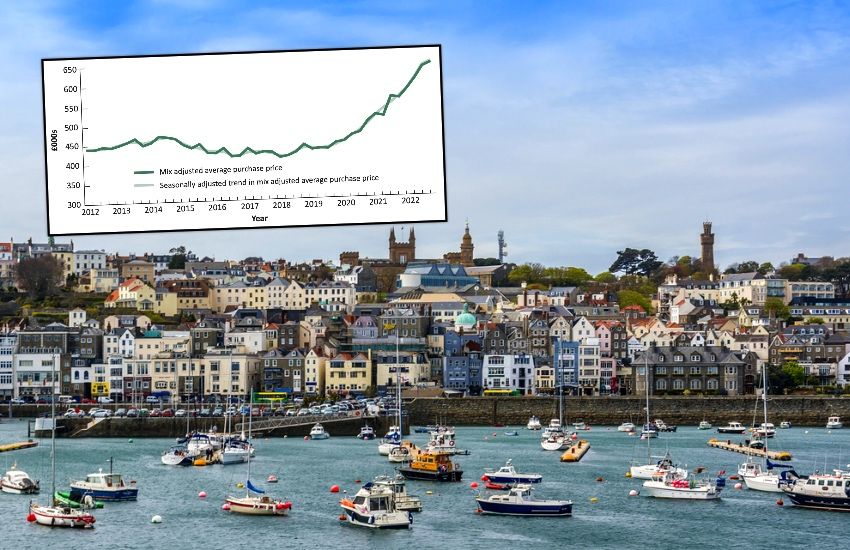

The average purchase price for local market homes continues to rise, new States figures for the past year and the past five years have shown.

On average, a local market home cost £638,267 in the final three months of 2022 – 15.9% higher than the same time in the previous year, 1.4% higher than the autumn of 2022, and 51.6% higher than five years previous.

