Guernsey businesses are potentially losing out as the island is blocked from full access to trade agreements agreed by the UK in the wake of Brexit.

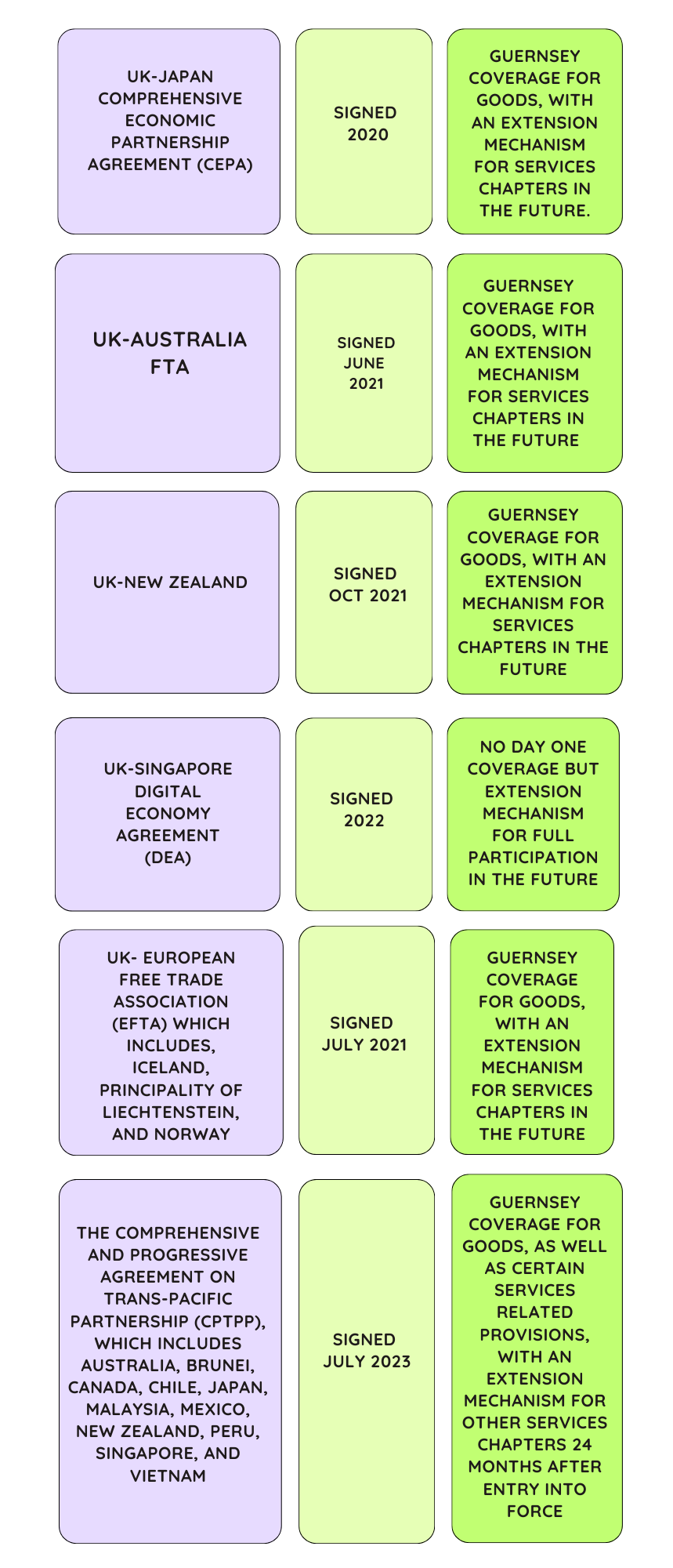

Since 2020 the UK has signed new deals that the island is keen on with Japan, Australia, New Zealand, Singapore, the European Free Trade Association and The Comprehensive and Progressive Agreement on Trans-Pacific Partnership.

For all of those that involve goods, Guernsey is covered, but the services elements have not yet been extended.

The difficulties faced in getting access to the deals was raised during the ongoing UK Justice Committee inquiry into the constitutional relationship between Guernsey, Jersey and the Isle of Man with the UK.

Free Trade Agreements provide preferential market access between countries.

If Guernsey is not included in all chapters, it potentially differentiates the island from the United Kingdom when trading in those countries.

It also means that Guernsey based business, and those of any trade partner wanting to trade or invest in the island, may not benefit from preferential market access or dispute resolution provided for within these agreements.

