The new owner of Sark Electricity has run into some financial difficulties as a result of a crime he committed more than a decade ago, which is now considered 'spent' in the eyes of the law.

Alan Jackson bought the utility earlier this month, through his firm Witney Price.

Mr Jackson has long links with Sark having previously lived in the island. He bought the only electricity provider after the death of its previous Managing Director, who had been involved in a price war with the island's Electricity Price Commissioner for more than a year.

Over the weekend, Mr Jackson announced immediate investment in the firm to ensure the power stays on in Sark during the corona virus crisis.

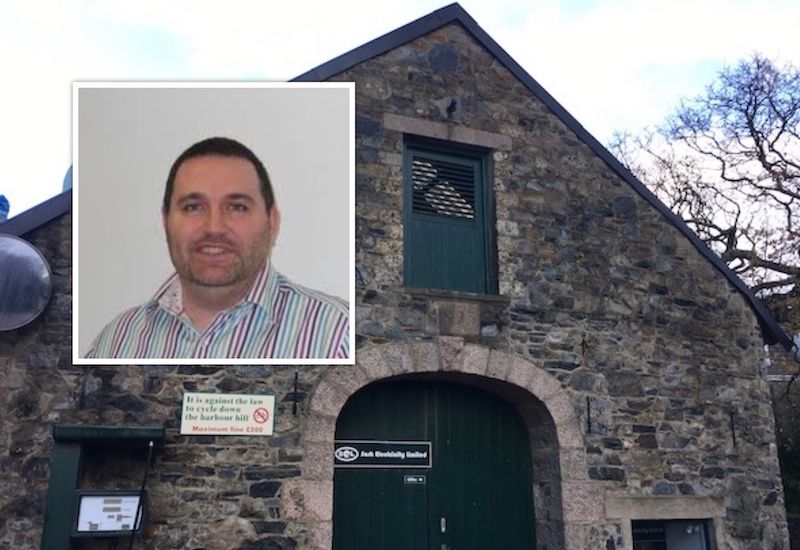

Pictured: Money worries are facing the new owner of Sark Electricity, but very different ones to those which the previous owner faced.

He has staff involved in cleaning out the island's diesel tanks to ensure storage reserves are optimised, while plans for further maintenance on the generators has had to be put on hold as a result of the increasing number of covid-19 positive patients in Guernsey. Mr Jackson is hoping to get around the travel ban to the Bailiwick by asking for help from Guernsey Electricity, the States of Guernsey and the wider Bailiwick business community.

An administration update is also being carried out to ensure everyone in the island stays connected with Sark Electricity.

To read Mr Jackson's open letter to Sark residents click HERE.

Mr Jackson's efforts to invest in the island have met a big stumbling block however, as an attempt to register the change of ownership of Sark Electricity with its bank has ended in the firm's accounts being closed instead.

Sark Electricity banks with NatWest, which Mr Jackson said has requested he close the firm's bank accounts with "immediate effect" because he has a conviction for fraud dating back more than ten years.

Mr Jackson has been very open about his conviction and told his new customers in Sark about his problems with NatWest.

"In a rather personal twist, I am disappointed to notify you all that, due to the change in ownership, NatWest Bank have requested that we close our bank accounts with immediate effect. They did not even give me an opportunity to apply.

"Apparently. my history simply makes business banking absolute impossibility. A lack of business banking services would clearly have an impact on our ability to function as a going concern."

Mr Jackson was made aware of the situation last week and said he made immediate steps to rectify the situation

He asked for help from Guernsey's Policy and Resources Committee, and said he "expressed my personal disappointment that 13 years after my offence and with my conviction now being officially classed as spent, that I am still being punished in Guernsey for the recognised failures of my past."

Mr Jackson's queried how a spent conviction can be held against him, more than a decade later.

"How does the Guernsey executive reasonably expect ex-offenders to effectively rehabilitate if practicalities such as business banking arrangements are out of reach of those with prison records? I accept that my failures would reasonably make it harder, or more expensive, but impossible!"

Pictured: File image.

Mr Jackson said he has had political support in both Sark and Guernsey and hopes to resolve the situation soon.

"I have asked the States of Guernsey to seriously consider leveraging its cash deposits with NatWest to ensure that the spirit of the Rehabilitation of Offender’s (Bailiwick of Guernsey) Law, 2002 is executed in practice. I understand that Deputy Al Brouard has now reached out to NatWest Bank and the Guernsey Law Officers to discuss the topic.

"As a private citizen, and not on behalf of SEL, I would respectfully ask that those of you that support the concepts of prisoner rehabilitation write to your Deputies and NatWest Bank asking them to reconsider this socially reprehensible policy.

"Conversations with the Price Commissioner in respect of the PCO and the historic case are ongoing. In fairness to Chief Pleas, responding to Covid-19 is a higher priority at this time and this will, I am sure, be dealt when they have a chance to take a breath.

"I would like to extend my personal thanks to Chief Pleas members and the team around them for facing this challenge as diligently as they have. Decisions that have stumped significant bureaucracies have been made swiftly and I have no doubt, will have saved lives."

Pictured top: Sark power station and (inset) Alan Jackson.

Comments

Comments on this story express the views of the commentator only, not Bailiwick Publishing. We are unable to guarantee the accuracy of any of those comments.