The Bailiwick has voluntarily published new documents outlining its approach to serious financial crime with just months to go until a visit from the Europe’s financial inspectors.

A risk assessment was last undertaken in 2020 but investigations, risk appetite, and a “vision” have been renewed with a major financial assessment by Moneyval due to start later this year.

It found the greatest risk for money laundering comes from foreign actors due to a low local crime rate, but noted the latter would mainly come from the drug trade and fraud.

Meanwhile, cross-border business, with funds passing through Guernsey, was found to be the greatest risk in supporting foreign terrorism.

A “national strategy” is published alongside the assessments for combatting these crimes which is jointly subscribed to by the governments of Guernsey, Alderney, and Sark.

It aims to comply with international standards, especially the recommendations of the global financial crime watchdog, Financial Action Task Force (FATF), and to minimise the risks identified internally.

It’s also the first time the islands have assessed the risks of the financing of weapons of mass destruction.

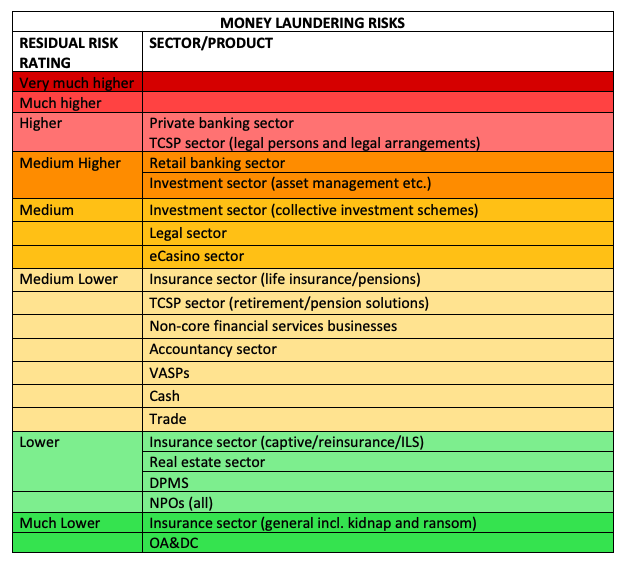

Pictured: The industries or products ranked based on risks associated with money laundering.

The States said it was committed to rooting out and preventing financial crime when in published the documents at the end of the year.

Deputy Lyndon Trott, President of the Policy & Resources Committee, said while there’s no requirement for the jurisdictions to produce a strategy it was felt important “to articulate the Bailiwick’s position publicly and transparently for the benefit of domestic and international stakeholders.

“The aim in doing this is to emphasise that public and private sectors alike are working to a common purpose – and by doing so to deter criminals from using the Bailiwick for their activities.

“As criminals adopt new approaches, and as global expectations change on what best practice looks like, the Bailiwick is committed to continually investing in and enhancing the controls protecting us from criminal abuse and contributing to the prevention and detection of financial crime outside our borders.”

The Home Affairs President, Deputy Rob Prow, added that “robust” structures have been adopted to ensure the strategy is delivered as intended, including a joint forum of senior politicians and service managers.

The documents can be found HERE.

Comments

Comments on this story express the views of the commentator only, not Bailiwick Publishing. We are unable to guarantee the accuracy of any of those comments.