Deputy Mark Helyar, the States' Treasury Lead, claimed that Government is moving on from the failures of previous Assemblies as the island's 2022 Budget was approved without amendment after only three hours of debate.

But there was criticism that the Budget presented by the Policy & Resources Committee lacked imagination and courage and relied too heavily on annual increases in fuel duty and property tax and gradually depleting the island's financial reserves.

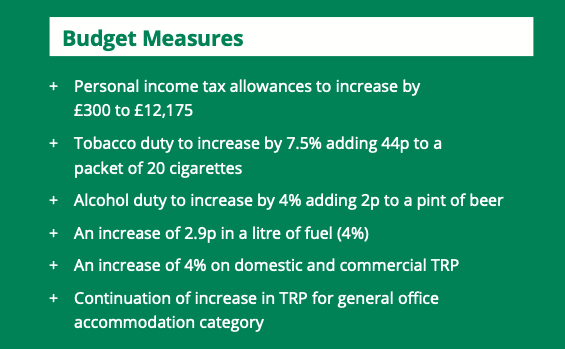

TRP (property tax) and duties on fuel, alcohol and tobacco will now increase above the rate of inflation in order to raise an additional £1m from islanders in 2022. Inflation itself is higher than it has been for a decade.

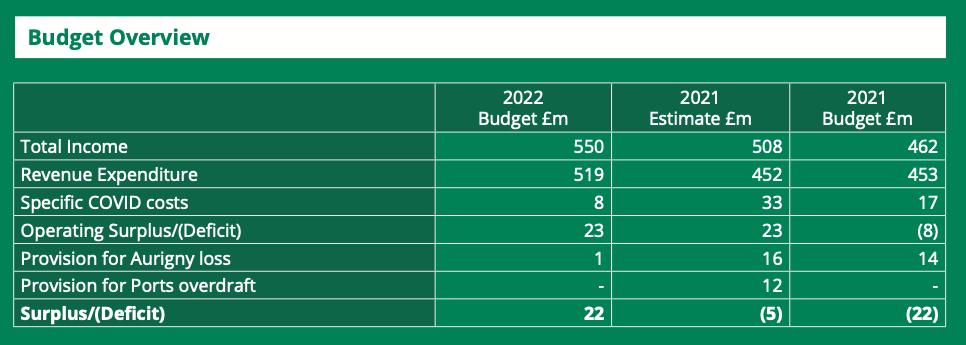

This time last year, the States' estimated that there would be a deficit of £22m in public expenditure in 2021. This estimate worsened with the second covid-19 lockdown. However, tax revenue then surged to nearly 5% above 2019 (pre-covid) levels.

This included much higher income than estimated from document duty due to a buoyant housing market and from customs duties because islanders had less access to duty-free products.

The States now estimate that the deficit in public expenditure - spending above income - will now be £5m in 2021. And they are projecting further improvements in public finances with a surplus - income above spending - of £22m in 2022.

Pictured: P&RC's estimated 2021 deficit of £22m improved during the course of the year to an estimated £5m deficit as a result of unexpected increases in tax revenue.

Deputy Helyar viewed the absence of amendments to the 2022 Budget and its straightforward passage through the States as evidence of improved joint working and collaboration across the States.

“The budget contains no fireworks and it is without precedent in recent years in there being no amendments," said Deputy Helyar.

"There is a very good and indeed deliberate reason for that. Members, not just P&RC, have spent a great deal of time studying and assessing priorities for this term and the expenditure required as part of the Government Work Plan process, including how much tax this budget would look to raise.

“This budget represents the very essence of consensus - something that has been sadly lacking in Guernsey’s Government in recent years. That is not alchemy, narrative or spin - it is doing things differently and frankly, in my view, not perfect, but certainly better. There has been a lot less internecine fighting for an extra piece of the cake by amendment.”

Deputy Helyar reiterated the message which accompanied the release of the 2022 Budget proposals last month when he said that the improvement in public finances compared to the original forecasts for 2021 “is not expected to translate to a long-term financial improvement”.

Deputy Helyar also pointed to forecasts indicating that inflation “may exceed 4% by the end of this year [and] how quickly this recedes will depend on macro-economic factors that are largely beyond Guernsey’s control.”

