Ravenscroft has entered into an agreement to sell its wealth management business to Titan Wealth - with employees in the island being assured their jobs are safe

The deal, which was mooted earlier this month, is subject to shareholder and regulatory approval.

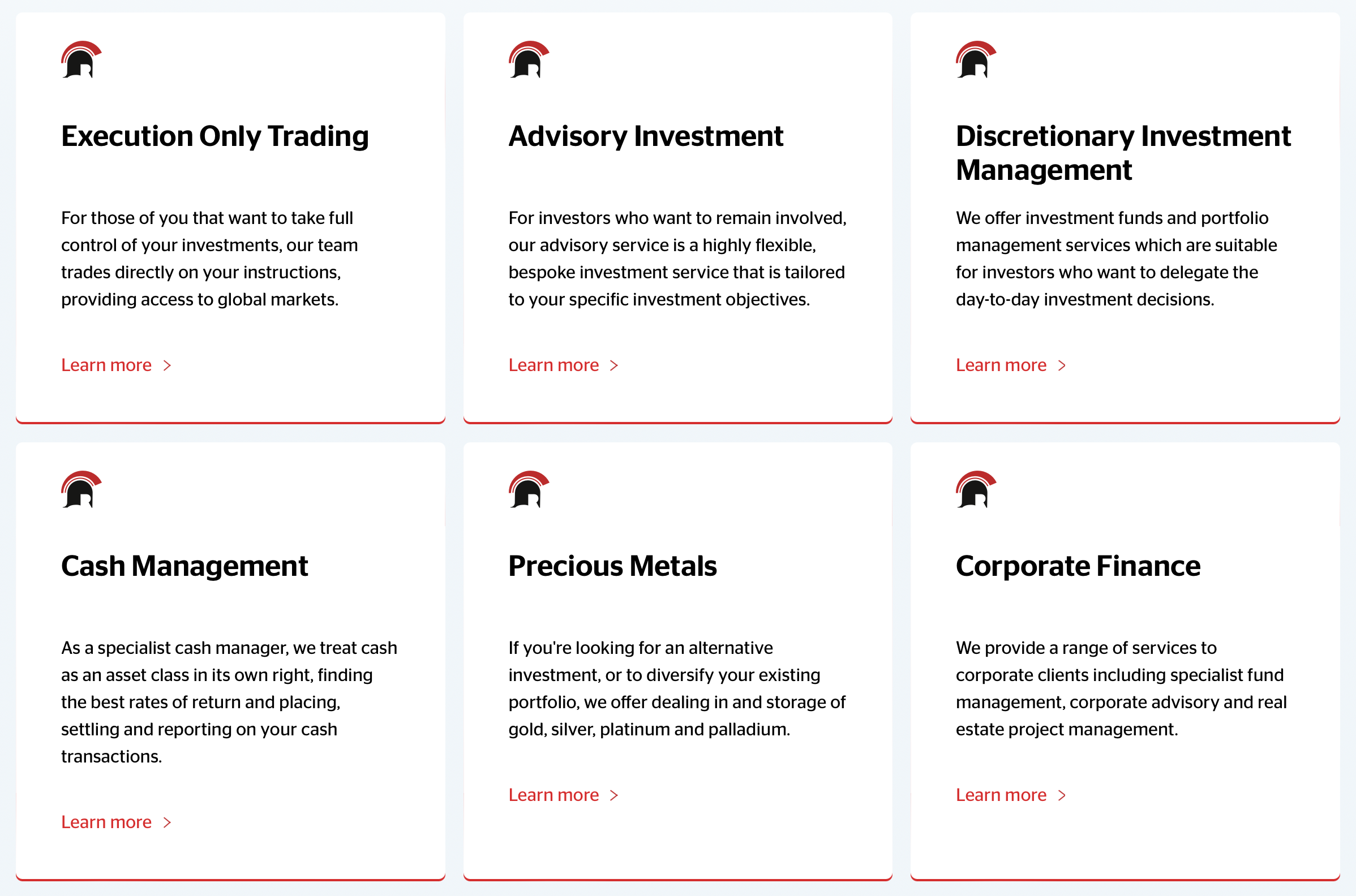

When it goes through, Ravenscroft's existing discretionary investment management, advisory investment services, cash management, execution only, and precious metals parts of the business will move across to Titan Wealth.

Titan Wealth's assets under management (AUM) and assets under administration (AUA) will then increase to £27.2 billion before a rebrand to Titan International next year following the completion.

The corporate finance and property management businesses of the wider Ravenscroft group are not included in the transaction, which follows Titan’s acquisition of Ravenscroft’s UK investment management business last year.

