A 5% GST alongside a package of other mitigating measures is a “far less damaging” alternative to the income tax increase proposed in the Budget, its backers have argued.

Policy & Resources’ 2025 Budget key proposal is a hike in the income tax rate from 20 to 22% to bring in an extra £28m, something it says will be for two years but critics fear would never be reversed.

Politicians are lining up alternatives, including a move led by Deputies Peter Roffey and former P&R President Peter Ferbrache to bring in the GST package that politicians rejected in February.

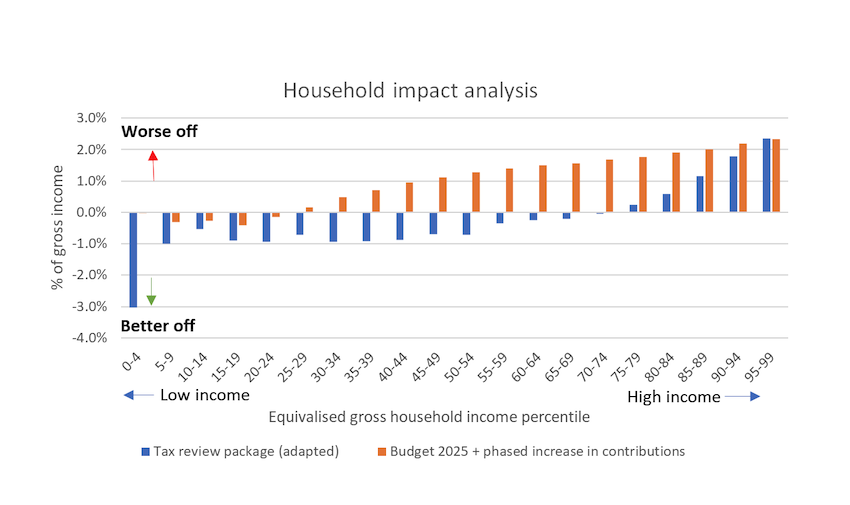

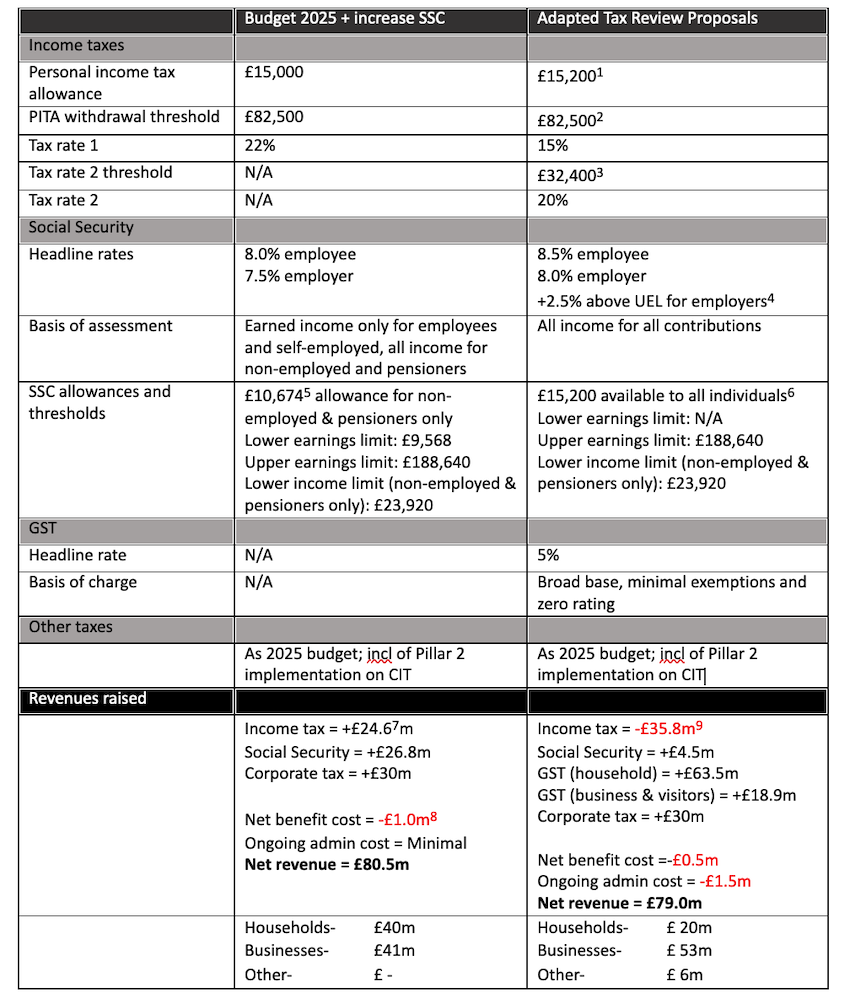

They cite independent Treasury analysis to back their case which shows that their GST/Social Security/15% income tax band package takes far less from households in total while generating as much revenue and that nearly every local household will be better off than under the Budget proposals.

GST would come in by January 2027 under their amendment.

"We are convinced that the carefully thought through fiscal package, worked up painstakingly during the first two years of the political term, is greatly superior to the apparently knee-jerk proposals in the Budget," they said in a report accompanying their amendment.

"In short, we regard it to be not only a much Fairer Alternative but a far more effective and less damaging alternative.

"We accept that it is a package which has been rejected on multiple occasions, but now that it is being offered up as a straight alternative to Budget proposals which would hit ordinary Guernsey families hard, and risk significant damage to our economy, we hope it may be viewed in a more favourable light. No measures to raise more money from our community will be welcomed, but some are less bad than others."

P&R's increase of the rate of income tax includes increasing personal allowance by an additional £400. This is said to reduce the impact by £80 per taxpayer.

But Deputies Roffey and Ferbrache say the net impact is to leave typical Guernsey families on moderate incomes more than £670 worse off each year.

"By contrast the previous package contained far more significant mitigations, including a 15% tax band, reforms to Guernsey's social security contribution system, and enhanced States Pensions, amongst several other measures."

P&R's proposals do not go far enough to address the shortfall in Guernsey's finances being driven by demographics increasing the costs of services and pensions, they said, still leaving a structural deficit of £38m. in 2025.

"So, in 2026 the States would need to continue with the elevated rate of income tax and very likely hike it even further. Even if they decided at that point that they would move instead to a broader based tax system, perhaps involving a consumption tax, that would likely take a minimum of two years to introduce.

"So, in reality the budget proposals would lead to at least four years of higher Income Tax rates. During this period Guernsey would be rendered 'optically uncompetitive' against its main competitor of Jersey. This could lead to significant damage to our economy."

They stress that one of the misunderstood elements of the tax package that include GST is that it would have raised "a great deal of revenues from the corporate sector, thus allowing the load to be very considerably lessened on individual islanders".

Pictured: Treasury assessment of the two options.

Treasury's comparison of the two packages concludes: "The household impact analysis suggests that the Tax Review package will have less impact on the majority of households than continuing an increase in the primary income tax rate, combined with an increase in social security contributions.

"This is because, while the two packages collect similar amounts of revenue the Tax Review package collects a greater share (around 75%) of revenues from companies and non-residents. This allows a net improvement in the financial position for the majority of lower- and middle-income households."

Read the Roffey/Ferbrache report in full here.

Comments

Comments on this story express the views of the commentator only, not Bailiwick Publishing. We are unable to guarantee the accuracy of any of those comments.