The Guernsey Financial Services Commission intends to increase its fees by 10.1%, a significant jump that has been deemed essential to keep the service ‘fit for purpose’.

The decision to increase fees from licensed and registered entities will allow the service to continue operating and is based off the "absolute minimum level of resourcing need."

The GFSC regulates the finance sector in the Bailiwick of Guernsey and adheres to 117 principles from 655 pages of international financial standards. These guidelines for best financial practice continue to grow and expand year on year, requiring the GFSC to keep up by hiring skilled policy officers.

The GFSC has published a consultation and explanation of its fees, with a seven-week window for people to give their opinion. You find the consultation ONLINE.

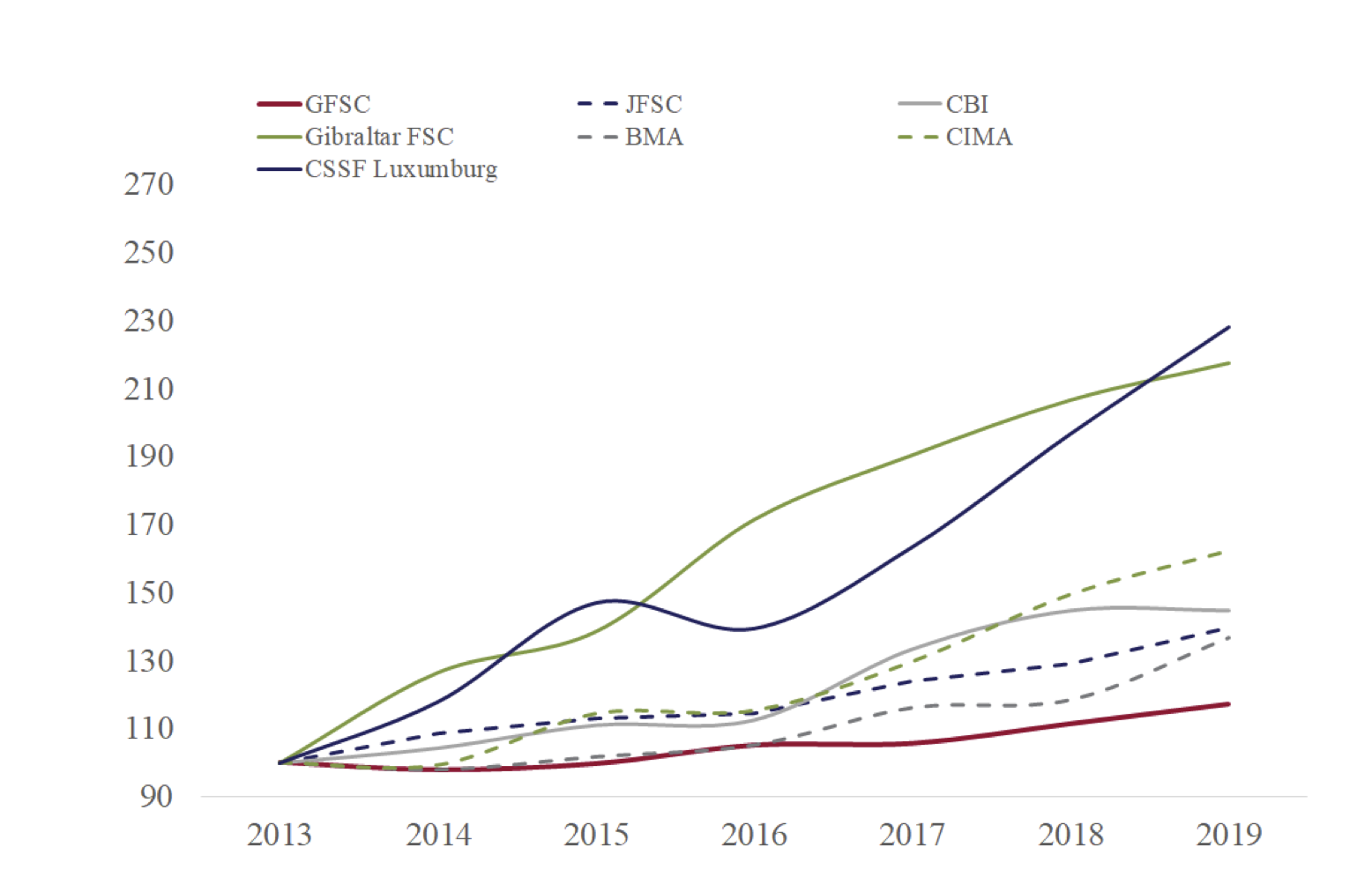

Pictured: Compared to similar jurisdictions the GFSC’s running costs have stayed relatively stable.

