Guernsey is in the crosshairs of the UK Government and transparency campaigners over its stance on access to registers which some argue help expose crime and corruption, but others say put individuals unfairly at risk.

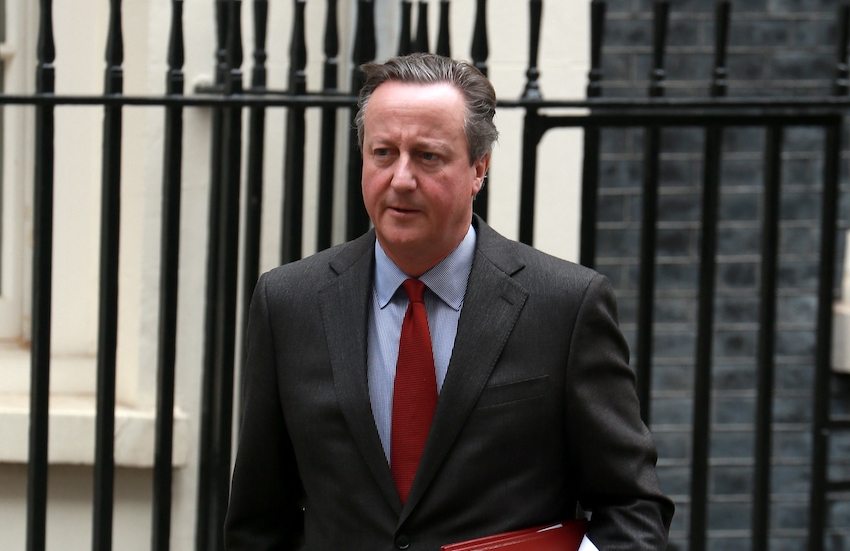

It is now a decade since the then Prime Minister David Cameron sought to put the UK at the forefront of the fight against terrorist financing, money laundering, tax avoidance and evasion by announcing the introduction of a register of beneficial ownership there that anyone could access.

For those who back these registers, they allow everyone to help expose wrongdoing and stem the flow of dodgy money, you are no longer just reliant on under-resourced law enforcement and tax authorities alone.

The registers allow people to join the dots which expose corruption and political interference.

Just look at Russian investments, VIP lane deals for PPE, or the stories and action that flowed from the Panama Papers.

They also allow other businesses to know who they are really dealing with.

Pictured: David Cameron.

But public registers are interfering in long established human rights around privacy, and as was ruled in a recent court case, doing so in a blanket manner can be disproportionate.

On 30 May 2018, European Union Member States were required to make their beneficial ownership registers accessible to the public.

It seemed that the tide was all flowing in one direction, and in May 2019 Guernsey, Jersey and the Isle of Man committed to follow by the end of this year.

They were cautious, and certainly did not want to move before it became a standard elsewhere, as threats abounded, however constitutionally questionable, that the UK would legislate to make it happen.

Then the tide ebbed.

The European Court of Justice ruled in November 2022 that the general public’s access to information on beneficial ownership constitutes a serious interference with the fundamental rights to respect for private life and to the protection of personal data.

It was a ruling which followed two cases of legal action in Luxembourg over information held on its register.

YO, a real estate company, had argued that general public access to its beneficial owner would expose them and their family to a disproportionate risk of fraud, kidnapping, blackmail, extortion, harassment, violence or intimidation.

The register includes full names, nationality, dates of birth, address, ID numbers and the extent of beneficial interests held.

Separate action on behalf of Sovim argued that it had not been shown how granting the public unrestricted access to the data held in the register met the aims of tackling money laundering or terrorist financing and ensuring certainty in commercial relationships and market confidence.

It also put forward a data protection argument.

The ruling sparked an EU review of the directive that led to fully public registers which is expected to conclude early next year.

The ruling was not a complete slap down, the rights in question are not absolute, they can, if justified, be interfered with, but full public access was seen as going too far.

Instead, the EU’s answer will allow access to those who can show a “legitimate interest” in seeing the information as well as financial institutions that need to do due diligence.

The UK is sticking with full public access - as have 14 other EU States and Bermuda.

Guernsey, and the other Crown dependencies of Jersey and the Isle of Man, last week announced another step on the road towards transparency, committing to allowing access for 'obliged entities', businesses required to conduct customer due-diligence, by the end of next year and then looking at a legitimate interest test which would allow the media and campaign groups access.

They stopped resolutely short of full public access, but carved out a defendable position internationally, especially given what is happening in Europe.

