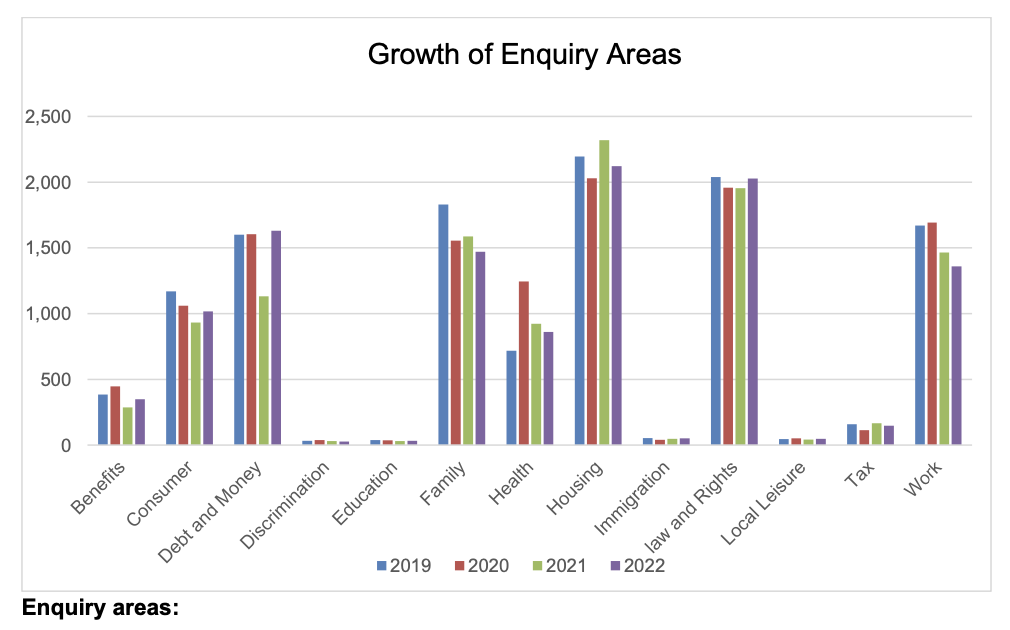

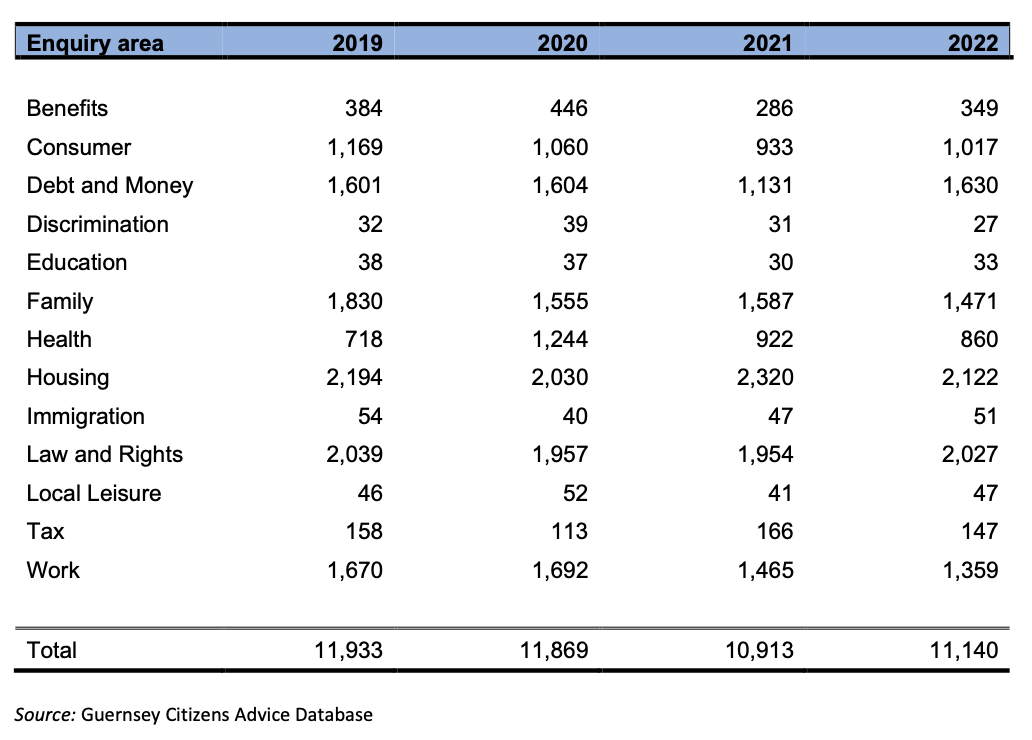

Housing related concerns continue to dominate the advice given by trained advisors at Citizens Advice Guernsey as people ask for help with a lack of housing, affordable housing, and trouble renting.

The increased cost of living also pushed people into asking CAG for help during 2022 with its annual report showing that it had more than 1,630 specific debt and money related queries last year.

That was up 44% compared to 2021 when there were 1,131 specific debt and money issues raised.

Pictured: Money related issues dominate the queries made to CAG.

CAG said its money-related queries last year covered issues such as banking services, insurance, pensions, credit, and debts with some people being helped with individual budgeting advice, individual repayment plans and negotiations with creditors.

Most of the money related queries dealt with last year came from 67 people (up from 52 in 2021). 28 of those people were repeat clients from the previous year while 39 were new clients of CAG.

David Beattie, the volunteers' representative at CAG, said that "many clients are facing some very difficult and stressful problems with huge increases in the cost of living, homelessness, lack of housing at reasonable prices, and finding good quality rented accommodation" among them.

Writing in the 2022 annual report, Mr Beattie said: "These difficulties place a great deal of stress on families and on relationships."

Pictured: Housing queries are the most common CAG deals with.

The 2022 annual report shows that housing was the issue CAG was asked for help with the most last year.

It came up 2,122 times, followed by legal queries.

Debt and money, family, and employment matters were also raised on well over a thousand occasions.

Trained volunteers spent time working on each of these cases and new volunteers are being recruited to replace those who have left CAG.

These volunteers helped people who were struggling with stress related to their defined issue.

