The financial services regulator wants to push more resources into focusing on parts of the insurance sector which it sees as posing an increasing risk to Guernsey’s reputation.

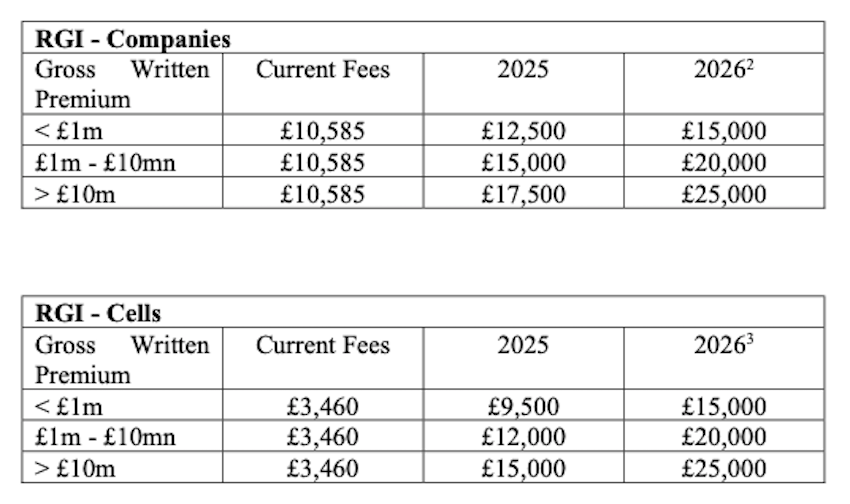

Its work would be funded by a big fee hike for retail general insurers, with the largest operators seeing them rise from £10,585 to £17,500 next year and £25,000 in 2026.

In March 2023 there were 35 clearly identifiable retail general insurers licensed in Guernsey, but the actual figure was thought to be higher as some insurers were not identifying their activities as retail.

The Guernsey Financial Services Commission has since tightened its rules around the sector.

General insurance includes coverage for house contents, bikes and health costs.

“Guernsey offers such insurance on a global basis and retail insurers have become an increasingly significant part of the insurance sector in Guernsey,” the GFSC said in its consultation on the fee hike.

“RGIs have a greater ability than other insurers to damage the reputation of the Bailiwick through not fulfilling contracts with policyholders.

“Additionally, over recent years the Commission has had to dedicate substantial and increasing amounts of time to mitigate the risks which have crystallised around individual RGIs. To some extent the costs of this work have been borne by other licence holders through their annual fees.

“We highlighted, during both the consultation and feedback period, that this would result in future consultation for an increase in fees for these types of insurers to reflect the additional resource requirement. The purpose of this change is not to shift supervisory resources from one sector to another but to increase the resources available for the supervision of RGIs.”

Pictured: GFSC's proposed fee changes for the retail general insurance sector.

It is proposing a staged approach to fee increased which will eventually see companies and cells paying the same.

“This staged approach will allow firms and cells which provide general insurance to retail customers to adjust to the proposed increase in their annual fee. In addition, the banding of the fees means they are proportionate to the volume of activity being undertaken.”

Elsewhere, the GFSC wants an overall proposed increase in fees of 5.3% in line with current Guernsey inflation.

“The purpose of these changes is to ensure that the Commission continues to have sufficient financial resources to meet its statutory objectives, including by having the skilled staff needed to supervise firms in a proportionate manner and being able to make continued investment in our IT infrastructure.

“These fees are proposed on the basis that the Commission aims, through 2025, to utilise reserves to cover some portion of the additional staff required to meet our ongoing supervisory requirements and to develop its IT infrastructure and online portals.”

Responses to its fee consultation need to be made by 4 October.

Comments

Comments on this story express the views of the commentator only, not Bailiwick Publishing. We are unable to guarantee the accuracy of any of those comments.