Founder Jon Ravenscroft will remain with the corporate finance and property management businesses, which will retain the Ravenscroft name, and he will also be a significant shareholder in the Titan Wealth group.

Pictured: Jon Ravenscroft.

"Ravenscroft is unrecognisable from the company it was almost two decades ago and I am proud of everything my incredible team has achieved," he said.

"I want to thank shareholders and clients for their unwavering commitment throughout. It was clear that future growth and expansion in order to realise the true potential of both the offering and our staff, required a change. It needed to be with the right people who had a client first ethos, shared our passion for community support, who were committed to ensuring that there were no job losses and who wanted to grow the business to bring benefit to both the Guernsey and Jersey economies so I am delighted we have found those values in Titan Wealth.

"With the Titan Wealth name and network, Mark Bousfield and Robin Newbould, together with the wider team, are the right people to take the business forward, allowing me to focus on the corporate finance and property management part of Ravenscroft.

"I will continue to be a significant shareholder in Titan Wealth and look forward to watching and celebrating their growth and international expansion," he confirmed.

Andrew Fearon, Joint Group CEO and Head of M&A at Titan Wealth, said the acquisition would significantly expand Titan Wealth’s international footprint.

"The acquisition of Ravenscroft Investments Limited in the Channel Islands is a significant milestone in our strategy to deliver Titan Wealth’s unique client to custody offering to clients and advisers in multiple international jurisdictions. Closely following our acquisition of Dubai-based planning firm AHR, we have now made significant progress in expanding our differentiated and integrated proposition for international clients and advisers. With investment management and investment funds in both Ireland and Channel Islands; offshore platform and custody solutions in the Channel Islands and the ability to provide financial advice in both the UAE and Europe and other jurisdictions we can service our clients wherever they may choose to live," he said.

"James Kaberry and I have worked closely with the Ravenscroft management team for a couple of years and have been impressed by the strength of the team and business, the values and client relationships that they have developed and continue to nurture. We look forward to seeing what we can achieve together now that they are part of the wider business."

Ravenscroft currently employs around 100 people, managing private and institutional clients and is one of the largest wealth managers in the Channel Islands.

Titan Wealth said the CI operation will continue to provide 'key operating capabilities offshore', as it looks to grow its international advice proposition, both 'organically and through further acquisitions'.

"Having spent many months working with the Titan Wealth team, it is clear that they have ambitious plans for growth and that we are an important part of that expansion. We have had numerous approaches over the years, but none were right for our clients, our shareholders and our team," said Mr Newbould, MD of Operations at Ravenscroft.

"The time is now right for Ravenscroft’s wealth management business to become part of a bigger company and have a strategic role in its future expansion. Titan Wealth was impressed with the skills and expertise of our team, their commitment to clients and the company’s excellent reputation in the community and it is exciting for all of us that the Channel Islands will become the hub for Titan Wealth’s international growth."

Ravenscroft website states it is an "independently owned investment services group with offices in Guernsey and Jersey".

Founded in Guernsey in 2005, by Jon Ravenscroft and initially operating under the Cenkos name, the firm quickly expanded with its Jersey office opening in 2008.

Initially offering investment services, the opening of the Jersey office saw the addition of an asset management team to provide segregated and pooled investment management services.

By 2012, Ravenscroft was the only Channel Islands based independent stockbroker and investment manager, after Cenkos Securities plc disposed of their controlling shareholding. A rebrand in 2013 saw the company name change to Ravenscroft Limited. The same year, the firm launched a corporate finance service.

Further acquisitions and expansions followed with Ravenscroft buying Bullion Rock in 2017, and Royal London Asset Management CI Limited and Royal London Custody Services CI Limited in 2018. This meant Ravenscroft now dealt in previous metals and offered an expanded cash management service.

Tees Investment Management Limited joined the brand in 2020 with an expansion into the Isle of Man the same year, and in 2021 a USD fund was launched.

Ravenscroft launched its Global Solutions Fund in 2022 and bought the Channel Islands operations of Milton Optimal Group in the same year.

Last year, the Higher Income Fund for the CI and IOM was launched.

By 2024, Ravenscroft employs more than 100 people and has £7.9bn of assets under administration for both private and institutional clients.

Ravenscroft website states that selling the wealth management business to Titan Wealth will allow it to focus on its Channel Islands offices and "shows our commitments to these jurisdictions".

Pictured top (l-r): Robin Newbould and Mark Bousfield.

Comments

Comments on this story express the views of the commentator only, not Bailiwick Publishing. We are unable to guarantee the accuracy of any of those comments.