The way annual increases to contributory benefits, including the States pension, are calculated could change if deputies back proposals being brought to the Assembly in October.

Employment & Social Security want the annual uprating of these benefits to look back at previous years to prevent a continual “ratcheting effect” that busts the rate of inflation and negatively impacts on public finances.

Things like the States pension are currently increased annually based on an informal “double lock” policy – uplifting payments by whichever is the greater of RPIX (a measure of inflation excluding mortgage interest payments) or RPIX plus one third of the real-terms increase in average wages.

When wages increase more than the rate of inflation, ESS proposes increasing benefits by that amount but only after looking back at previous years and adjusting based on where increases were made solely based on inflation.

“When the rate of RPIX is applied to increase the rate of the States pension and other contributory benefits, if it exceeds the one-third policy by, for example, 0.1%, that amount will be deducted the next time the one-third uprating policy is employed, so long as this does not bring the increase below RPIX,” ESS said.

ESS says the current way these benefits are increased year on year has a “negative financial impact” on the Guernsey Insurance Fund, and the proposed new calculation method would be “more nuanced” and promote sustainability.

Pensions are forecast to cost over £166,000,000 in 2024 – up nearly £33m on what was paid out in 2020. Incapacity and sickness benefit expenditure has also grown in that period, with £2.5m and £0.9m increases respectively estimated for next year.

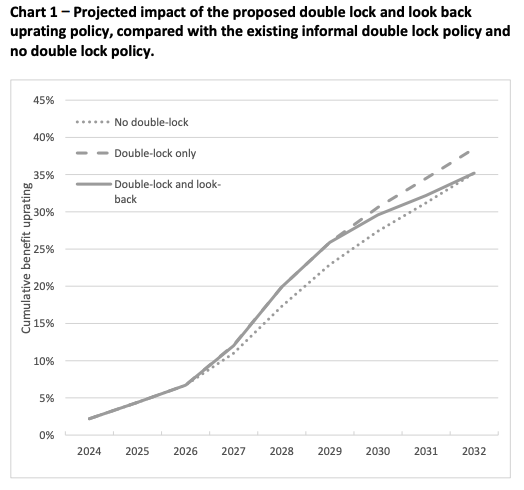

Pictured: How the ‘look back’ policy could stack up compared to other options.

ESS is simultaneously seeking a 6.8% increase in contributory benefits for next year, matching the rate of inflation for the year up to 30 June, which is greater than inflation and one-third of wage growth. It said this will raise an extra £5.25m per year.

For employees that’s a weekly rate of between £12.60 and £249.05, and employers between £12.08 and £238.67 within the upper and lower earnings limit.

Policy & Resources is said to support this.

ESS is also looking for States approval to investigate a “progressive restructuring” of social security contributions, reporting back to the States before the end of the year.

This could include introducing personal allowances for social security payments much like the income tax system, and other elements which have previously featured in P&R’s defeated tax package.

ESS says “significant” work will be required for this, and could also include making employed and self-employed rates the same, making employers pay more into the pot based on employee income, and aligning rates for those of working age but unemployed.

As the proposals will be debated at the same meeting where P&R will re-propose its tax, borrow, and spend package, ESS says its “more difficult to set out, with complete certainty, the exact contributions reforms which the Committee is most likely to pursue”.

Meanwhile, the States will be asked to increase contributions for all in line with the currently agreed rate increases at their October meeting.

Comments

Comments on this story express the views of the commentator only, not Bailiwick Publishing. We are unable to guarantee the accuracy of any of those comments.