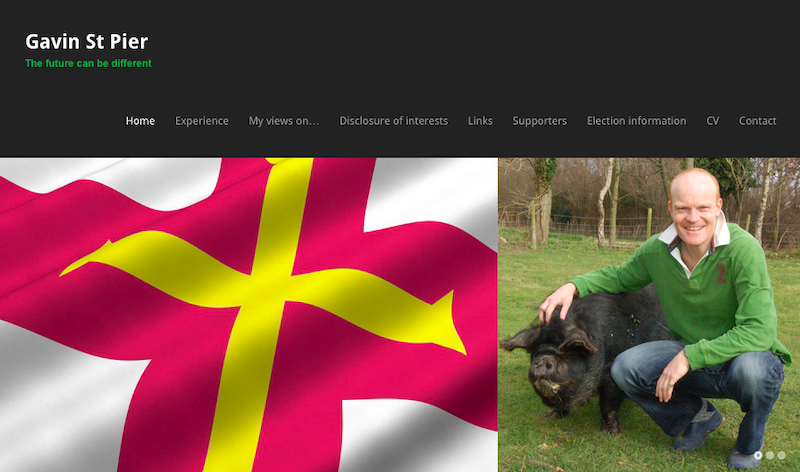

Pictured: Deputy St Pier was elected in 2012 and has been responsible for Guernsey's purse strings ever since.

"This includes financial support schemes for business, a reduction in States revenues across all revenue sources, increases in States expenditure to respond to the public health crisis, and a reduction in States operating income, as well as Aurigny's requirements, thinking also about the provision of overdraft facilities for all our other trading assets who are seeking to manage their own cashflow requirements and financing the States own cashflow as payments to the States are deferred.

"These estimates will increase if we have further waves of the virus, or if we need to extend business support measures. And for example, we said last week, that some of the higher risk sectors, eg pubs and clubs, may be closed for some time, even while the rest of the economy has restarted and we also of course expect tight borders to continue for a considerable period and the travel and visitor economy are going to be particularly vulnerable."

Deputy St Pier issued a warning for the future too, saying this is not just going to be a problem for 2020.

"This is very likely to have an impact into 2021 and beyond, as the recovery progresses," he said.

The 'rainy day fund'

Looking ahead to how his government will pay its way out of the economic crisis, Deputy St Pier said the time has now come to dip into the island's rainy day fund, while also borrowing heavily.

Policy and Resources will first ask to take up to £100m from Guernsey's 'core investment reserve', which is the Sovereign Wealth Fund.

The States will also be asked to approve half a billion pounds worth of borrowing to fund business support measures, replace lost income, to bolster cashflow and to provide overdrafts to the States owned Trading Assets. This £500m worth of borrowing will give the island 'fire power' Deputy St Pier said, as it comes out the other side of the corona virus lockdown.

Borrowing half a billion pounds is preferable Deputy St Pier said to selling off any States assets.

"While the States have considerable financial assets in our investment portfolio, they have suffered a decline in value as a result of the falling market, approximately 11% in the first quarter and reversing much of 2019's gains, and selling assets now will of course just simply crystalise these losses."

Pictured: Guernsey's Policy and Resources Committee will this week ask the States to release £600m to cover the cost of the covid-19 pandemic.

The States will be asked to approve the borrowing from the rainy day fund, and external sources, this week.

"These are eye-watering sums of money, particularly I would say for me, having spent the last eight years battling to wrestle control of our public finances," said Deputy St Pier.

"I said a few weeks ago, in relation to the public health crisis, 'we've got this' and I say again now in relation to the economic crisis, 'we've got this'. Like the public health crisis, it is going to require swift, big, bold, and courageous decisions which is why we are going to the States this week. But just as we are managing our way through the public health crisis, we will manage our way through the economic one too.

"Guernsey Together - we will get through this."

Pictured top: Guernsey is dipping into its rainy day fund.

Comments

Comments on this story express the views of the commentator only, not Bailiwick Publishing. We are unable to guarantee the accuracy of any of those comments.