Three prominent deputies have alleged that introducing a goods and services tax (GST) will cost the States £90million, not the previously proposed £42million.

Deputies Heidi Soulsby, Gavin St Pier and Sasha Kazantseva-Miller have published their understanding of the cost implications of introducing GST, alongside an announcement that they’ll be publishing an alternative set of proposals in due course.

Deputies will be asked to vote on P&R’s Funding and Investment Plan later this month, which’ll include three options for tackling a looming £100million deficit.

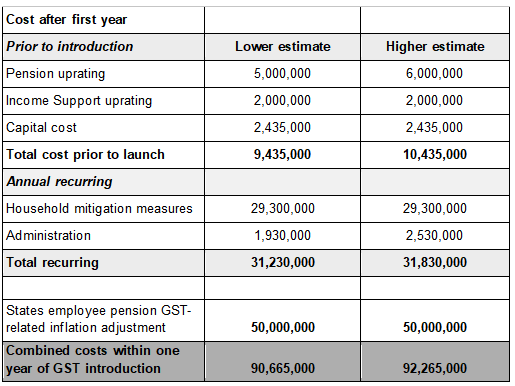

P&R’s preferred option includes a combination of GST, borrowing and social security reform. It had been estimated that introducing GST would cost up to £42million, but the deputies behind the ‘Fairer Alternative’ proposals have claimed this figure is off by nearly £50million.

“Deputies behind the Fairer Alternative proposals have found that the impact on the fund of introducing GST would be a one-off deterioration to the funding level of approximately £50 million against what might otherwise have happened without it. This would bring the total forecasted range of the cost of GST to £90.7 million and £92.3 million within 12 months of its introduction,” they said in a letter to the media.

“Having undertaken further analysis of the effects of GST since the last tax debate, we have discovered a significant adjustment would be required to the public sector employees’ pension fund”, said Deputy Heidi Soulsby.

“This is not something that was captured or known at the time when the second Tax Review policy letter was published and debated earlier this year.

“This is material to the discussions surrounding GST and the Funding and Investment Plan, including the importance of the timing of measures. Making a decision to introduce GST at a time of the continuing cost of living crisis, and persistently high inflation, remains challenging.”

Pictured: Deputies Soulsby, St Pier and Kazantseva-Miller have published the above table.

“Deputies behind the Fairer Alternative proposals have been scrutinising the Funding and Investment Plan in discussions with the States Treasury team and will be publishing an alternative set of proposals,” they concluded.

Express has reached out to P&R for comment. It's understood that the Committee will be publishing comment on the claims shortly.

The Fairer Alternative was an amendment to P&R’s GST proposals at the beginning of the year.

The package would've put off any decision on GST until other changes and work had been done.

"This amendment represents a credible, comprehensive but most importantly a fairer alternative to that put forward in the policy letter," said Deputy Soulsby, opening debate on her proposal in January.

"It takes account of the fact that the tax burden on households has grown in comparison to corporates since zero-10, that families who until recently could make ends meet are struggling to put food on the table, heat their homes and make enough money to live independent lives as increases in wages have not kept up with price increases."

Comments

Comments on this story express the views of the commentator only, not Bailiwick Publishing. We are unable to guarantee the accuracy of any of those comments.