Express untangles the fiscal web ahead of a landmark States debate where big questions over future taxation, spending, borrowing and what the government promises to deliver for the public is staged.

Here, Express’ Laura Clayton and Kit Hannah explain how we got here, why some of our politicians want to act, why others want to act less, why it isn't just about GST, and what the various options on the table for the island’s future are.

But first, it’s important to consider the challenges that underpin it all, and why the situation is so serious.

Pictured: When deputies walk out this door on Friday evening they might have committed to the largest tax increases and highest level of borrowing in decades.

The island is barreling towards a gap between public spending and income of around £100m per year, every year.

In essence, this means that what the government should be spending to keep services on track and up to expected levels is heavily outstripped by what’s paid in by taxpayers.

The simple truth is the average taxpayer takes far more out of the system than they pay in yearly through taxes and other contributions.

Yearly, it’s estimated that someone on median earnings contributes around £7,000, but the cost of public services – that's everything from providing roads, police, doctors, pensions, and social schemes – is £11,000 per person.

The cost of running this island of around 63,000 is therefore £700,000,000 per year.

£7,000 is not enough cash to send one child to secondary school for a full year.

Add to this an ageing population - which means demand for health and social care services and pensions is guaranteed to go up by tens of millions of pounds, while the income tax take goes down as more people leave the workforce - and you get a worsening structural deficit.

There are expected to be 5,500 more pensioners by 2040, hence the label given to the situation: The demographic timebomb.

Simultaneously, the States have agreed to a long list of infrastructure projects, both physical and digital, with a total price tag of more than £0.5billion, to execute within this political term.

The response to covid also wiped-out hundreds of millions of pounds from the island's savings.

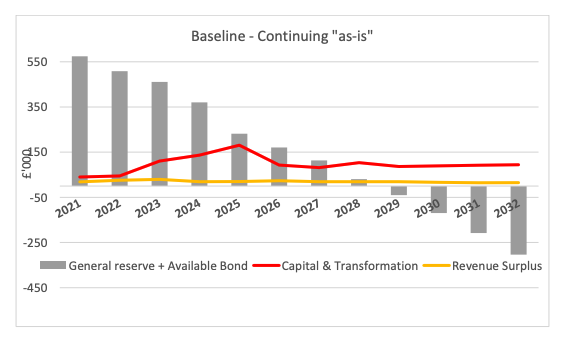

Pictured: P&R projects that all the money will be gone before 2030 if the island doesn't chart a new financial course.

If the island proceeds with all this capital spending without any changes to how the government raises money, it’s estimated there will be nothing in the pot by 2030.

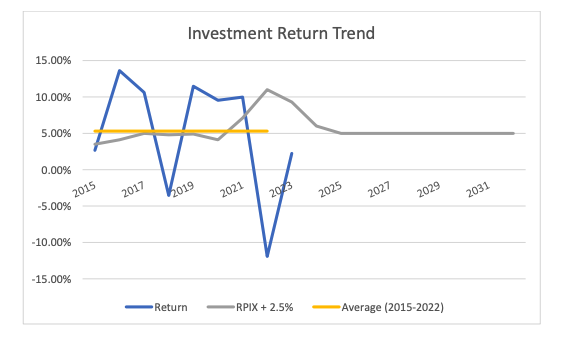

That also poses a risk to investment returns. Money from public savings is reinvested in assets, which can swing from profits to losses depending on yearly market conditions.

But with spending expected to unavoidably grow, the island already facing a gap between spending and income, and the need to dip into savings to pay for critical infrastructure, it will create a “double whammy” of being broke and having no investments to rely upon, Deputy Mark Helyar has said.

So, how do we stop this? Cut pensions or stop paying them out at all? Stop all benefits? Reduce the size of government and what it promises to provide? Stop treating the sick? Force people to work? Raise taxes? Borrow the cash? All the above?

One thing is for certain. While our politicians haven’t yet agreed on what should be done, all of them have accepted that the long-term financial position of Guernsey is unsustainable, and things must change.