In total the people asking for help with debts owed more than £3 million collectively. That is nearly 11% higher than the collective debts from a year earlier. Many of these debts are linked to credit & store cards, tax bills, hire purchase, catalogues and family loans.

Pictured: The 2022 CAG annual report can be read HERE.

Annie Ashmead, CAG's Interim Chief Executive, wrote in the annual report that volunteers were told that debts became unaffordable as a result of relationships breaking down or health issues, while low incomes, jobs losses and business failures also contributed.

Poor budgeting, legal fees, gambling, and rent arrears were also a factor behind some of the debts listed with CAG.

"It is anticipated that with the cost-of-living crisis, this is going to impact further on those who are already struggling, as well as those who have just managed to survive thus far. With that in mind, we will no doubt see an increase in the need for our dedicated Money Advice service over the coming year," wrote Ms Ashmead.

The charity has previously raised concerns over housing and monetary pressures in the island.

Its figures have previously shown that it received more requests for help around 'access to affordable housing' than any other topic over the last four years.

It has also focused on other issues with reports published on the demand for help with employment contracts and consumer issues, and another on domestic abuse and discrimination are being written.

Eviction, deposit protection, and mold concerns reported to CAB

New leadership at Citizens Advice Guernsey

Citizens Advice shop set for relocation

New CEO at Citizens Advice Bureau

Citizens Advice saved from lockdown closure

Ageing IT systems force Citizens Advice into lockdown closure

Citizens Advice hail action – but more still to be done

New IT system a "game changer" for Citizens Advice

Comments

Comments on this story express the views of the commentator only, not Bailiwick Publishing. We are unable to guarantee the accuracy of any of those comments.