Pictured: Inflation is expected to be around 4% by the end of the year - and duties are going up above the rate of inflation on fuel, cigarettes and alcohol to help fund an estimated increase of £67m in States' revenue expenditure next year.

Deputy Helyar said the OECD’s new global tax standard for large multi-national companies will be “a major change to the tax landscape”. But he warned that the “level and timing of additional tax revenue is still uncertain” and is “unlikely to be a silver bullet for our increasing cost pressures.

“The bad news is that, despite a spectacular and probably unique reversal of economic fortunes, our structural funding problems are not going to go away. The good news is that for the time being at least there is no more bad news.”

Deputy Sasha Kazantseva-Miller, who, like Deputy Helyar, was elected to the States in 2020, disagreed with Deputy Helyar's criticism of previous States' Assemblies.

“The previous States allocated a total of £193m into the capital reserve," she said. "There is a congratulatory air to this budget. However, for the avoidance of doubt, we are eating into the reserves provided by taxpayers and previous assemblies with no idea of how this will be repaid.

"In addition to the complete lack of transfers into the capital reserve, this Budget is also presiding over a massive increase in public spending."

Pictured: Deputy Gavin St Pier, a former P&RC President and 2020 election poll-topper, questioned how Guernsey Ports was going to pay back an 'internal' States' loan of £12.5m and referred to a recent States' decision to spend tens of millions of pounds to re-capitalise Aurigny.

It was an unusually short Budget debate. Deputy Helyar opened proceedings at 09:30 and was able to deliver his closing speech less than three hours later. Many members did not contribute to the debate. The limited criticism of the Budget proposals was represented most forcefully by Deputy Gavin St Pier, a former P&RC President and 2020 election poll-topper. He said the Budget was "unambitious".

“The planned savings to be delivered in 2021 of a pretty measly budgeted £7m – 1.5% of total spending - is likely to fall woefully short at £1m,” said Deputy St Pier.

“The budget next year of £3.15m is also very unambitious and disappointing. Similarly, the capital income from sale of States-owned properties at £1m in 2021 and only £3m in 2022 is a far cry from expectations set a year ago – giving no indication or confidence that anything substantial is happening with property."

Pictured: Deputy John Dyke criticised aspects of States’ spending. He cited a budget of more than £600,000 a year for "non-teaching special needs coordinators" in schools. “When I hear the word ‘coordinator’ I start to tremble to be honest," said Deputy Dyke. "I just wonder if that is something that’s nice to have that we don’t need – we don’t have them now."

Before and since the 2020 election, Deputy Helyar has consistently argued that the States should be able to make significant savings by cutting public spending. But in the Budget debate he acknowledged that savings found so far were limited and that the States’ property portfolio lacks direction.

“Yes, they [the expectations] are not as ambitious as they could be," he said. "A number of properties would already have been sold had it not been for the review about how to use them or how to joint venture for housing development.”

Deputy St Pier highlighted the need for a longer-term solution to the States’ reliance on fuel duty revenue in an era of pressure on fuel consumption for environmental reasons. He also criticised P&RC for failing to recognise the “inevitability” of domestic TRP increases.

“The inaction on bringing forward the overdue proposals to replace motor fuel duty is really starting to play out at pace," said Deputy St Pier. "Electric vehicles are increasingly entering our roads, with a £300,000 fall in duty budgeted next year, despite a 4%, 2.9 pence per litre increase in duty. This is unsustainable and swift action is needed now.”

Pictured: It is anticipated that £25m of business support expenditure will be incurred during 2021. This is made up of £12m in payroll co-funding; £11m in sector-specific grants for visitor accommodation, visitor attractions and other travel-related business; and £2m in grants to small businesses.

“The decision to only increase domestic TRP by 4% is short-sighted and will come back to haunt the Committee when they try and present a coherent tax base as part of phase two of the tax review next July. Property taxation will inevitably need to play a significant part in that new tax base and every Budget that slips by without recognising that inevitability is a wasted opportunity to ease the adjustment.”

The 2022 States of Guernsey Budget can be read in full HERE.

Comments

Comments on this story express the views of the commentator only, not Bailiwick Publishing. We are unable to guarantee the accuracy of any of those comments.