Pictured: 2022 was a poor year for public investment returns.

The island is spending more than it brings in – that's not new, and it’s been happening for years.

It’s not even the first time it’s happened, with the Second World War and the Occupation; the most notable event in our recent history, bringing financial troubles with it.

Prior to the Occupation the island was already seeing an increasingly wide divide between the least and more well-off members of society.

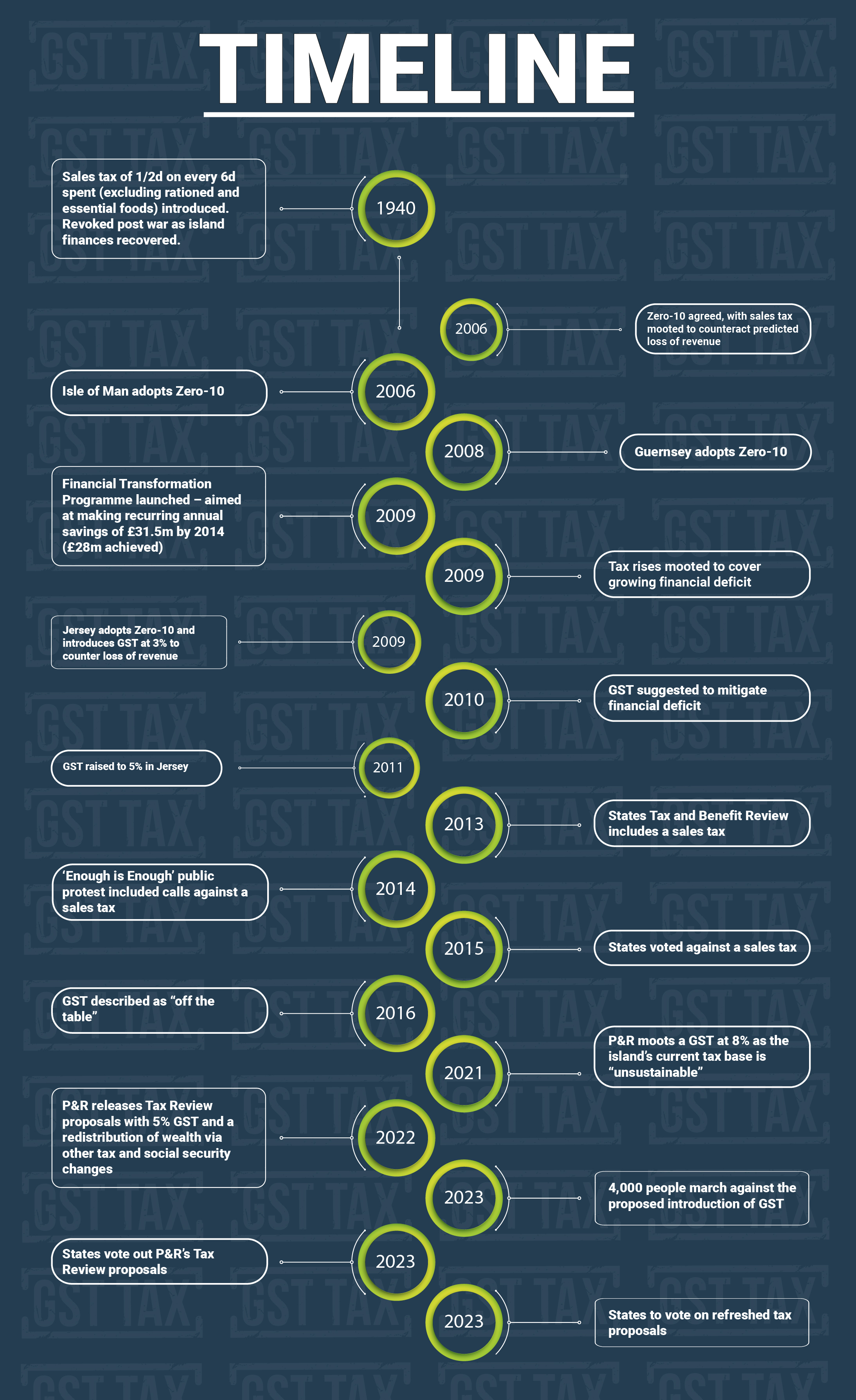

By August 1940, with income streams stymied for many, a sales tax of 1/2d sales tax on every 6d spent was brought in on all items except for essential foods and all rationed foodstuffs to raise general revenue. That tax stayed longer than the Occupying Forces before eventually being revoked once the island had recovered financially in the years after the Liberation.

In the post-war years the need for social housing increased as people returned home and families grew.

The boom years which had followed the war brought tourists, tomatoes and then finance to our shores helping to pay for the various improvements to infrastructure we still use to this day including the Princess Elizabeth Hospital, the Beau Sejour Leisure Centre and what was St Peter Port Secondary, La Mare de Carteret Secondary and the Guernsey Grammar schools

The recession of the 1990s and the global financial crash of 2008 affected Guernsey as much as other places, however.

In more recent years, a sales tax has cropped up regularly in States proposals as our government has repeatedly tried and failed to balance the books, often hampered by other States policies.

One of the most notable challenges to public finances was the decision made in 2006 to bring in Zero-10. That decision meant that since January 2008 some companies have paid 0% in corporation tax on their profits while others have paid 10%.

Accepting that this would impact public finances, it was suggested at the time that Guernsey may need a consumption tax of some sort to lessen the blow of the change to corporation tax, but nothing happened then.

A goods and services tax was again suggested in 2010 as the island’s financial deficit grew but there was no political appetite to bring it in then either.

By 2013, the States elected in 2012 had agreed to carry out a Tax and Benefit Review. Its key points included “the need to restrain public expenditure and to maintain a limit on the tax burden set by the States on households” while it also noted “a clear majority against the introduction of GST”.

By 2020 the island’s finances were growing even more precarious with the current P&R mooting an 8% GST in 2021 blaming the “unsustainable” tax base we have.

2022 saw the first iteration of the latest Tax Review proposals which included GST as part of a much wider package of social security and income tax reforms. Ultimately the States rejected that earlier this year with P&R now backing amended proposals – with increased personal allowances, social security reforms and a GST of either 5% or 6% (if food and soft drinks are exempt) - due to be debated this week. Extra spending and borrowing are also included.

