Work is continuing to restructure the island's social security contributions systems - but in the meantime it's been proposed that contributions increase again next year.

Employment and Social Security announced this week that it wants to put up pensions, and benefits by almost 5% next year.

To cover that expenditure and the natural increase in outgoings on pensions and other contributory benefits, ESS said it wants to continue the "gradual increase of contribution rates for employers, employees, the self employed and the non employed".

That planned gradual increase in contributions was agreed in principle by the States in October 2021, to keep the social security system and its outgoings sustainable.

If approved by the States later this year, the increased rates will come in from 1 January 2025.

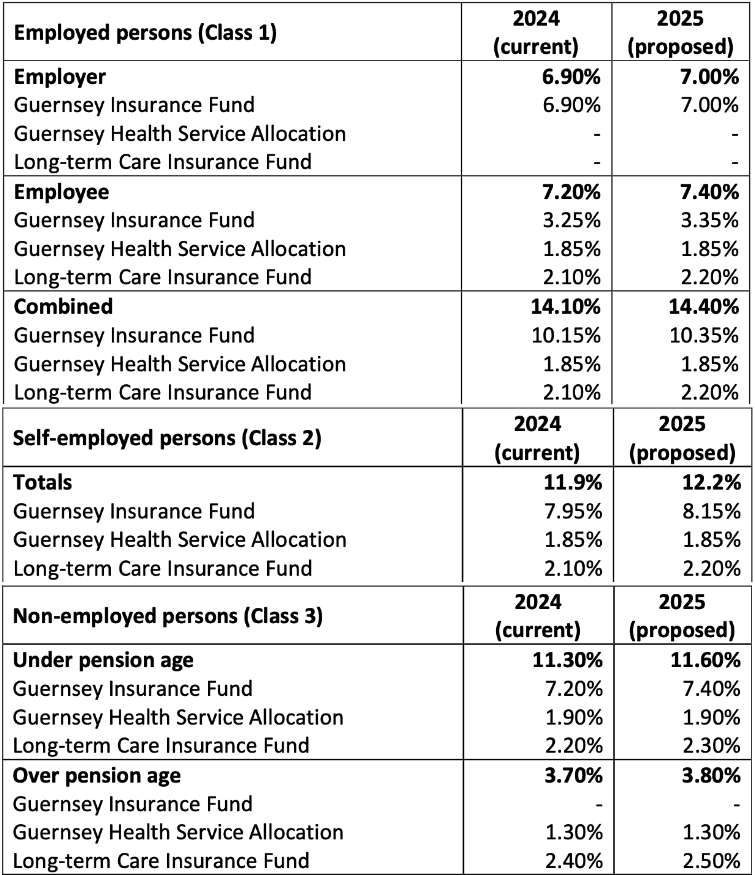

That would mean the employers contribution rate would increase from 6.9% to 7.0% while employees would pay an extra 0.2% at 7.4%.

The self employed rate would increase from 11.9% to 12.2%, while anyone non-employed under pension age would see their contribution rate increase from 11.3% to 11.6%.

The rate for non-employed persons over pension age would go up 0.1% to 3.8%.

Pictured: The proposed 2025 contribution rates, to be agreed by the States.

ESS said these proposed increases are in line with what was previously agreed by the States.

It also said work is continuing on restructuring the social security contributions system - as directed by the States.

"The aim of the proposed restructure is to address some of the inequalities in the existing system and to make it more progressive by moving some of the contributions liability away from lower- and middle-income households," said ESS.

"It is intended that the proposed model will be entirely self-funding.

"The Committee intends to report back to the Assembly with its proposals before the end of the political term."

Benefit changes greenlit by States

Social Security contributions set to increase

Comments

Comments on this story express the views of the commentator only, not Bailiwick Publishing. We are unable to guarantee the accuracy of any of those comments.