The Committee for Home Affairs is confident that Guernsey will be fully prepared for a crucial inspection of its finance industry despite ruling out an independent trial run used by other jurisdictions.

Inspectors from the European body Moneyval will visit in 2024 to examine the island's defences against money laundering and the financing of terrorism. An unsuccessful inspection could put Guernsey on a grey list, making it less attractive to financial services companies and investors.

Jersey set aside nearly £500,000 for a team of international experts to lead a mock evaluation last year ahead of its Moneyval inspection in 2023. Several other financial services centres have arranged similar mock evaluations ahead of their own Moneyval inspections.

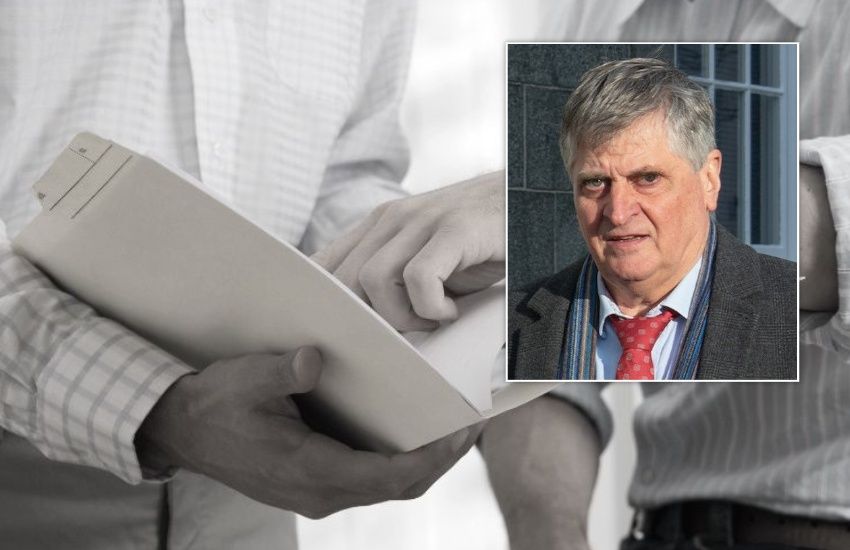

But Deputy Rob Prow, the President of the Committee for Home Affairs, told a scrutiny public hearing yesterday that Guernsey did not need an independent mock evaluation to be well prepared for its inspection the year after next.

"I would say the preparedness is first class and a total mock evaluation is not the best use of resources," said Deputy Prow, pictured top.

"You mentioned a mock evaluation [but] I am convinced that, with the processes we have, if there are any other issues they will be teased out, and we will address them."

Pictured: The Scrutiny Management Committee panel at yesterday's public hearing, which included former Deputy Mark Dorey (far right), who asked the Committee for Home Affairs: "In the case of other jurisdictions, they have engaged in a mock evaluation ahead of the Moneyval inspection. Is that what you intend to do in Guernsey?"

Deputy Prow said his Committee was fully aware of the importance of the Moneyval inspection to the future of the island's financial services industry.

Deputy Prow himself is taking charge of a group set up to oversee preparations for the inspection.

"There is constant engagement at an officer level and a political oversight group alternately chaired by the President of the Policy & Resources Committee [Deputy Peter Ferbrache] and myself," he said.

"That process [of preparation] is effectively being conducted not necessarily by a mock evaluation, which takes a lot of time and effort, but by real scrutiny around matching what the Financial Action Task Force recommendations require and what our response is.

"It would be irresponsible not to be on top of this. It's an evaluation. We're not being complacent."

Pictured: Moneyval's inspection in 2024 will assess how well the island's government and financial services industry combat money laundering and the financing of terrorism.

Deputy Prow said "the States are well served by expertise" to help prepare for the inspection. "We have two resources that we supply to the International Monetary Fund doing evaluations in other jurisdictions," he said.

"Moneyval will ask for submissions and turn up and these evaluations get harder and harder. We will have very thorough scrutiny of all the activities that I have outlined. In some areas, we will be evaluated higher than in some others. That's the nature of evaluation. Very, very few jurisdictions get a consistent score across all the evaluation criteria.

"What I really want to say is that from a government perspective, with regard to the structures we've put in, the legislation we've put in and the assurances we're getting from the independent statutory organisations, be they the Law Officers of the Crown or those which come under the Committee for Home Affairs, everybody is absolutely committed and completely understands what is required.

"Anywhere where there is a deficiency that has been highlighted, action is being taken to address this. The majority of those actions, particularly from Home Affairs perspective, have already been put in place."

Pictured: Deputies Peter Ferbrache (left) and Rob Prow co-chair a group overseeing preparations for the Moneyval inspection in 2024.

Express reported yesterday that a recent Moneyval report on the Isle of Man found that it complied or mostly complied with 39 out of 40 standards but still needed to do more to combat money laundering and the financing of terrorism.

Express also reported yesterday that earlier at the scrutiny public hearing, held yesterday morning, it was revealed that there are dozens of unfilled jobs across law enforcement in the Bailiwick – and that the Committee for Home Affairs thinks vacancies in some services have reached "a critical level".

Deputy Prow said there are "up to 60 vacancies across law enforcement and the Economic and Financial Crime Bureau". The Committee’s Director of Operations, Dave Le Ray, told the hearing that 19 of the vacancies were in financial crime services.

"35% of our target operating model is vacant within the Economic and Financial Crime Bureau," said Mr Le Ray.

"We are still being able to complete investigations and complete the mandate of the Bureau. However, I would say that we are at a critical level in the number of recruitments which we are able to attract."

Deputy Prow said: "It is a concern. It is a challenge. But I have absolute confidence in the Bureau and the Financial Investigation Unit that they will continue on their efforts to recruit and think outside the box, as they already have. It's not as though we're not rising to the challenge.

"I'm not trying to dismiss the challenge that recruitment presents. What I'm saying to you is that I have absolute confidence in the staff we have. It's well run, well managed and well motivated to deliver. I have every confidence…in our preparedness for the Moneyval inspection and that's one message through this hearing that I want to give."

Law enforcement under pressure as staff vacancies hit "a critical level"

Isle of Man remains tied up by Moneyval

What is MONEYVAL and why is it so important?

LISTEN: "There isn't an unlimited supply of people who would like to join this work."

Comments

Comments on this story express the views of the commentator only, not Bailiwick Publishing. We are unable to guarantee the accuracy of any of those comments.