States members have backed introducing a GST package from the start of 2027.

After four days of Budget debate, they also overwhelmingly rejected Policy & Resources’ flagship proposal of an income tax increase from 20 to 22% for the next two years.

It is expected to mean an emergency Budget in the New Year which could include delays to major capital projects like the next phase of the hospital extension so that the States can balance its books.

The voting saw the fracturing of a late compromise alliance that had been built between P&R and the prime mover behind the GST amendment to the Budget, Deputy Peter Roffey.

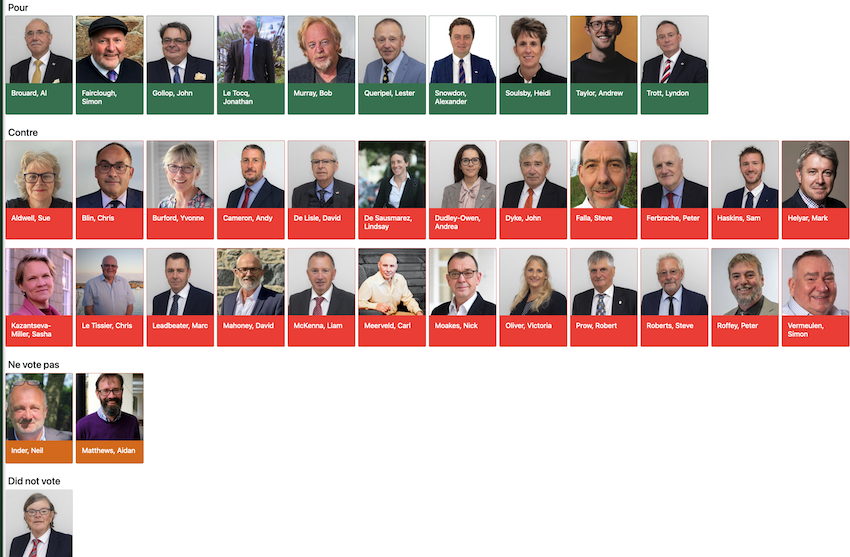

Only 10 members backed the proposition that had sought to maintain P&R's income tax rise.

Pictured: The vote that doomed the income tax rise.

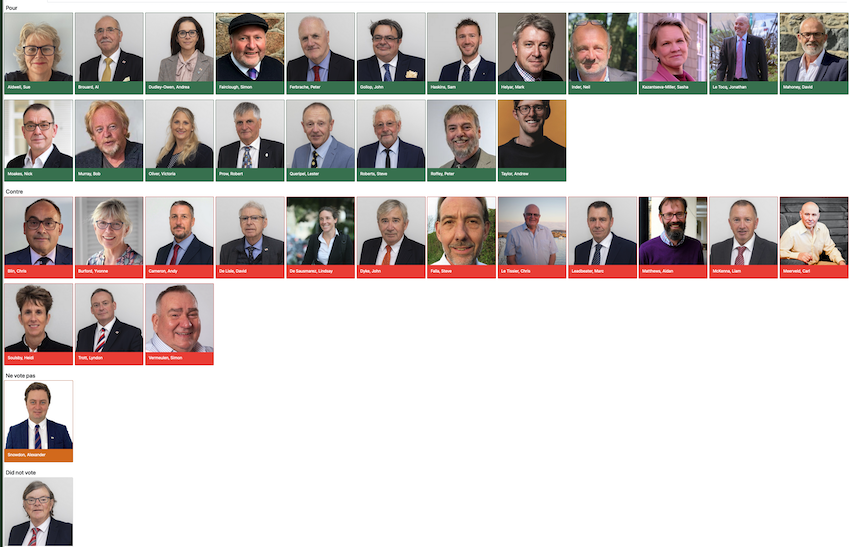

Instead members rallied behind a much more direct instruction to introduce a package of revenue raising measures from the start of 2027 which included a 5% GST, an additional 15% lower tax rate band for individuals, restructuring social security contributions and other mitigating measures.

Pictured: How they voted on introducing a GST package, lower personal tax band and other mitigations in 2027.

That will need to survive a General Election and a new set of States members before it becomes a reality.

Losing the income tax vote blows a £23m. hole in next year's Budget as members ignored the warnings from P&R President Lyndon Trott about the need for short term action.

In debate, he had said voting against the combined proposition for an income tax rise and GST investigation would have consequences.

"The Policy and Resources Committee would need to return in the next two months with two different proposals. Firstly, we would need to consider the revenue for 2025, the Budget deliberately did not propose real terms increases to indirect taxes like TRP and customs duties, they may need to be readdressed," said Deputy Trott.

"But secondly, and far more fundamentally, we would have no choice but to cut back on investment through reducing the capital portfolio."

Without the income tax rise, combined with commitments already made by the States, there would be £100m. less to spend on capital projects, he had argued.

During the debate, many members spoke out about the impact on islanders of the income tax rise and how it hit competitiveness, as well as the need for savings to be made.

Previous opponents of GST had been won around to it because of the mitigation measures it had for those on lower incomes and the financial position the States now found itself in.

Read all the key points from the Budget debate as they happened in our liveblog.

Comments

Comments on this story express the views of the commentator only, not Bailiwick Publishing. We are unable to guarantee the accuracy of any of those comments.