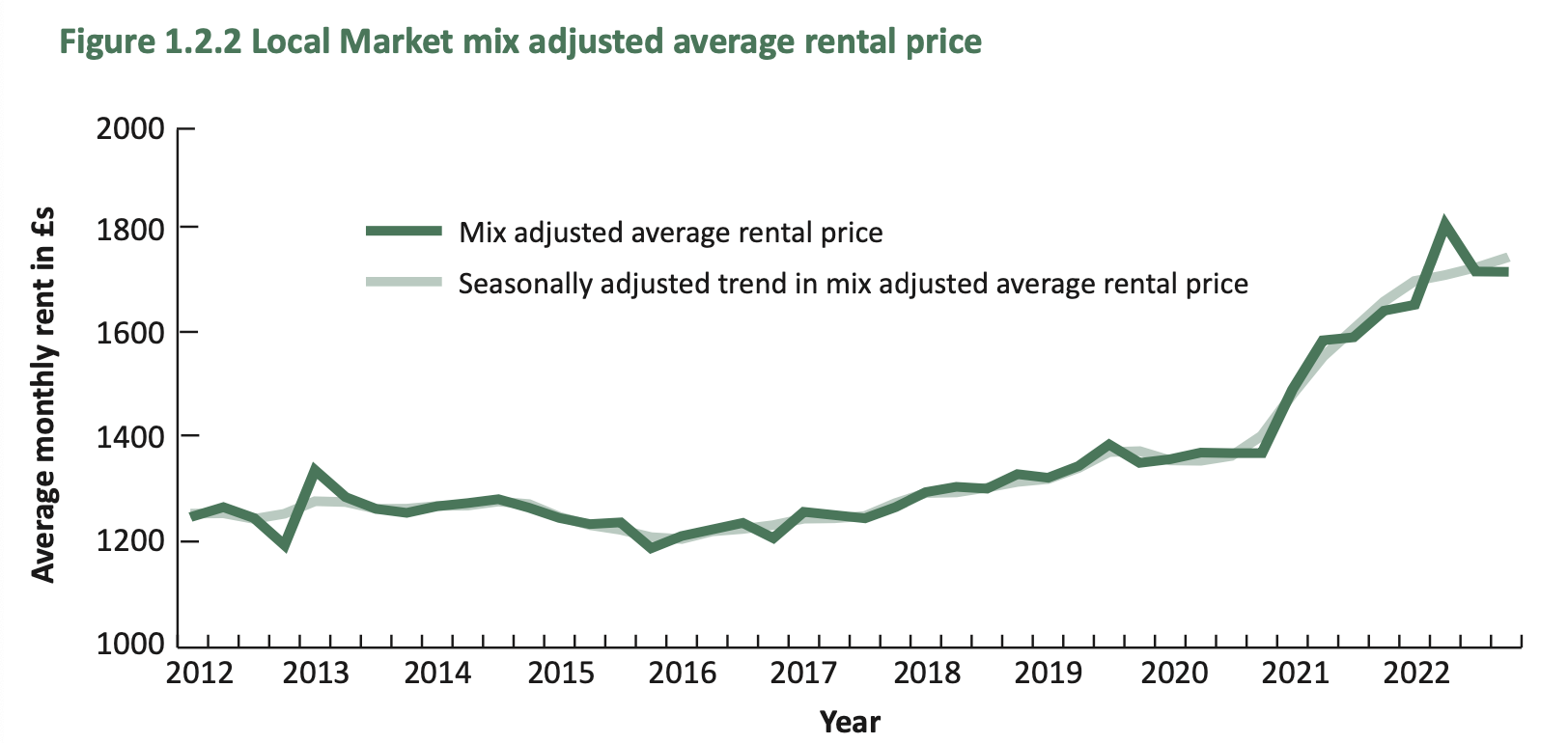

Average rental prices at the end of last year remained in check with previous months and 2021, but a monthly cost of £1,725 means it is over 35% higher than five years earlier.

The number of property transactions at the end of 2022 also fell by 53 compared to the previous quarter, and the same quarter in previous years, with 181 recorded.

The number of new builds sold as a proportion of all sales fell by 1.5% in the quarter on the previous year.

The new figures come just a week after the Bank of England’s base rate was increased to 4%, in efforts to combat inflation nationally.

Pictured: Rental prices have risen sharply since 2021.

The States measure house prices by calculating the average cost of purchasing a property including both the building and land, and moveable assets such as fixtures.

This method also weights properties according to their type and the number of bedrooms to reflect the profile of all the owner occupied and buy-to-let property units across the island.

The States noted that the most recent annual percentage change of 15.9 % is running well above the annual percentage change in RPI – one of the key measures of inflation – which was at 8.5%.

Pictured: Savills' Stuart Leslie expects the local market to outperform the prime UK market deep into this decade.

Property professionals recongised that 2022 continued to see strong demand for housing in the face of a restricted supply of housing stock.

Stuart Leslie, Head of Residential Sales at Savills Guernsey, said it’s “unsurprising that activity levels have cooled in terms of the number of transactions. Interestingly though, sales above £1m increased, possibly indicating less of a reliance on borrowing toward the higher end of the market”.

He argued this was due to a record breaking 2021 and “significant political and economic upheaval” in the UK and further afield.

“The heady heights experienced at the end of the pandemic were always going to be impossible to sustain over the longer term and the latest property bulletin perhaps gives a flavour of what’s to come,” said Mr Leslie.

“Guernsey has not been completely immune from the tougher lending rates and economic uncertainty facing the UK – and the full picture will not become clear until the quarter one figures are released later this year.

He added that market conditions are stabilising with more people looking to sell to capitalise on price growth, with plenty of willingness to move internally or from abroad still on show.

“Looking ahead, the island’s housing market should remain robust given the underlying demand and quality of life on offer – and we expect property to outperform the prime UK market over the next five years,” Mr Leslie concluded.

Comments

Comments on this story express the views of the commentator only, not Bailiwick Publishing. We are unable to guarantee the accuracy of any of those comments.