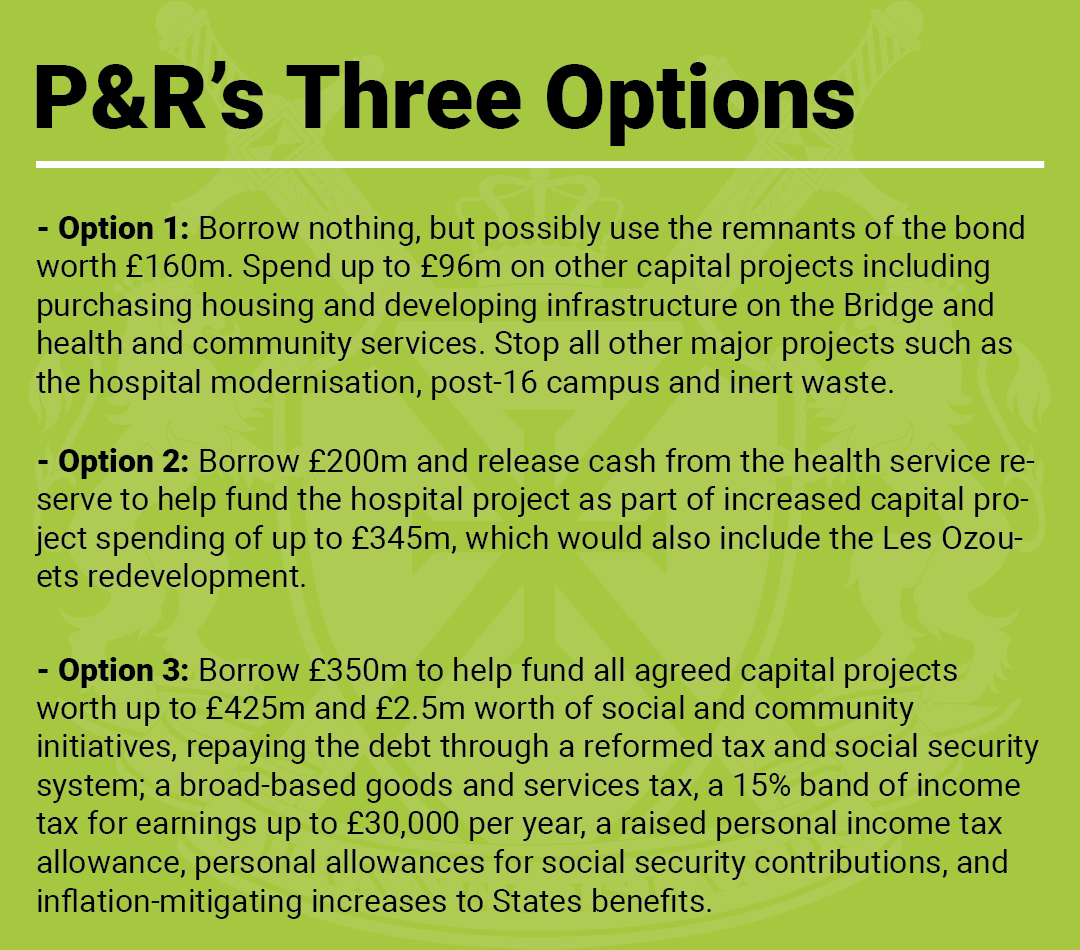

P&R will ask the States to debate and vote on a series of options to solve the problems laid out above.

The plan it has presented contains three different packages which range from little to no reforms and cutting back on projects, to radically altering the tax and social security systems while delivering what has already been agreed, with some less critical projects put on the backburner.

It also says £3m is required for essential policy development. In terms of getting extra cash each year, P&R assumes £25m will come from corporations and £10m can be recouped from savings in the public sector.

