"Decisive steps" are being planned as Credit Suisse looks to restructure its investment banking business with the potential loss of 9,000 jobs as it aims to shore up its core interests.

The Credit Suisse Group has announced a transformation plan, as further heavy losses were reported at the end of Quarter 3.

The Swiss firm, which is headquartered in Zurich, has offices across the world, including in Guernsey.

The St Peter Port site employs people across the Wealth Management division, which is said to be central to the firm's future proofing plans.

Pictured: Credit Suisse has announced plans to return the business to a more profitable position within three years.

Today's announcement details a three-year plan to "create a simpler, more focused and more stable bank built around client needs".

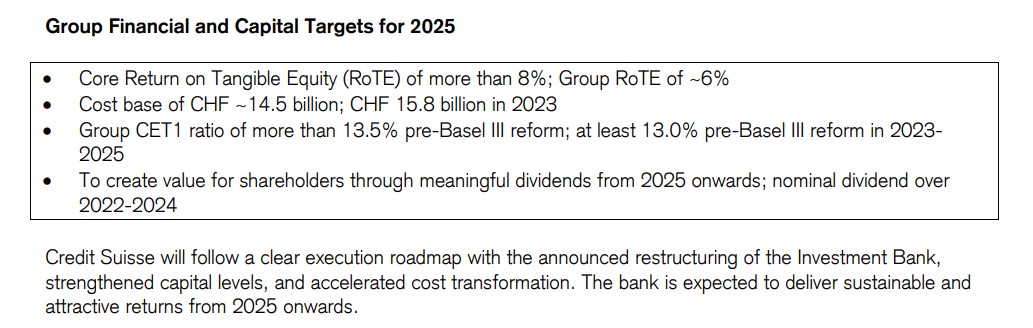

The plan aims to radically restructure the Investment Bank to significantly reduce Risk Weighted Assets (RWAs) and accelerate cost reductions including reducing the Group’s cost base by 15%, or CHF ~2.5 billion, to CHF ~14.5 billion in 2025.

Axel P. Lehmann, Chairman of the Board of Directors of Credit Suisse, said the Group needs to refocus on its priorities.

“Over 166 years, Credit Suisse has built a powerful and respected franchise, but we recognize that in recent years we have become unfocused. For a number of months, the Board of Directors along with the Executive Board has been assessing our future direction and, in doing so, we believe we have left no stone unturned.

"Today we are announcing the result of that process – a radical strategy and a clear execution plan to create a stronger, more resilient and more efficient bank with a firm foundation, focused on our clients and their needs.

"At the same time, we will remain absolutely focused on driving our cultural transformation, while working on further improving our risk management and control processes across the entire bank. I am convinced that this is the blueprint for success, helping rebuild trust and pride in the new Credit Suisse while realizing value and creating sustainable returns for our shareholders.”

Among the 9,000 jobs reported as at risk today, we've learnt that a number of leading individuals within the Credit Suisse Group are either standing down or being moved into new positions.

Those departing include Christian Meissner, who has served as CEO of the Investment Bank and member of the Executive Board, who has decided to leave the bank, effective immediately.

Credit Suisse said it has already started implementing its cost reduction activities with a "headcount reduction of 2,700 full-time-equivalent employees (FTE), or 5% of the Group’s workforce" already underway.

Eventually, the plan is to run the bank with fewer than 43,000 FTE by the end of 2025 compared to around 52,000 at the end of the third quarter of this year.

Pictured: The Trust business had already been sold to Butterfield before today's announcement.

More than 160 people work at the Guernsey branch of Credit Suisse, based at Les Echelons.

Credit Suisse has restructured its Guernsey based business, with a focus on wealth management. Just last month, the Trust business, run out of Guernsey, the Bahamas, and Singapore was sold to Butterfield. Credit Suisse Trust had had a presence in Guernsey for nearly 50 years by this point.

A new Chief Operating Officer, overseeing Guernsey's Credit Suisse operations, was appointed in January of this year. Edward Daughtrey's responsibilities were said to include joining the Guernsey Branch Management Committee, chairing the Branch Operating Committee and joining the Credit Suisse UK Operating Committee.

Mr Daughtrey transferred to Guernsey from Credit Suisse’s Singapore office and said he was looking forward to enhancing the client offering.

"I have the opportunity to deepen my understanding of the unique competitive advantages our organisation enjoys here in Guernsey and look forward to making our offering even more efficient," he said in January.

"It’s important to me to focus on enabling growth for our business by developing our employee’s careers and I can’t wait to get started."

Butterfield buys Credit Suisse Trust

Comments

Comments on this story express the views of the commentator only, not Bailiwick Publishing. We are unable to guarantee the accuracy of any of those comments.