Deputy Gavin St Pier has explained how fuel duty is calculated, after the States were accused of lying about the amount of money it raises each year.

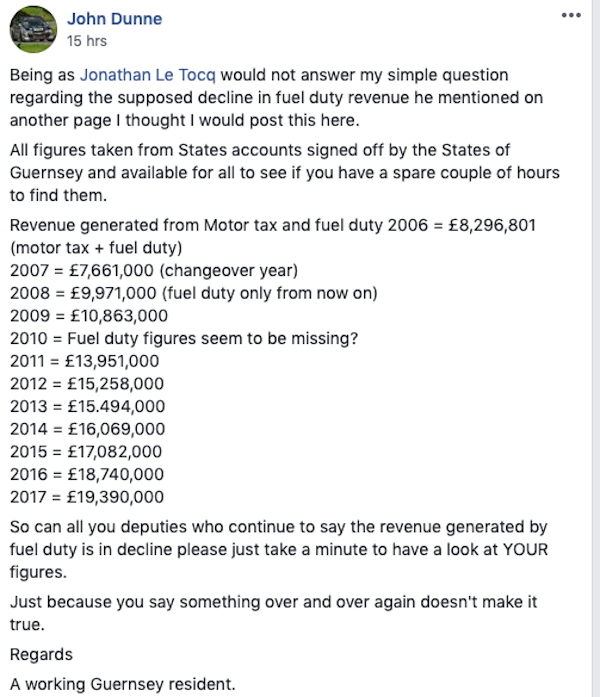

The States have repeatedly said in recent years that the value of revenue has decreased, but John Dunne searched the gov.gg website to find the figures out for himself.

Mr Dunne posted the figures on Facebook with numerous comments in reply expressing surprise at the numbers.

Since then, the 2019 Budget - with the latest fuel duty rise - has been approved.

Pictured: John Dunne's post on Facebook.

Deputy Gavin St Pier said the fuel duty increases have been imposed to ensure the amount of money raised by sales maintains its 'real terms value'.

His statement is reproduced in full below:

Deputy Gavin St Pier, President of the Policy & Resources Committee, said:

"The policy in the last two years has been to increase fuel duty to maintain the real terms value of the revenue it generates. This is to ensure the value of the revenue keeps pace with inflation.

"Prior to that period, there were various reasons for increasing fuel duty. These included an increase in lieu of paid parking and increases to raise additional revenue as part of the tax strategy – both of which were directed by previous Assemblies.

"I hope that clarifies, as I would not wish islanders to wrongly have the impression that all duty increases in the last decade were as a result of needing to maintain the real terms value of revenue generated. That has been the policy for two years only while we examine alternative options for this unsustainable revenue raising measure. The Policy & Resources Committee is determined by September 2019 to bring alternative options for the States of Deliberation to consider.

"In summary - the increase from 29p to 70.1p over the last dozen or so years can be broken down as 11.5p to keep pace with price inflation; 9.8p to compensate for falling volumes; 1.2p in lieu of paid parking (a States’ decision at the time) with the rest (18.6p) to raise additional revenue."

Pictured top: Deputy Gavin St Pier.

Comments

Comments on this story express the views of the commentator only, not Bailiwick Publishing. We are unable to guarantee the accuracy of any of those comments.