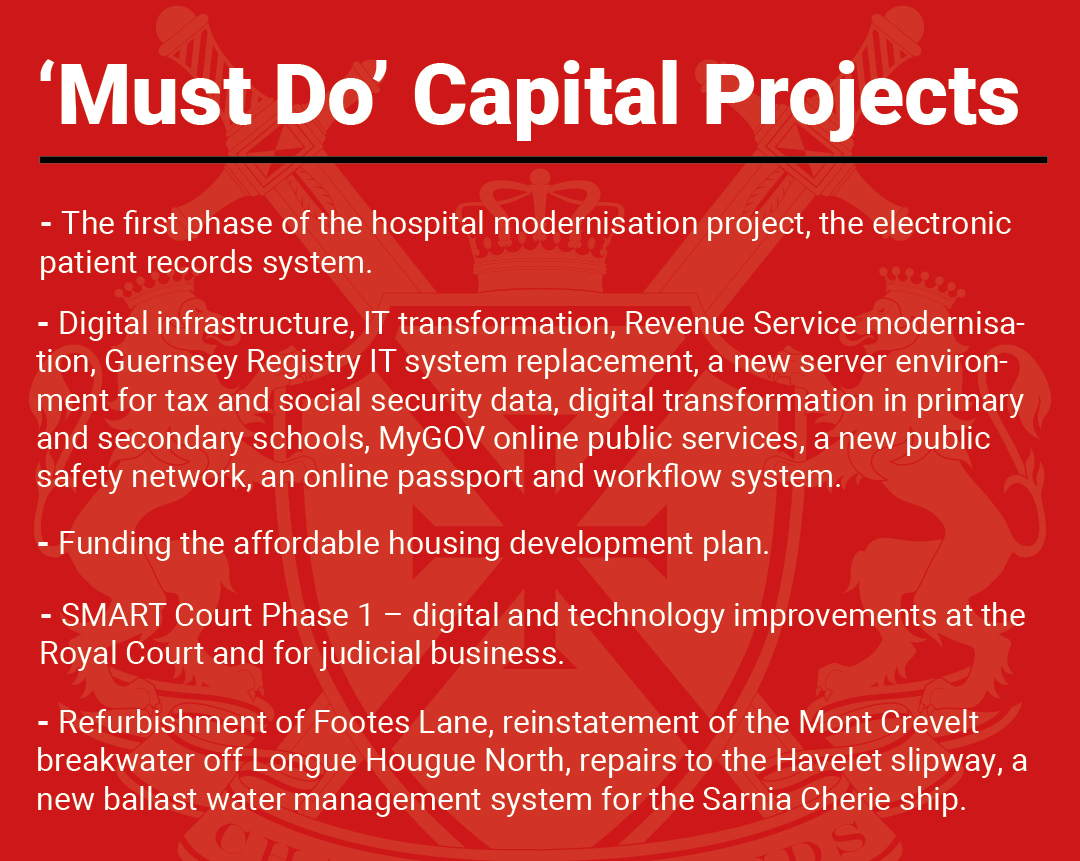

No matter what, P&R has identified 17 projects which are considered too advanced to be stopped, with a price tag of £96m.

These are baked into each of the options, but additional projects are added in, with each based on the amount of cash States members are willing to cough up or borrow, and how to top up reserves or repay any debt incurred because of them.

As a minimum, P&R wants cash to also be spent on infrastructure and housing at Leale’s Yard and on “health and community services”.

Everything else would be paused in Option 1, apart from the following:

