Deputy Lyndon Trott, the President of the Policy and Resources Committee, says “we were only really left with one alternative” for plugging the gaps in Guernsey’s finances as he suggests increasing income tax in his 2025 Budget.

Islanders could be paying an extra 2% in income tax for two years should the proposed budget be supported by deputies next month. The proposals also see an increase in personal allowances too, meaning up to £15,000 can be earned before paying into the tax pot.

Pictured: Deputies Trott and Soulsby of Policy and Resources briefed their fellow Deputies, the Media and Community Stakeholders yesterday.

That’s just the headline statement, as this year's budget comes with a whole host of other suggestions, such as freezing duty on alcohol and edits to TRP.

Deputy Trott referenced that some of these get labelled as “stealth taxes” and even if he “doesn’t see them that way”, those who do will be pleased as there should be “no real terms increases” besides tobacco.

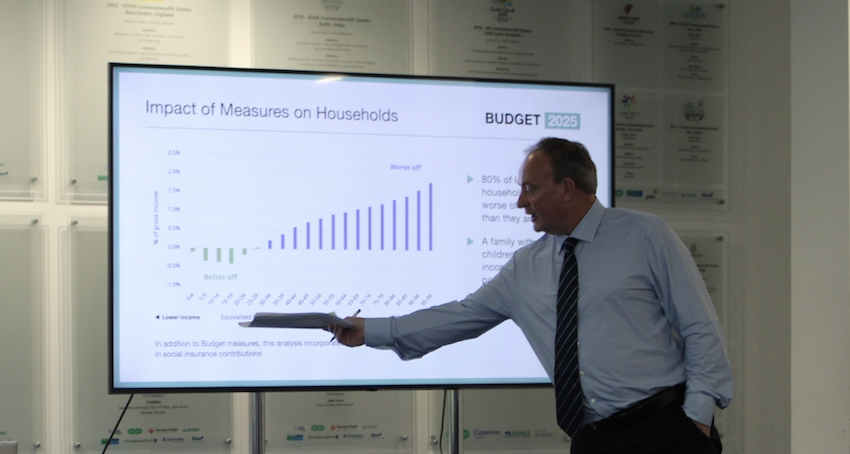

Deputy Trott stated that for the lowest earners in Guernsey, they should be protected from seeing any major changes to their monthly bills, as the States say “80% of the lowest income households would be better off, or no worse off in real terms” under the proposed Budget.

P&R are also hoping to adjust rates in line with the current strains on the Housing Market. For first time buyers this should be good news with less to pay on your first property, however for anyone in the market for a luxury property, around the £5m mark, it would mean more to pay.

There’s also good news for Guernsey’s third sector, with charities being given access to better tax rebates, so more money and easier to access.

There’s also comments and notes on penalties for empty and vacant rental buildings, rent-a-room tax relief, and changes to what defines a “small brewery”. But, like the budget itself, these need to be picked through with a fine tooth comb in the build up to the debate that is due to start on 5 November.

There’re a host of ‘key initiatives' aimed at fixing the housing shortage too, but those will have to wait for another day, as for now let's just focus on those tax increases.

Few will be happy to see increases in personal income tax rates, but as Deputy Trott stated to deputies and the media yesterday: “It would be irresponsible” to leave the finances as they are ahead of the election next year."

A large debt-based blackhole is still needing plugging, and that’s what P&R have attempted to do.

They’re not looking to reattach the leg, but instead stop the bleeding and hope the next group through the chamber doors have better luck.

Pictured: Deputy Heidi Soulsby was nominated to the Vice-Chair of P&R last December, after a vote of no confidence against her predecessors.

Deputy Heidi Soulsby, the Vice-President of Policy and Resources, said: “We're taking a really pragmatic approach to the situation we're in. We know, the figures aren't lying, we know we need to do something. We can't wait a few years.

“We've all come from different positions on P&R and some have supported GST. I didn't, and others have supported income tax (increases) before now.

“I think we've really looked at this in a grown-up way and said we've got to do something and this is the best thing we can do now. Nobody wants to see increases in income tax, but we have kept things simple. So we're not increasing the indirect taxes more than real terms.

“This is a tax that is understood, well established, and we can move the dial quickly…and things need to happen quickly.

“We are currently showing a predicted deficit for 2024 of over £60 million. If we didn't do that, the deficit would be a similar number next year and possibly even greater the year after. So the point is, the matter has got to be addressed and this is the most sensible way to do it.

“In short, there aren't many dire moving options available to us. We've got a very real problem. The States has rejected a wide-ranging goods and services tax, so you are only really left with personal taxes. I stood on that mandate. The States elected me to the position on that mandate, and I'm delivering in line with their wishes.”

If approved the amount islanders pay in tax would increase, and it would be in place for two years, giving time for the next cast of the Guernsey political pantomime the chance for a few dress rehearsals, which is crucial according to P&R's President.

"These proposals are time limited for the fiscal years of '25 and '26," said Deputy Trott. "The states will have to decide whether they want to stick with these proposals or whether they want to decide upon an alternative.

"So does it force a year into the next States a decision? Yes it does and it's been designed that way purposefully because there's no hiding. If you want to be a States member you've got to make tough decisions.

"It isn't an easy ride, it's a tough job and you've got to be thick-skinned but primarily as a States Member you've got to do what is fiscally prudent and what is appropriate for this community. I believe the Policy and Resources Committee has done that and I believe the States will support it," he said.

The budget debate is due to take place in the States Chamber next month, starting Tuesday 5 November.

Over the next few weeks, Express will unpick the 2025 Budget proposals and how they will affect you...

Comments

Comments on this story express the views of the commentator only, not Bailiwick Publishing. We are unable to guarantee the accuracy of any of those comments.