Detailed implementation plans for the OECD’s global reforms of corporate taxation are set to be concluded in the coming weeks.

The OECD has been working to establish a global solution to reform the international corporate tax framework, impacting how large multi-national enterprises are taxed around the world.

Guernsey - which has signed up to the two pillar plan - has been able to attract business for many years by keeping its corporate tax rate at 0%, with financial services businesses taxed 10%. This is known as the 'Zero-10' regime.

‘Pillar One’ would create new profit allocation rules for the world’s largest 100 global multi-national companies, who might have to re-allocate some to the jurisdictions of their markets and customers. All regulated financial services are excluded from this.

'Pillar Two' would introduce a new framework of taxation where companies falling within the scope of the Pillar Two tax would pay a Minimum Effective Rate of taxation on their global profits, calculated on a country-by country basis. This does not include funds.

The level of the Minimum Effective Rate contained in the OECD statement is “at least 15%”.

Pictured: P&R's Treasury Lead Mark Helyar said the island welcomes a global standard that will allow everyone to compete on a level playing field.

When Guernsey’s current corporate tax system was introduced in 2008, much of the lost revenue was replaced by increases in commercial TRP rates and increases in social security contributions from employers.

The Policy & Resources Committee says it “continues to monitor the appropriateness of the corporate tax regime, having due regard for the need to retain an internationally acceptable and competitive tax environment for the islands’ businesses.”

Meanwhile, the OECD is working on the technical details of a implementation plan for global reforms, and are expected to reveal the results of that work “by October.”

P&R does not believe, based on current information, that Guernsey will be significantly affected. However, the island will not go untouched.

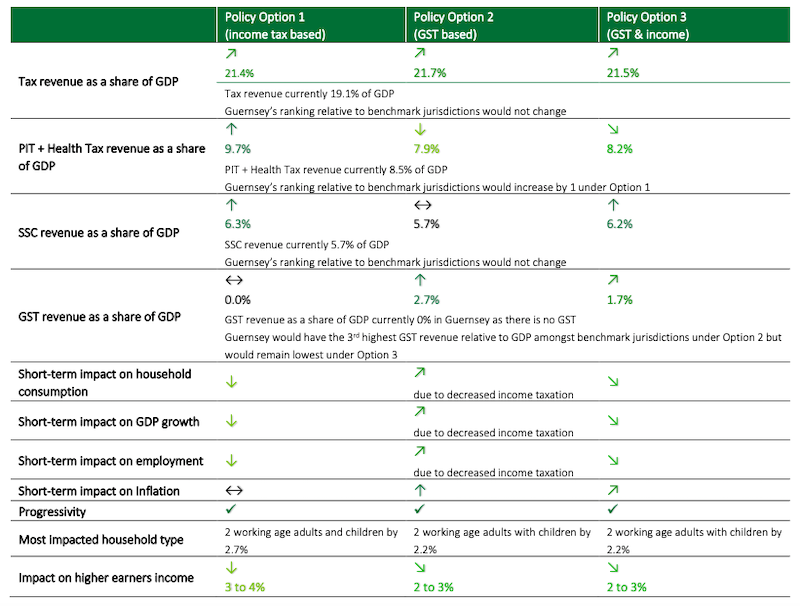

Pictured: The Steering Group behind Guernsey’s tax review has projected that changes to the corporate income tax system may generate £10m a year of additional revenue. That is one part of controversial tax overhauls that could see a GST of up to 8% introduced in the island.

“The number of companies headquartered in Guernsey who would meet the criteria for an MNE under international rules is very limited,” said P&R.

“As technical discussions continue, it is not yet clear how these rules will be applied and therefore whether Guernsey would implement aspects of Pillar 2 that were not a minimum standard.

“Nor is it clear what the behavioural effects of the changes might be. As a result, the estimated revenues which might be generated from the implementation of the OECD proposals are limited and uncertain at this time."

Prior to the introduction of Zero-10, corporate income tax accounted for approximately 23% of government revenues and up to 33% of tax revenues. Currently, corporate income tax (and distributions from companies) account for 10% of total revenues and up to 13% of tax revenues.

Comments

Comments on this story express the views of the commentator only, not Bailiwick Publishing. We are unable to guarantee the accuracy of any of those comments.