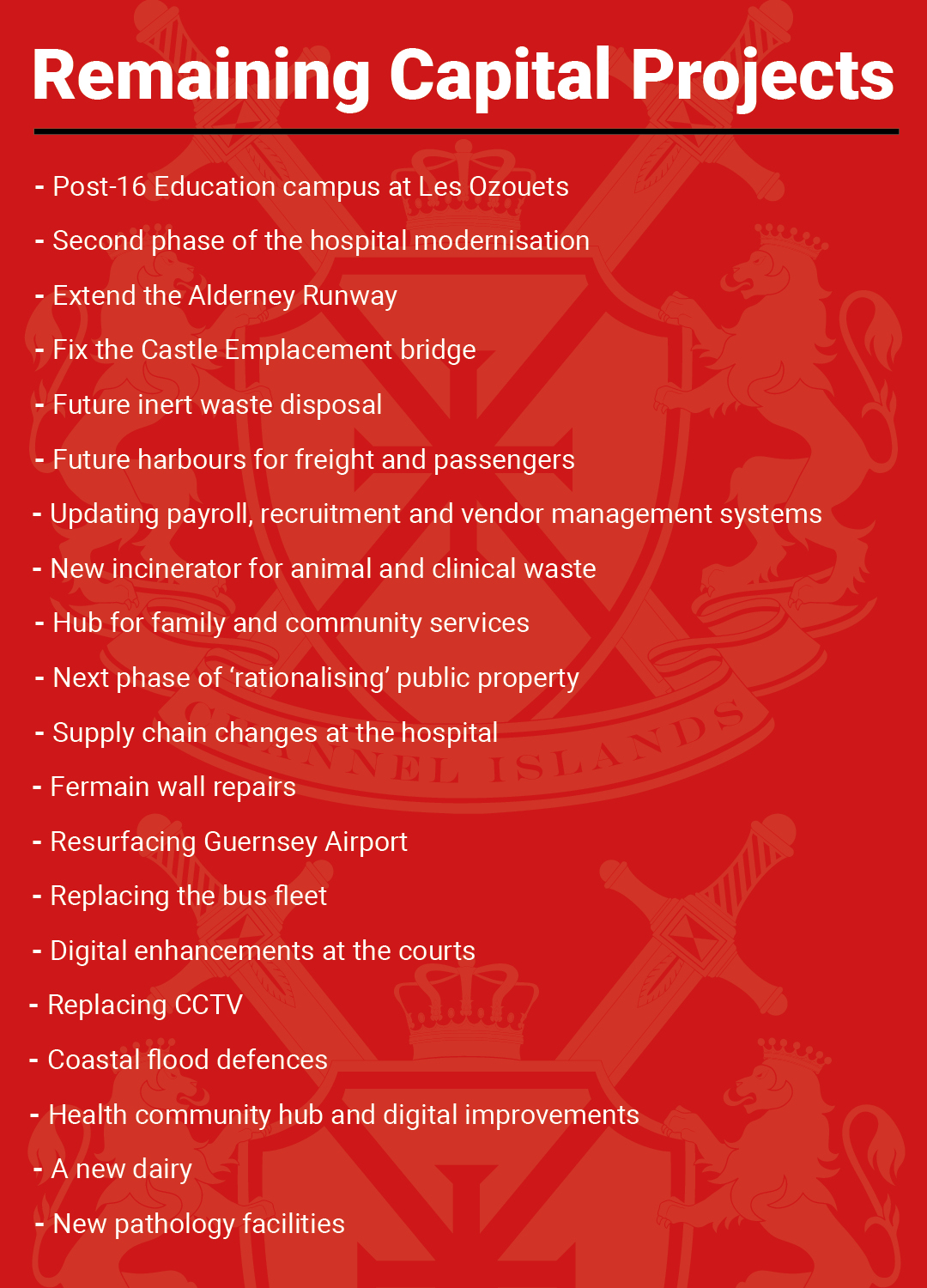

Those are what P&R consider unavoidable, but hundreds of millions of pounds worth of projects which have already been agreed by deputies, both this political term and previously, remain.

The argument at the start of the year was to raise extra cash through GST and social security reform to bridge the demographic deficit, but now these measures are tied up with funding the above projects.

Spending lots on what we need and preparing for the service demands of the future needs to be repaid and saved for. P&R thinks this can be achieved in its third option through up to £350m of new borrowing.

The most controversial aspect of P&R’s tax reforms is a GST on practically everything at 5%. It has consistently said its tax package is progressive and would mean 60% of households contribute less than what they do now, even with the inclusion of GST.

This is achieved by a 5% cut to income tax on every pound earned up to £30,000, after the personal allowance of some £13,000. Individuals would also only pay social security contributions on earnings which exceed a personal allowance, much like income tax. Existing benefits and allowances would also be increased.

Deputies will also have the option to vote on a GST which excludes food, but the rate in that case would be 6%. They previously voted on a food exemption in the February debate, which was approved, but many abstained and it’s therefore hard to tell if there will be majority support when it's put to a vote again.

But there is skepticism over the extent of borrowing, usually only allowed for projects which guarantee a financial return, such as social housing. Schools and hospitals are, naturally, not for profit. P&R says borrowing is suitable regardless, arguing years of underinvestment is coming home to roost, and doing nothing now will make it more costly in the future.

