Householders with a room to spare could receive some beneficial bonuses at tax rebate time, if Policy and Resources plans are put through when the 2025 Budget is debated.

It states they hope the proposed new tax relief would “encourage use of under-occupied properties”.

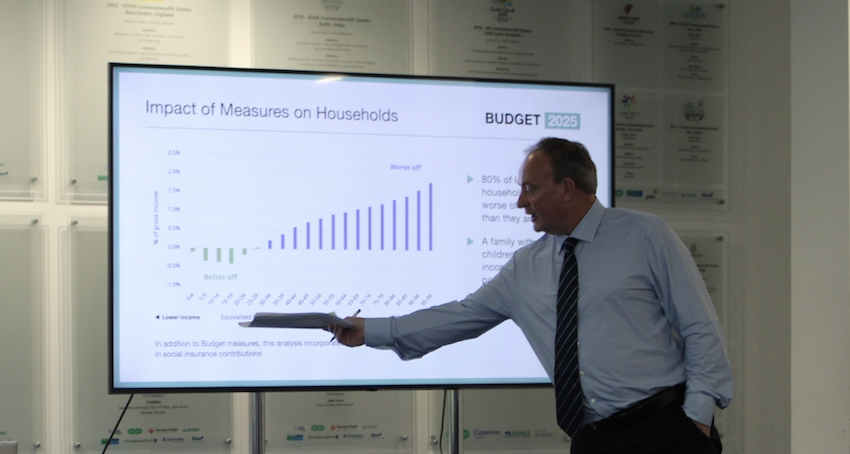

Pictured: Deputy Lyndon Trott, President of the Policy and Resources Committee, detailing the plans for next year's budget.

This scheme would see a “room-to-let” annual tax-free allowance for personal taxpayers who rent out a room in their property, regardless of whether the property is owned by them or not, but there are a swathe of other restrictions in place.

The tenant must be over 18 but can't be a family member, and the room cannot be part of a guest house or bed and breakfast business.

The room must be in the taxpayer’s principal private residence, and must be furnished, but it cannot be a self-contained unit.

It does however put a bit of a rental cap in place, in a roundabout way.

The last point on the list of ‘do’s and do not’s’ is that the annual income from renting rooms cannot exceed £10,000 per room, or the whole lot will be subject to income tax. This means if “rent-a-room” landlords want to claim that tax relief, a single room to let can’t cost any more than £833 per month.

Posts online currently show rooms available for rent in Guernsey at around £900-£1,000 a month, so it may help reduce the price of renting a room.

The budget itself explains why schemes need to take place with the “average advertised price of rentals now exceeding £1,900 a month”.

Comments

Comments on this story express the views of the commentator only, not Bailiwick Publishing. We are unable to guarantee the accuracy of any of those comments.