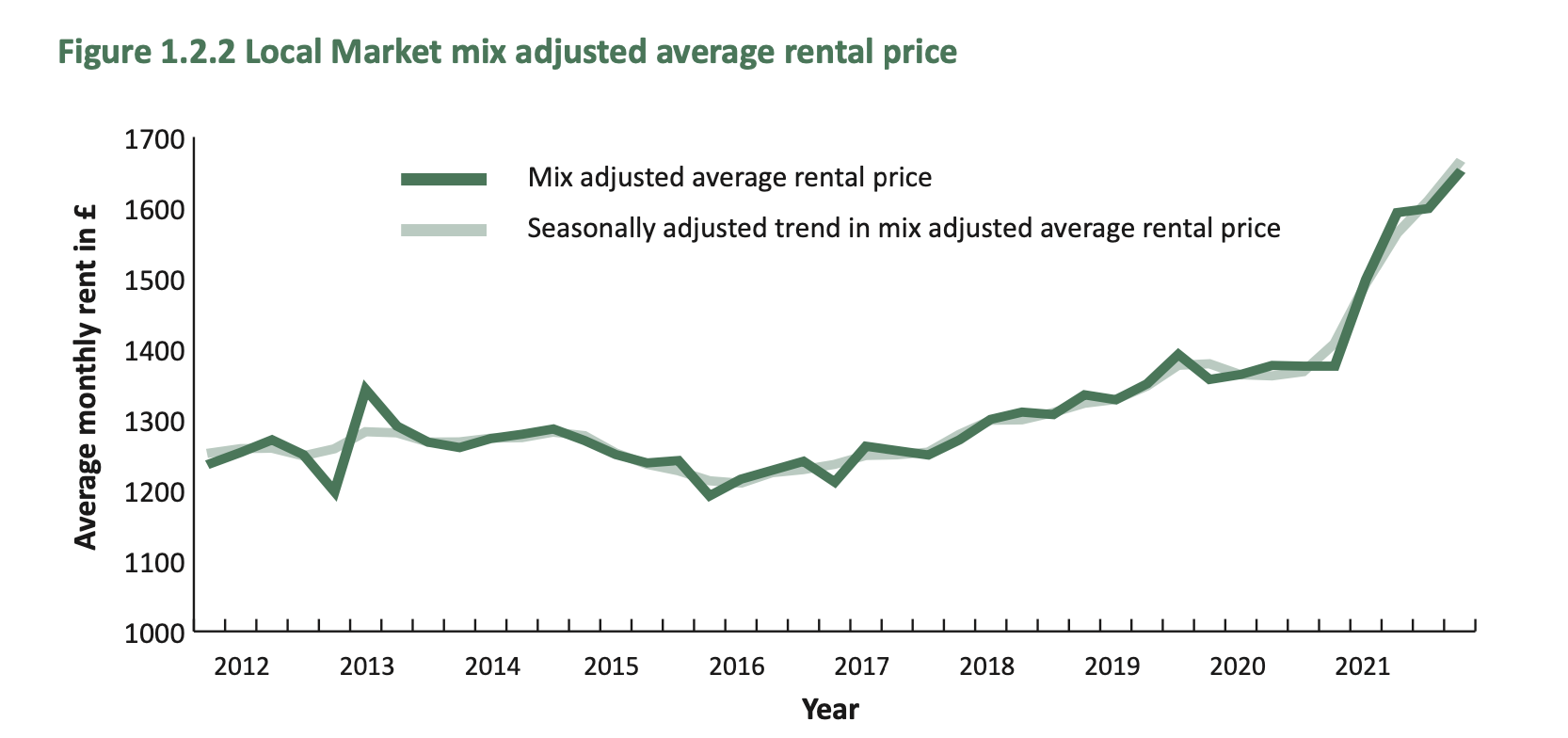

The average cost of renting a local market property has increased by 20% in just one year.

The States' latest quarterly residential property prices bulletin reveals that in the fourth quarter of 2021 the average rent was £1,650 per month - 20% higher than in the fourth quarter of 2020.

Lead for letting at Savills, Gill Mooney, said she was not surprised by the figure based on her team's experiences over the past year.

“The annual rental rise of 20% is astonishing, but perhaps not surprising," she said.

“Monthly rental prices have held a steady upward course and demand remains incredibly high, especially for homes with a garden and more outside space, as reflected in the quarterly findings for three- and four-bedroom properties.

“Similar to our colleagues in residential sales, there have simply not been enough properties on the market to meet people’s needs.

“As a result, properties are being snapped up within a matter of days – often before they come onto the market."

Pictured: Ms Mooney said the dramatic increase in rental costs was largely driven by a lack of available properties.

The average cost of buying a house reached £550,893 at the end of 2021. That was 11% higher than in 2020.

“The latest States' statistics tally with our own experiences,” said Keith Enevoldsen, Savills' lead for residential sales.

“Despite the challenges presented by the pandemic – including the most recent omicron wave and subsequent tightening of restrictions – the island’s property markets have been busy.

“The lifestyle factors that people are looking for have driven consistent demand, particularly in the open market.

"Guernsey, with its stunning coastline and strong sense of community, has remained a very desirable destination.”

Pictured: Keith Enevoldsen said: “In many cases, properties have been on the market for a very short period of time, especially those on the local market, with a sale agreed in a matter of days.”

“Looking ahead, there is some uncertainty about how the markets will react as we move into the spring and early summer, but for the moment the market remains buoyant.

“There is a large pool of highly motivated buyers who are ready, willing and able to move and we are seeing more activity in this early part of the year than we would normally expect.”

Head of Wealth and Personal Banking at HSBC Emma Bunnell said the latest figures indicated the challenges facing first-time buyers as they try to get onto the property ladder.

“It is important that lenders pay close attention to market conditions and provide products that are suitable and, importantly, accessible,” said Ms Bunnell.

You can read the latest property bulletin in full ONLINE HERE.

Comments

Comments on this story express the views of the commentator only, not Bailiwick Publishing. We are unable to guarantee the accuracy of any of those comments.