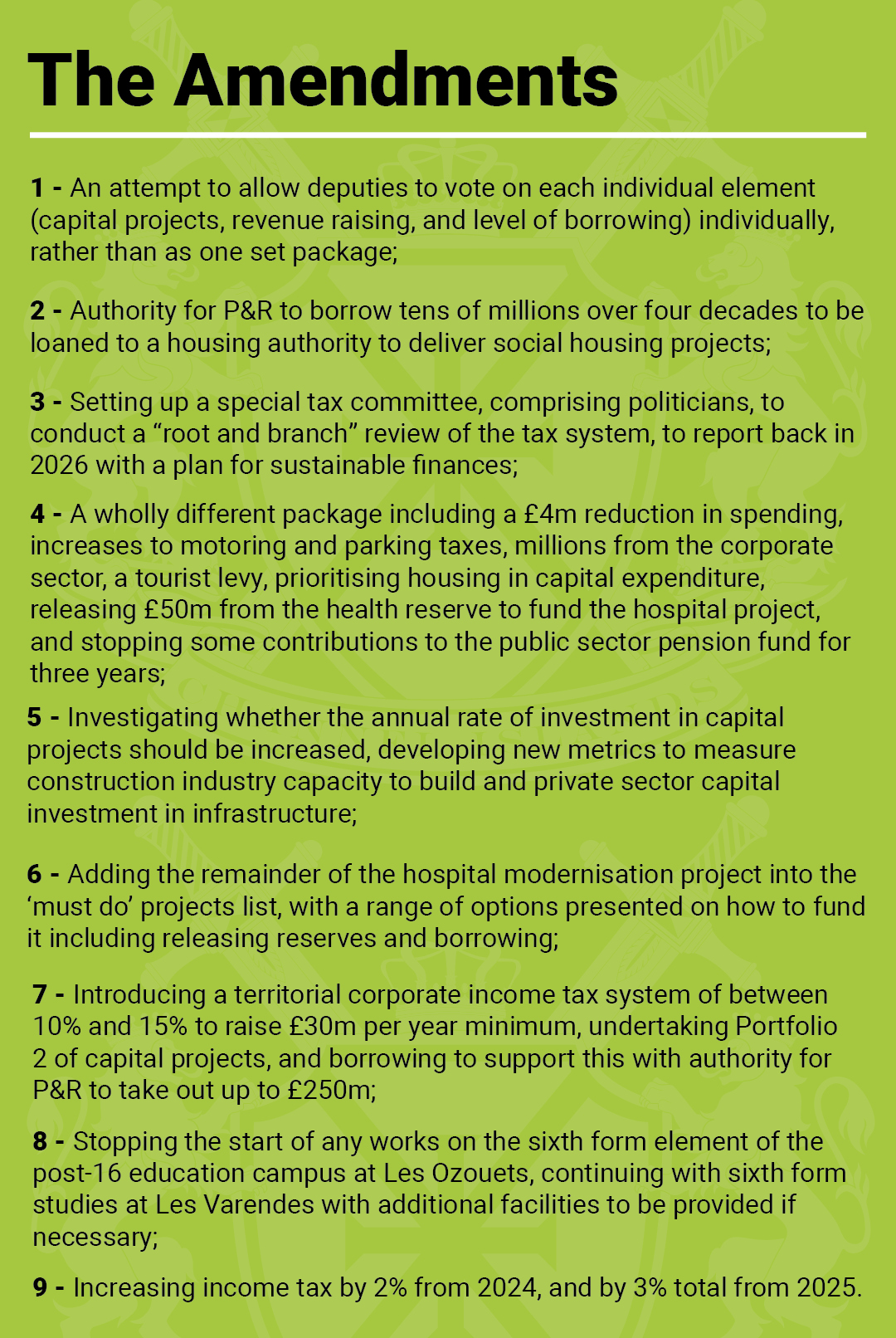

However, all deputies can challenge and change what is being proposed on the day through amendments, and those changes will be adopted if they achieve majority support.

This time is no exception, and nine amendments have been laid - so far - attempting to slightly modify, add to, or completely change what P&R, and therefore the States, should do.

These are what have been submitted so far, but more could come in, even on the day and from P&R itself.

Adopting some or all these modifications can have major consequences on the governments’ direction of travel.

If deputies back number four, the baby and the bathwater are thrown out, replaced with a whole new package and providing almost certain embarrassment for P&R.

Seven and nine will only come into play if a decision is not reached on anything else.

Others only add measures or investigations into the mix alongside the existing propositions. This is the case in two, three, five, six, and eight.