Opinion remains, as ever, divided.

“The debate is unlikely to die out any time soon, and large sections of public society point at recent scandals – such as the Panama Papers, Paradise Papers and Pandora Papers – as a reason for having public registers,” said Filippo Noseda, a Partner at Michcon Private, who has been leading on the Luxembourg appeals on behalf of clients of the firm.

“However, following the Sovim judgement and a more recent judgement from the European Court of Human Rights, it is important to recognise that fully public registers may expose compliant citizens who, for one reason or another own a stake in a UK company, to threats, abuse and even scams from criminals.

"Nobody doubts the need to fight crime, but this cannot be done at the expense of the fundamental right to privacy and data protection of millions of compliant citizens. There are almost five million companies registered in the UK. Experts recognise that this issue is more nuanced than some campaigners are portraying. Data minimisation is not a bad principle to strive for with public records and the ruling does not automatically ban beneficial-owner registers; it restricts the public’s access to them in all cases.”

Pictured: Dame Margaret Hodge.

Labour MP Dame Margeret Hodge has staunchly pursued the introduction of public registers in the Crown dependencies and Overseas Territories and won considerable cross party support in the process.

She believes the CD’s are using every excuse not to comply.

“Why does all this matter?” she said in the House of Commons.

“The epidemic of tax avoidance, tax evasion and economic crime flourishes in an environment of secrecy, and our overseas territories and Crown dependencies facilitate that secrecy.

“We know from the ever-growing number of leaks of data on financial misdemeanours that their role is central to enabling economic crime. Half the shell companies exposed in the 2016 Panama papers were incorporated in the British Virgin Islands. In 2017, the Paradise papers—a massive tranche of documents leaked from the offshore law firm Appleby—showed that a frightening number of frontline politicians held secret accounts, with the overseas territories appearing prominently as destinations of choice for hiding money.

“Those included people such as Justin Trudeau’s chief fundraiser, Donald Trump’s Commerce Secretary, Brazil’s Finance Minister, Uganda’s Foreign Minister, and our own Lord Ashcroft, who had—and probably still has—a Bermuda-based trust where he hides some of his wealth.

“Some 20% of the files in the FinCEN—Financial Crimes Enforcement Network—leak of 2020 contained clients that listed an address in the British Virgin Islands. The leak also revealed, because it was a leak of documents from an American agency, that the Americans viewed Britain as a higher-risk jurisdiction for its role in money laundering and financial crime. The Pandora papers leak of 2021 involved 12 million files, with data from 14 different law firms and company services providers. Over two thirds of the companies analysed in that batch of leaked documents were registered in the BVI.

“A World Bank review of 213 corruption cases that were investigated over the 30-year period to 2010 found that 70% involved anonymous shell companies. The UK, its overseas territories and Crown dependencies accounted for the second jurisdiction in terms of the number of corruption cases associated with it.”

There is unlikely to be any great internal political pressure in Guernsey to go the whole way on public access.

Too many people gain too much from servicing wealthy clients that want privacy. A quick glance at politicians' declaration of interests also show that some of them are directly involved. The dominant internal voices in this debate are all from one side.

There is also a large constitutional play here.

For the dependencies, this is a domestic issue and as such the UK cannot legislate.

They will move at their own pace - even if the Home Office has said it is too slow.

Supporters of UK legislative action frame it as a national security issue for which it is responsible.

It serves some people's interests to belittle this debate as being about nosy journalists and campaign groups on fishing trips, when the focus should be on how effective a collective effort, based on quality data, can be in fighting crime and corruption.

People might not like it, but financial regulators, the taxman and law enforcement can be outflanked by criminals and corrupt influence peddlers, and that can happen in Guernsey just as much as it can in London, New York or the BVI.

Guernsey wants to be part of the international community, it wants fuller access to trade deals being struck from the UK because they will benefit business in the island and those are the types of levers that the UK can pull on to encourage swifter action without creating a constitutional flashpoint.

We should have obliged entity access early, so that financial services business and other operations will be able to use the register to carry out due diligence checks.

Then our definition of what constitutes a legitimate interest, who decides and how, will go a long way towards showing our true colours on transparency.

Lord Cameron’s elevation back into government may well put some fresh impetus back into this area.

But Guernsey's stance is clear, it will follow International policy developments, not invent its own.

Comments

Comments on this story express the views of the commentator only, not Bailiwick Publishing. We are unable to guarantee the accuracy of any of those comments.