Policy & Resources wants the States to agree to big changes to TRP, especially for commercial parking, as part of next year’s budget.

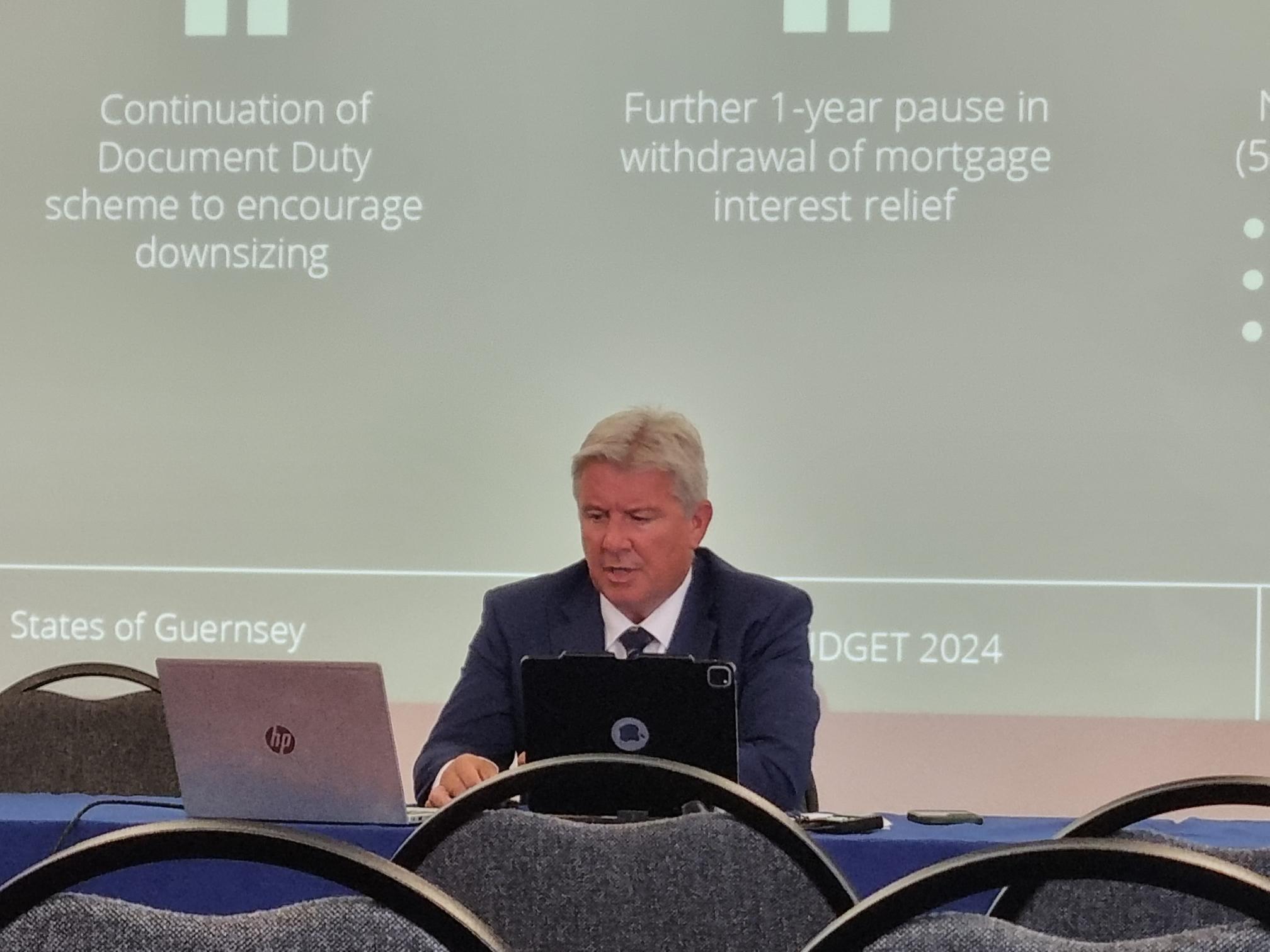

Deputy Mark Helyar, P&R’s treasury lead, said revenue raising measures, expected to bring in £2.2m next year should the budget be approved in its current form, are generally limited due to the island’s reliance on income taxes.

The majority of cash raising proposed for next year will come from property taxes set against the backdrop of a forecasted structural deficit of £64m in 2024.

The 2024 Budget Report, published today, says the “proposed TRP increases are weighted towards those with commercial or larger domestic properties”.

Many of the measures suggested by P&R were agreed in principle by the States when the 2023 budget was passed.

Pictured: Deputy Mark Helyar presenting the Budget Report.

P&R wants the States to agree to increases in penal TRP rates for derelict properties, glasshouses, and the non-development of sites, at five times the standard tariff.

Taxes on glasshouses are very low - 5p per unit - and would rise to 7p per unit, but the Budget Report notes the main driver behind the tax is to encourage the clearing of redundant sites.

This is in addition to a 20% uplift for commercial built car parks, and a five times increase to outside commercial parking.

Deputy Helyar explained that ‘built’ car parks, such as underground parking, and outside land has historically been taxed separately but these will now be brought closer together through a two year phase programme.

P&R expects this to raise £133,000 in real terms, with more to be earned when further increases are activated in 2025.

It also wants the lowest domestic TRP bands - 0-200 - split into three, each with their own gradual rate increases each year. P&R proposes that the lowest band, those with a rating up to 99, will increase by inflation, while those with the largest properties and more land will go up by inflation plus 40%.

There will be an average 17% increase in property tax for homes next year under P&R’s plans. Raising an additional £1.3m, with inflation, measured as RPIX, forecasted to be at a rate of 3.9%.

Commercial TRP tariffs are in line for a 7.5% increase also, estimated to raise £850,000 in real terms.

Pictured: A breakdown of how many homes fall in the proposed lower bands of domestic TRP.

Other measures to assist the housing crisis are proposed alongside the TRP changes, such as continuing to freeze mortgage interest relief. Interest rates and the cost of property in Guernsey are the main drivers, Deputy Helyar said.

A 0% document duty scheme to encourage down-sizing is also recommended to continue.

Deputy Helyar added that there are some deputies who want to see the island’s sliding financial position corrected largely through changes to property taxes, but warned that a balance needs to be found.

Encouraging downsizing through higher taxes could be a “non-sequitur”, he said, as there is limited stock of smaller homes in the island.

An attempt by some deputies to introduce a new system of property taxes based on market value was rejected by a large margin in February.

Comments

Comments on this story express the views of the commentator only, not Bailiwick Publishing. We are unable to guarantee the accuracy of any of those comments.