If Guernsey is not included in a particular FTA it does not prevent trade. Businesses can still trade within the protections of the World Trade Organisation principles, but these are less favourable.

The UK represents the island in trade talks and its focus has been on getting extension mechanisms for services in the deals, a major sticking point now appears to be getting the UK to accept that Guernsey is compliant with their requirements - and for the island this is not just about copying what the UK does.

Pictured: Rt Hon Greg Hands MP.

“We are all keen to move forward those activations when the CDs [Crown Dependencies] want to and crucially when they are ready in ensuring they are compliant at the same time,” Rt Hon Greg Hands MP, Minister of State at Department for Business and Trade, told the inquiry.

He had earlier stressed said that the dependencies bring something real to offer to the table and are a great asset in terms of trade for the British family overall, but that "ultimately it's the UK's name on the international treaty and we obviously have to bear responsibility if there’s a lack of compliance".

Negotiations are at times hampered by other jurisdictions not understanding what the dependencies are and how they relate to the UK - and this can be further complicated when the three jurisdictions adopt different positions on what elements they want extended. This happened with the CPTPP, and in Guernsey's case, it had a sub-position where it wanted a carve out for Sark and Alderney within its position.

One area of disagreement in the past has been about differences in intellectual property regimes.

When the UK was in the EU, the dependencies were not in service elements of trade deals. Mr Hands said this was about maximising opportunities.

There has been some discontent voiced by Guernsey about how the Department for Business and Trade goes about consulting with it before acting on the island's behalf, complaining of being informed when thing are a fait accompli.

It spoke of "several recent examples of negotiating texts, 'non-papers' or draft legal text being shared with potential trade partners about the CDs, which the islands themselves have not had sight of in advance, and which Guernsey Ministers have not been consulted upon or consented to".

It has also raised issues about time pressures when these deals are being negotiated. The islands are not in the room and there was one example quoted when there was less than 48 hours to feedback. But the UK has stressed that this reflects the nature of negotiations when things can happen quickly.

Yes, but quantifying that is far more difficult. If you just take the CPTPP, services accounted for 43% of the UK's trade with its members last year. Joining the agreement can reduce red tape – for example, UK firms will not be required to establish a local office or be resident to supply a service and will be able to operate on a par with local firms.

Pictured: The GDP of the jurisdictions that the UK has signed new trade deals with. Map created with flourish.studio

Membership of the trade group is expected to spark further investment in the UK by CPTPP countries, already worth £182 billion in 2021, by guaranteeing protections for investors. Without the extension, Guernsey firms will be left at a disadvantage when it comes into force next year.

"It is very important to activate the extension mechanism so that Guernsey can participate in the services and investment elements of the CPTPP as soon as practicably possible," P&R said in its written evidence to the inquiry.

"Guernsey stands ready and eager to assist DBT in vigorously pursuing that as soon as the UK has ratified its own participation in CPTPP."

The Justice Select Committee has been gathering evidence as part of its review of the UK's constitutional relationship with the Crown Dependencies.

Written evidence submitted by the Department for Business Trade and Industry prompted a noticeably forthright response from Guernsey ahead of a hearing last week.

That undoubtedly helped guide the discussions that took place at the hearing, which delved into the trade agreements issues and what could be done to improve the process.

Pictured: Deputy Le Tocq at an earlier hearing.

“The relationship between Guernsey (and the wider Bailiwick) and the Crown has existed for centuries and is the basis for our relationship with the UK," said Policy & Resources external relations lead Deputy Jonathan Le Tocq in the days after the hearing.

"The relationship with the UK Government is continually evolving, as are the incredibly complex and challenging matters that our respective governments have to contend with. I very much welcome and support this Inquiry which is aimed at identifying challenges and opportunities from all sides as we continue to develop and enhance our long standing and positive constitutional, economic and social links and inter-governmental working relationships.”

The UK is seeking new deals with more counties, including the US, although there is no expectation of that being agreed any time soon. An October 2022 deadline on a trade agreement with India has been missed. It wants to update existing trade agreements with Canada, Mexico, Israel and Switzerland. It is also negating with the Gulf Co-operation Council which represents Bahrain, Kuwait, Oman, Qatar, Saudi Arabia and the UAE.

Comments

Comments on this story express the views of the commentator only, not Bailiwick Publishing. We are unable to guarantee the accuracy of any of those comments.