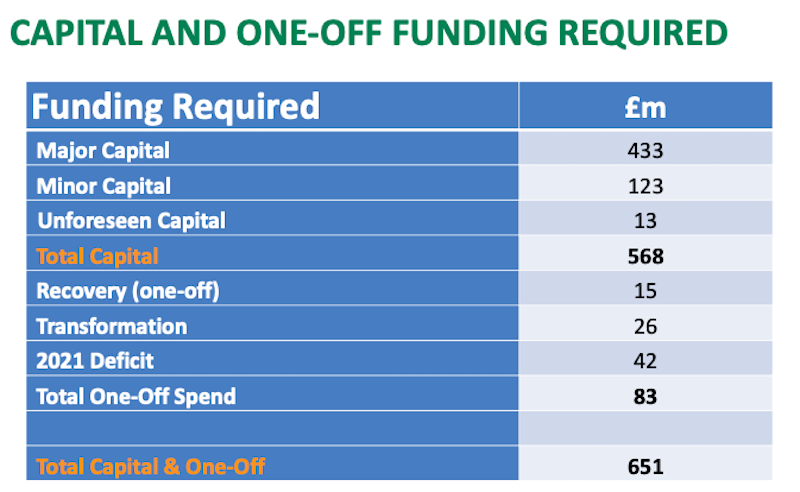

The States has agreed to capital spending of £568m in the next five years, in the process handing over full delegated authority to Policy & Resources on the delivery of the capital portfolio.

The Government Work Plan sets out a roadmap for the political term, outlining which capital projects will be taken forward and the covid-related deficits in public finances that will need to be met as one-off costs.

Two amendments to the GWP were successful, leading to the increased availability of 'life-extending' NICE drugs - which were approved last term without any long-term funding - and a commitment for a review of end-of-life care, which is already behind schedule and would have been pushed to the back of the queue by P&R and HSC.

An amendment aiming to stop Equal Pay for Work of Equal Value from being put on the back burner was voted out by the smallest of margins. as were efforts to delay the approval of £200m worth of Government borrowing until after September's debate on long-term taxation.

Pictured: The States plans to spend more than a half a million pounds on capital projects this term.

It also means that the States has signed off an astonishing transferral of delegated authority to the States' senior Committee, P&R. In the last budget, the general delegated authority level for capital schemes was raised from £2m to £5m.

That cap has now been removed entirely, despite opposition led by Deputies Gavin St Pier and Yvonne Burford, who sought to cap it at £10m.

"This is the most fiscally incontinent plan I’ve seen in my nine years in the States," said Deputy St Pier in his general debate speech.

"To drain £258m from our reserves and borrow an additional £200m, both as part of what is described as a temporary solution and a way of managing and not removing the underlying structural deficit with millions added to spending and almost nothing cut from it. It’s depressing.

"In particular, I remain deeply concerned by granting unlimited delegated authorities over both the financing and delivery of the capital portfolio."

There was a feeling that the Assembly was abdicating its own responsibility by not continuing to provide that oversight and scrutiny of public funds in the light of day. However, an amendment seeking to limit P&R's authority was again unsuccessful.

Quite remarkable move to curtail debate on the Government Work Plan. The States is considering spending £650,000,000 including new borrowing of £200,000,000 and 13 members think we don’t need to discuss it.

— Yvonne Burford (@YvonneBurford) July 23, 2021

As the latter was voted through, Deputy John Gollop could be heard muttering: "That's a big win for P&R".

In a week of debate that solidified the current P&R's almost executive position in the States Assembly, the Committee was granted permission to borrow £200m to help finance the GWP.

Deputy Heidi Soulsby argued that the States “has no alternative” but to do so. "The very real and immediate impact of a decision not to borrow is that when we continue the debate on secondary education, we must have at the back of our minds that, as things stand, we don’t have enough money to fulfil any propositions agreed or complete phase 1 of the hospital modernisation. In fact, it is worse than that.

"Assuming we want to leave some funds in the bank for the next assembly, after we’ve funded the minor capital already agreed, this year’s deficit and the recovery one-offs, we’d only have about £52m left for capital. This isn’t enough for the must do’s (£80m) or finishing the in-train projects (£60m) let alone a school or a hospital."

"If we don’t [borrow] we will have one hell of a bun fight with committees wanting to submit their businesses case right now to try to get the small amount of money available for their projects."

Really delighted all propositions in the Government Work Plan were passed today. A lot of hard work from the team to get us this far since October. Thanks to everyone for their effort.

— Deputy Heidi Soulsby MBE (@HeidiSoulsby) July 23, 2021

Deputy Sasha Kazantseva-Miller attempted unsuccessfully to delay the decision on multi-million pound government borrowing until September, when the States will debate the future of taxation.

"This level of capital infrastructure and extra borrowing will put the island in an unsustaibale financial situation, breaking the agreed fiscal framework and leaving future governments without resource unless further measures are taken such as additional taxation, public cuts and accelerated economic growth," she argued.

"This decision is out of order with the review of taxation. We are asked not to conflate them, but I do not see how you can decouple the two."

P&R's Treasury Lead Deputy Mark Helyar responded, saying Deputy Kazantseva-Miller's plea to the Assembly to show "basic financial common sense" was "a complete misunderstanding" of the facts.

This vote means that the States are happy to remove the upper limit (currently £5m) on P&R's delegated authorities to approve capital projects. No previous States would have sanctioned such a transfer of power from Assembly to P&R. https://t.co/ZZ1tjlZrnr

— Gavin St Pier ???????? (@gavinstpier) July 22, 2021

Deputy Helyar said the funding approved in the GWP can be covered within the current tax revenue forecasts "with adequate headroom".

He added: "It would be a very dangerous and, in fact, reckless governance failure to approve the Government Work Plan without having the money to finance it."

Deputy Helyar told the Assembly that September's debate on taxation was for long-term changes, coming into effect from 2024/2025.

When his committee's proposals come to the States, they will almost certainly include proposals to increase taxation in order to cope with the island's "insurmountable financial problems".

Comments

Comments on this story express the views of the commentator only, not Bailiwick Publishing. We are unable to guarantee the accuracy of any of those comments.