The estimated total cost of States support for businesses using the payroll co-funding scheme during the covid-19 pandemic could reach £40million, or more.

The scheme is currently set to end this month but it is likely to be extended past June in recognition of the ongoing support some affected businesses will need.

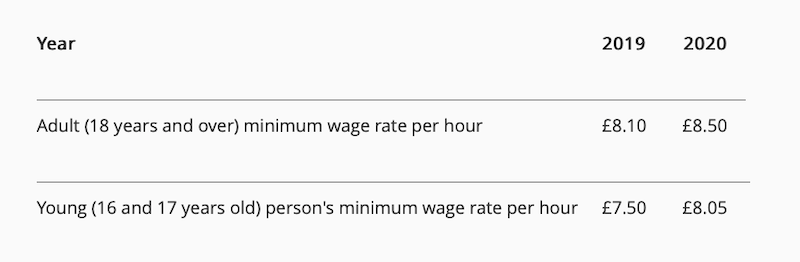

Deputy Chris Green questioned why the minimum wage was set as the benchmark for the payroll co-funding scheme, meaning initially businesses were offered 80% of that figure for all employees in impacted sectors - whether they were working during the lockdown or not. That was later upped to 100% of minimum wage

The States announced the payroll co-funding scheme on 23 March - just days before the Bailiwick was put into lockdown. By that time a number of businesses had already seen their work stopped by the corona virus, with travel restrictions already in place affecting hotels, pubs and nightclubs forced to close and other industries strictly limited by social distancing measures.

By the beginning of May it had been decided to increase the payments available to 100% coverage for those businesses which qualified for enhanced support.

Pictured: The 2020 minimum wage rate came into force in January.

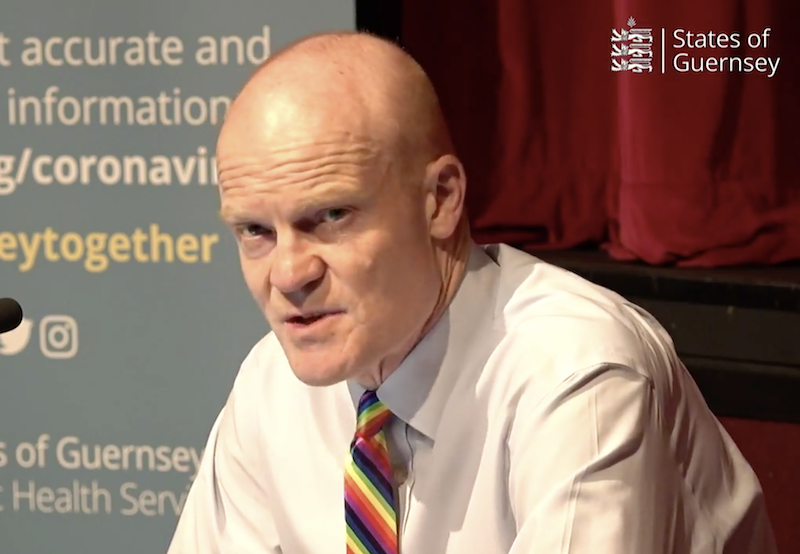

In response to written questions from Deputy Green, who asked "what exactly was the rationale for this approach?", Deputy Gavin St Pier - as President of the Policy and Resources Committee - said when deciding what level to set the payroll co-funding scheme at, they had to "strike a balance between the level of financial support provided to businesses and individuals, against the financial burden on the taxpayer".

He said the minimum wage was chosen as the benchmark at a time when there was "significant uncertainty as to (the) extent and duration" of the impact of the lockdown on the economy.

Deputy St Pier said "it is also worth emphasising that the Payroll scheme is only one measure of the overall support package that includes the payment of a Grant for £3,000, Business Disruption Lending Guarantee Scheme (BDLGS), deferment of employer contributions, TRP and States commercial rents as well as a Hardship Fund for individuals.

"Taking a measured stance on the extent of the Payroll support creates favourable conditions from which to both consider further enhancements, as and when justified, as well as extended the period of support should that be necessary."

Pictured: Deputy Gavin St Pier is Guernsey's Chief Minister.

Deputy Green asked why the Guernsey payroll co-funding scheme was "materially less generous than the equivalent UK and Jersey schemes?", which Deputy St Pier said is not true.

He said it is "difficult to make direct comparisons as all of the schemes are somewhat different."

The UK scheme is a Furlough scheme, meaning payments are only available to those who have been temporarily laid off, unlike the Guernsey scheme which saw payments made to people still working.

He also admitted that the headline rate in Jersey appears more generous that the Guernsey version, but the Guernsey one pays out to a maximum of 42 hours per week, while the Jersey version uses a 35 hour week - so the upper payment cap in both islands is similar at £1,551 per month in Guernsey and £1,600 per month in Jersey.

Guernsey has also paid out grants of £3000 to small businesses, with up to 20 employees, which was not offered in Jersey.

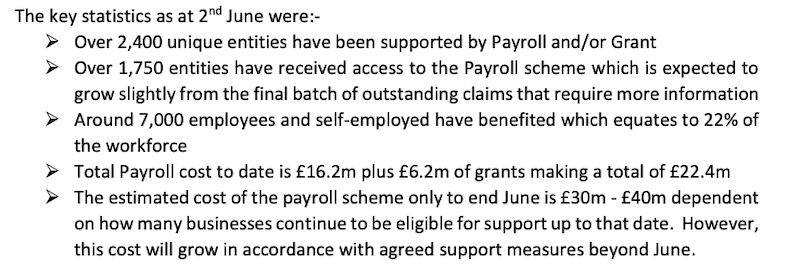

In total all of the financial support measures offered to businesses in the Bailiwick have helped nearly 2,500 businesses, which have in turn helped to support nearly a quarter of the islands' workforce.

The payroll scheme could end up costing the Bailiwick £40million or more based on the data currently available.

Pictured: The latest available data on the States covid-19 financial support measures.

It's already been suggested the payroll co-funding scheme could be extended beyond its original intended end date of this month, as the impact of the lockdown is still being felt.

Deputy St Pier said while "the rules are clear as to when businesses stop being eligible for support – that is at 70% or in in some cases, 80% of normal turnover," payroll support will remain available for two weeks after that date "to provide the business with breathing space as it aims to get back to near normal trading".

With the hospitality trade, and those particularly reliant on tourism, likely to be affected for longer than other industries, more tailored packages might be introduced.

"It is therefore very likely the Payroll scheme will continue in some form after June and a decision on this will be taken by the Policy & Resources Committee within the next two weeks," said Deputy St Pier.

Pictured top: Deputy Chris Green.

Comments

Comments on this story express the views of the commentator only, not Bailiwick Publishing. We are unable to guarantee the accuracy of any of those comments.