Policy & Resources is declining to publish its workings behind new global corporate tax rates which it predicts will raise an additional £30m per year for public coffers.

The States are edging closer to agreeing to implement the new 15% international tax on the profits of large multi-national corporations, with a debate penned for September ahead of the tax applying from 1 January.

Earlier this year Treasury revised its initial estimate of how much cash this would bring in from £10m to £30m per year after new information on the approach was distributed by the OECD, which is spearheading the initiative.

That upgraded forecast was the foundation for political support which saw the multi-million-pound funding for the new post-16 education campus be approved after the project was initially sidelined. The aged building is now being torn down, with a preferred bidder selected for the build just this week.

Nig Garland, Deputy Director of the Revenue Service, said the political members of Policy & Resources were presented with workings earlier this year, with a “high-level overview” given to other deputies during internal briefings.

But he said the details will go no further than that.

“Wider circulation of the methodology has not been disclosed further, owing to the sensitive nature of the underlying information, being based on confidential income tax records held by the Revenue Service,” he said.

P&R’s latest policy letter on the tax says the £30m take is “unlikely to be fully realised until 2027” and that scepticism should still be applied to the £30m per annum estimate.

“There remains some uncertainty around the estimate of additional revenue which may be raised, because it is dependent not only on how the legislation is applied in Guernsey, but also how it is applied in countries where those same entities might also face tax, or in jurisdictions where business might relocate if they feel there is an advantage to doing so,” it says.

“This means there remains uncertainty around the estimated revenues.”

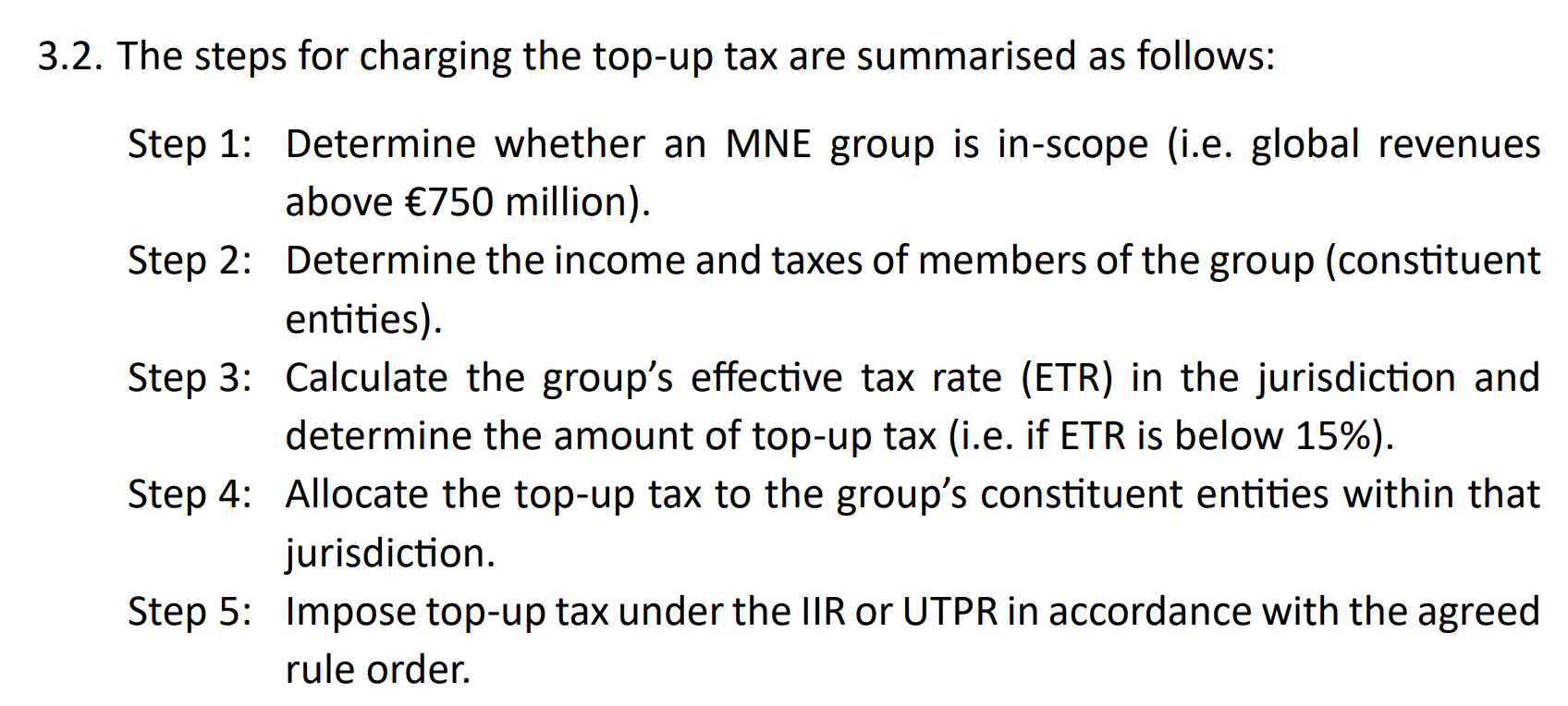

Pictured: How the tax will be applied.

The OECD has proposed a two-pronged approach to gather more tax from large companies across the world in response to digitisation of the economy. Hundreds of countries have signed up to the scheme, which will see consistent profit charges for the largest multi-national companies.

Pillar One focuses on digital firms and suggests relocating taxing responsibility to countries where users and consumers are located, rather than where the company is physically located. Regulated financial services are excluded.

Pillar Two focuses on ensuring the largest firms would pay a minimum level of tax regardless of where they are based to avoid the shift of profits to low-tax jurisdictions. Funds are excluded.

Only the second ‘pillar’ applies to Guernsey with multinational groups of companies with global annual turnover of more than €750m facing a 15% tax on profits generated locally.

It won’t signal the end of the zero-ten tax regime locally which sees financial services businesses pay a 10% tax on profits, as the OECD rules are in addition to domestic tax arrangements.

Attempts to alter the zero-ten arrangement have been rejected on multiple occasions by this States, and the current P&R has no desire to deviate Guernsey’s corporate tax policy to that of Jersey and the Isle of Man.

“Guernsey is committed to offering an attractive and globally competitive investment environment for business, providing administrative simplicity, certainty of outcome and adherence to international standards.”

Comments

Comments on this story express the views of the commentator only, not Bailiwick Publishing. We are unable to guarantee the accuracy of any of those comments.