The Commission has invested £3.6 million in its IT system over the past three years to keep up with technological developments and prepare for a major international inspection, expected in 2023.

Guernsey will be assessed my MONEYVAL to make sure as a jurisdiction it is observing international standards on money-laundering and financial crime.

This investment has led to two years of operational deficit, coupled with a staff turnover rate of 18.5% in 2020, and a subsequent ‘breaking point’ for recruiting and retaining staff.

This 10% is a large increase, but by comparison, the Jersey Financial Services Commission increased the fees by 20.5% last year. The GFSC argues that because of constantly evolving standards, regulatory inflation is higher than general inflation.

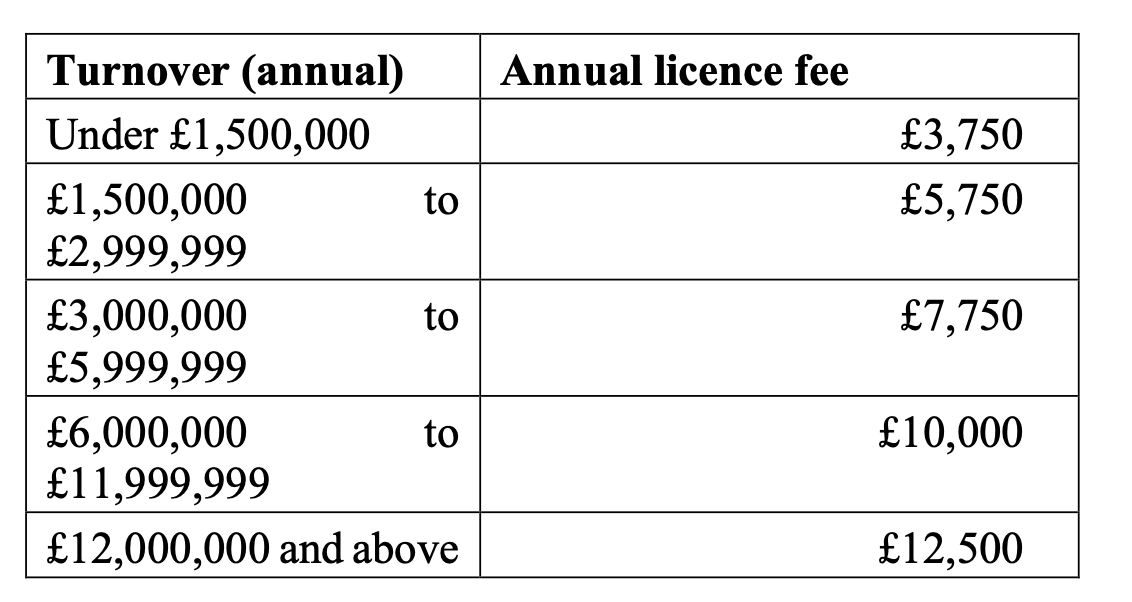

Additionally, the fee system is set to be restructured by 1 November to encourage growth from smaller firms.

Pictured: Some POI licensees will be charged based on their size instead of paying a flat-rate.

“Since 2013, the Commission has exercised considerable control over its costs as explained in the consultation paper,” said the Commission’s Chairman, Dr Cees Schrauwers.

“The additional income provided by the proposed fee increase would be invested in increasing staffing numbers within key areas of the Commission, such as the Authorisations Division where we are seeing an increase in applications.

“It will also allow us to invest in our internal systems and ensure that the Commission remains effective and able to demonstrate that the Bailiwick meets the standards required for international financial services businesses to continue to prosper in the future,” he said.

The consultation period closes on 8 September.

Comments

Comments on this story express the views of the commentator only, not Bailiwick Publishing. We are unable to guarantee the accuracy of any of those comments.