And number one winning more than half of votes means deputies could approve P&R’s desired tax and social security reform while not committing to £0.5bn of expenditure via high levels of borrowing this term.

This week all those amendments will be debated ahead of the main proposals.

The way it will work is that P&R will open debate by explaining what they want to do. The Presiding Officer will then take speeches on the various amendments in order of influence they may have on the policy letter if approved.

By the end of the week, we should have an idea of what P&R’s proposals, as amended, will look like.

When we may get a decision on the amended Funding & Investment Plan is currently anyone’s guess.

The States meeting is due to run until Friday at 17:30. With each day’s meeting due to start at 09:30 and a two-hour lunch break each day, that means deputies will have at least 24 hours this week to get through all their business.

Those hours may be increased if it’s decided to start the meetings earlier, finish later or trim the lunch break but regardless, history tells us that such decisions are rarely rushed by the States of Deliberation.

With the public engaged in this topic it means every possibility will be explored, debated and brought up again before a vote is taken, with all eyes expected to be on who votes for what, and how much it will cost each of us.

Pictured: It will be the third time since 2020 the Policy & Resources Committee tries to win States support for reforms to the tax system.

This is the third time P&R has tried to get tax proposals through the States, but time is running out to get any new tax structures approved and implemented during this term of government.

An island wide election is due in 2025, and if approved this week – the new GST would come in on 1 January 2026.

That makes up one small component of the wider proposals with P&R also raising revenue and releasing cash in other ways to fund the capital projects detailed above.

It’s known the education project at Les Ozouets could commence within a few months once a contractor is approved, with work at the hospital coming after the end of Phase One and most in agreement that Phase Two could continue seamlessly.

Other projects are also likely to move more quickly than others once the island’s financial footing is secured.

With the election due before GST would be likely to come in, and public opposition expected to continue if it is approved, then there could be further challenges no matter what is decided this week.

There have already been calls for P&R to resign if the Committee loses this week’s debate and its proposals are rejected again.

Deputy Peter Ferbrache has made it clear that he is unlikely to stand down and, with his tightly knit band of brothers working ever closer together, it seems unlikely any of them will offer to resign either.

They would be hard pushed to bring another set of proposals back to the States over the next 20 months, and with their flagship workstream defeated for a second time in a year the States leading committee may find itself in a state of paralysis and disfunction.

The amendments could change the proposals to such an extent they are no longer recognisable as P&R’s policy letter, again leaving the senior committee in a leadership role that it may not have the support for.

Either way, if P&R lose we’re back where we were at the beginning of the year with no wholesale financial direction set.

Deputies Gavin St Pier, Heidi Soulsby and Sasha Kazantseva-Miller led alternative proposals during the first Tax Review debate earlier this year, which narrowly lost out on securing a majority.

Their key proposals include plans to raise more money through corporation taxes, while holding off on any work to introduce a GST until other changes have been made to improve island finances.

Now they are suggesting a break in paying into public sector pensions, as well as raising taxes on motorists, companies and tourists, alongside increased corporation taxes.

P&R says the so-called Fairer Alternative plans would not lead to any less strain on the public purse while several public sector unions have reacted angrily to the proposals affecting their pensions.

This week’s States debate is due to start on Tuesday.

Once statements, elections and legislation are out of the way the first debate will be on next year’s proposed benefits and contribution rates. In terms of money coming in and going out, that is a key component.

Following that, the Government Work Plan and the Funding & Investment Plan will be debated.

If the States back the GWP and F&IP as proposed by P&R, work will start to implement their policies immediately.

If any amendments are agreed to the official plans, then the way forward will be altered in ways that can’t yet be confirmed.

Minor changes may not materially impact what is planned, while the more far-reaching amendments could lead to calls for P&R to stand down, votes of no-confidence or even an early election, although officials say the latter would take just as long to prepare as it would to host an election in 2025.

Comments

Comments on this story express the views of the commentator only, not Bailiwick Publishing. We are unable to guarantee the accuracy of any of those comments.