Policy & Resources plans for pushing through "a fair and progressive tax system" have been published in detail today with a 158 page explanation of what it wants to do and why.

Last week, P&R explained their plans which include a fresh look at its defeated tax and social security package on top of hundreds of millions worth of borrowing to ensure all infrastructure projects can proceed in a sustainable way.

Today, the policy letter which will be debated by States members next month, was published at gov.gg

P&R said it has drawn up a "five-year medium-term plan" which it knows is "not sustainable in the long-term" but will address some immediate financial concerns.

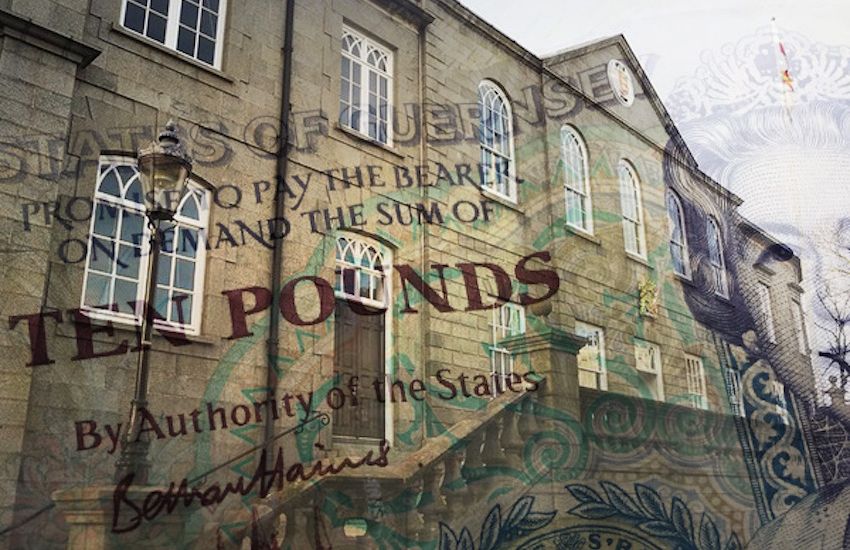

Pictured: Policy and Resources with President Peter Ferbrache in the centre and (clockwise from top right) Deputies Bob Murray, David Mahoney, Mark Helyar and Jonathan Le Tocq.

P&R will present the following options to deputies in the October States debate, but it has identified “core” spending which it thinks must make the cut no matter what deputies decide.

This includes raising £25m per year from new corporate taxes, and transport taxes. Identifying and delivering savings and efficiencies in the public sector worth £10m per year. £3m per year for “essential” policy development, and the execution of 17 major building projects which are at an advanced stage for £95m.

Option 1: Borrow nothing, but possibly use the remnants of the bond worth £160m. Spend up to £95m on other capital projects including purchasing housing and developing infrastructure on the Bridge and health and community services. Stop all other major projects such as the hospital modernisation, post-16 campus and inert waste.

Pictured: Option 2 is evidenced to be unsustainable in the long-term.

Option 2: Borrow £200m and release cash from the health service reserve, currently totalling £3.5m, to help fund the hospital project as part of increased capital project spending of up to £345m, which would also include the Les Ozouets redevelopment.

Option 3 (P&R’s preferred option): Borrow £350m to help fund all agreed capital projects worth up to £425m and £2.5m worth of social and community initiatives, repaying the debt through a reformed tax and social security system. That will include elements common in the Committees’ defeated tax package; a broad-based goods and services tax, a lower band of income tax for earnings up to £30,000 per year, a raised personal income tax allowance, personal allowances for social security contributions, and inflation-mitigating increases to States benefits.

Pictured: P&R forecasts that the island will quickly move into a negative financial position if nothing changes.

In presenting its latest plans - which include an element of GST - P&R has said "What is clear is that the States cannot continue 'as-is'. Latest forecasts estimate that, without action, cash reserves available to fund general revenue and capital expenditure will be depleted in just over five years.

"The Assembly therefore must agree measures to improve the current financial position so that the States can continue to afford the critical services they provide to the island, invest for future generations and improve services in response to community needs."

Tax reform and borrowing seen as as prime way to make island sustainable

Comments

Comments on this story express the views of the commentator only, not Bailiwick Publishing. We are unable to guarantee the accuracy of any of those comments.