Reports of suspicious activity in the finance sector dropped by 25% in Guernsey last year - but e-gambling remained the cause of the majority of them.

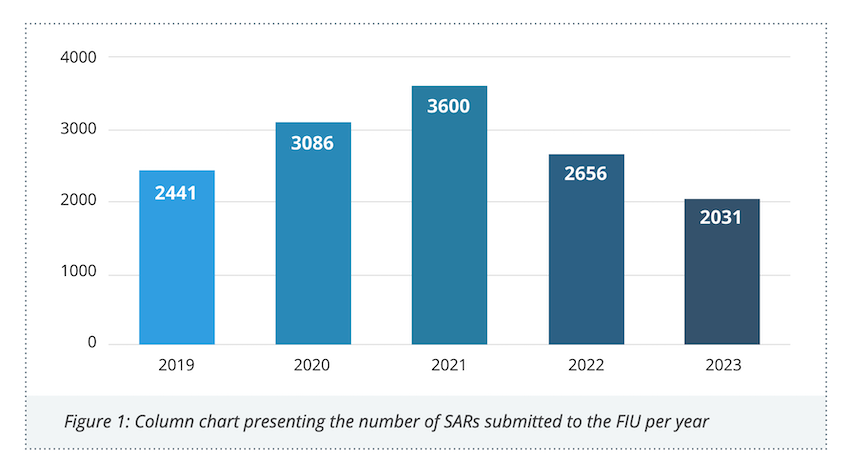

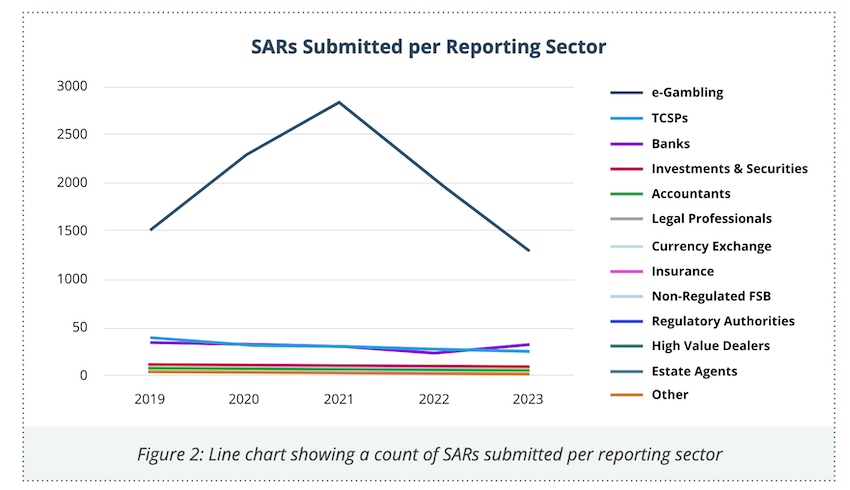

The Bailiwick’s Financial Intelligence Unit’s annual report shows that it received 2,031 Suspicious Activity Reports in 2023. The e-gambling sector was the instigator of 64% of them.

A SAR is a document that financial institutions must file whenever there is a suspected case of things like money laundering or fraud.

They help monitor any activity that is deemed out of the ordinary, could be a precursor of illegal activity, or that might threaten public safety.

Last year continued a downward trend from a high of 3,600 in 2021.

A quarter of SARs in the Bailiwick were linked to the trafficking of illegal substances, 24% to money laundering, 23% to fraud, and 15% tax evasion.

"There remains a significant e-gambling sector regulated in Alderney with a large international client base, so their prevalence in reporting of suspicion is a trend that looks set to continue for the foreseeable future. However outreach to the industry during recent years has resulted in a steady decline in SAR submissions, with a 36% reduction recorded between 2022 and 2023," the annual report says.

"Approximately 86% of SARs from the e-gambling sector were submitted to the FIU by one main licensee which has a significant client base (in excess of six million clients) which is consistent with previous years."

The risk from this sector is relatively lower than others, so the FIU has adopted procedures to "limit the resources deployed to dealing with SARs from the e-gambling sector".

Adrian Hale, Head of the FIU, said: "There are many challenges when targeting economic and financial crime and acts of terrorism and proliferation, however by working in collaboration with other authorities, and public-private partners we can strengthen the fight against money laundering, terrorist and proliferation financing.

"Throughout 2023 the FIU maintained its industry outreach programme, including issuing revised guidance and continued to work closely with other Financial Intelligence Units and law enforcement agencies."

Home Affairs president Rob Prow said: "Ensuring the Bailiwick has a robust system of law enforcement to tackle the potential of money laundering, the financing of terrorism and proliferation financing is vital.

"As a first-class global financial hub, Guernsey must ensure that those with criminal intentions cannot use our financial services and be allowed to undermine the international trust in our finance sector. The FIU is a key part of our armoury, and I am pleased to see the good work they continue to do highlighted in their latest annual report."

Comments

Comments on this story express the views of the commentator only, not Bailiwick Publishing. We are unable to guarantee the accuracy of any of those comments.