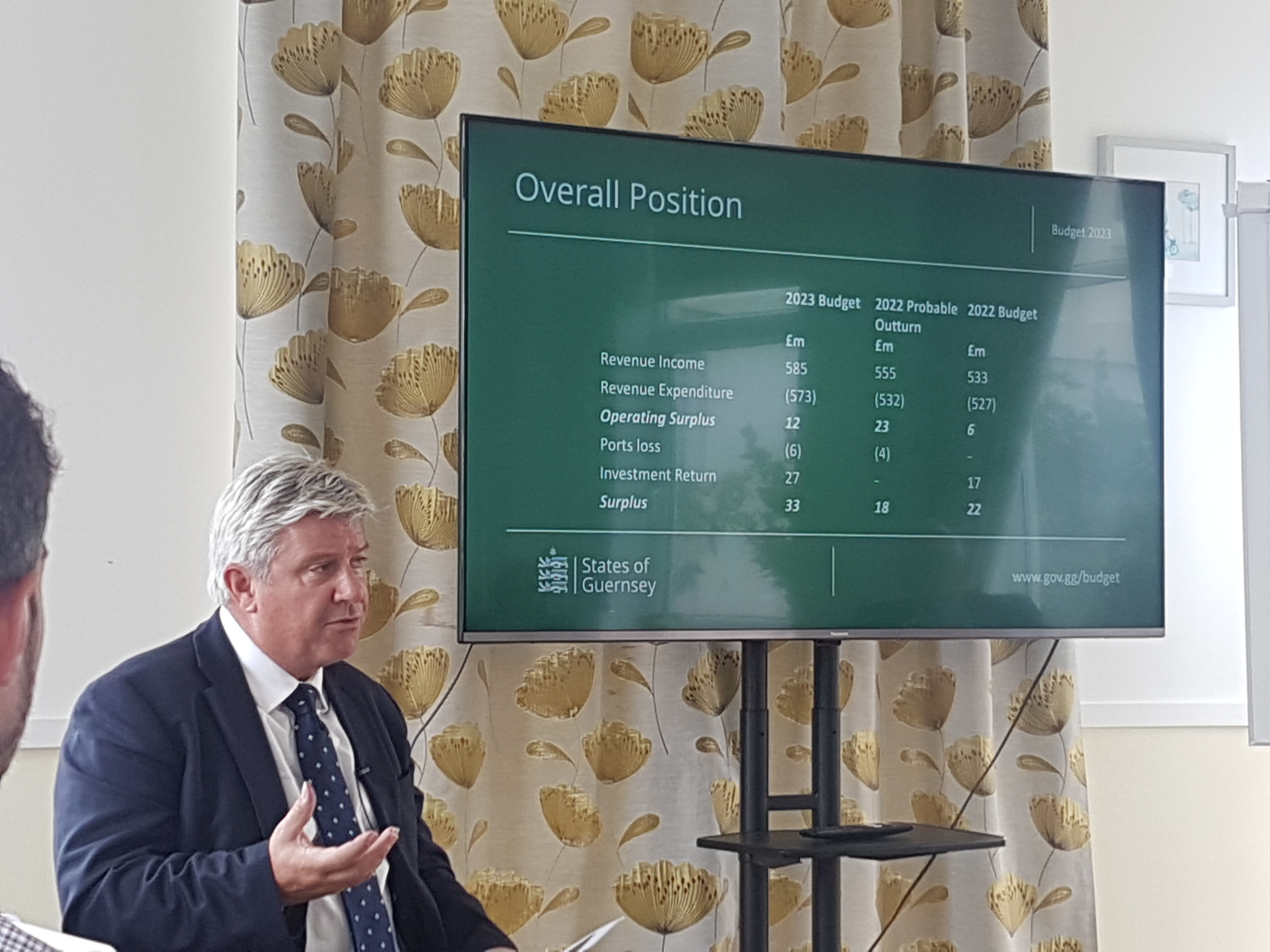

The 2023 Budget was released last week and will be debated at the beginning of next month. The IoD's economic lead has agreed with the budget's proposers that difficult decisions need to be made to ensure Guernsey's public finances are balanced again.

The IoD Guernsey said it "notes the States of Guernsey’s 2023 Budget, which shows the significant financial pressures the island is facing now and in the future, due to the impacts of inflation, strong demand for public services and the ageing population".

Pictured: Deputy Mark Helyar presented his budget proposals last week.

IoD Guernsey’s lead on economics, Richard Hemans (pictured), has said:

"The fiscal deficit after capital expenditure is unsustainable as limited reserves are exhausted, and will contribute to local inflation when it is already elevated. The 8% overall increase in department spending is concerning because it exceeds both inflation and the 6% increase in forecast tax receipts, thereby making the deficit worse.

Whilst the cost of living measures are probably more limited in scale than expected or required, at least compared with the UK and Jersey, we are generally pleased with the housing incentives that will help to increase the capacity of the existing housing market and discourage speculation. However, attention must be paid to the impact on the local rental market.

Pictured: The cost of living and housing crises are just two priority areas.

The use of the tax system to influence the housing market is powerful and could be used more widely, for example to encourage investment in skills and infrastructure, business creation and labour market participation. This could also be extended to encourage decarbonisation, net-zero goals and a greener Guernsey.

It is clear that difficult long-term choices need to be made to bring the public finances back into balance. The discussion should not be limited to increasing taxation through such measures as GST and corporate levies, but must continue to consider the provision of services, efficient procurement, capital prioritisation, borrowing and the sale of assets.

A stable, certain, balanced fiscal position is essential to maintain Guernsey’s attractiveness as a place to invest, live, set up a business and support a strong economy with low inflation and full employment. The political and economic turmoil suffered by the UK over the past week illustrates this perfectly."