A survey of Chamber of Commerce members has shown broad agreement with P&R’s main tax package going to the States this week, and the unsustainability of the island’s public finances generally.

Businesses were asked whether they agreed that a deficit between government spending and income exists, if they thought the Policy & Resources Committees preferred measures are the best way to deal with, and if they thought more details were needed on cost cutting and reforming pensions for government employees.

79% agreed with the seriousness of the deficit, 73% backed the full tax and social security reform package, which includes GST, as the most viable option for righting the fiscal woes, and 89% agreed that a clear path for cost reduction from the States is needed.

The full package involves a broad goods and services tax on most consumption, a cut to income tax on earnings up to £30,000, changes to social security contributions which would see most given a personal allowance before they start paying in, increases to existing allowances and other States benefits, as well as the authority for P&R to borrow up to £350m to fund major infrastructure projects.

90 responses were received, which Chamber said was “statistically significant and representative” of its members.

The Chamber executive said these views diverged greatly from survey results which were gathered in January, where just over half of 233 respondents were convinced of a significant gap between income and expenditure when first queried. Now a clear majority believes there is. Just 8.9% also thought that GST was the best option, while now a package which includes it has been backed.

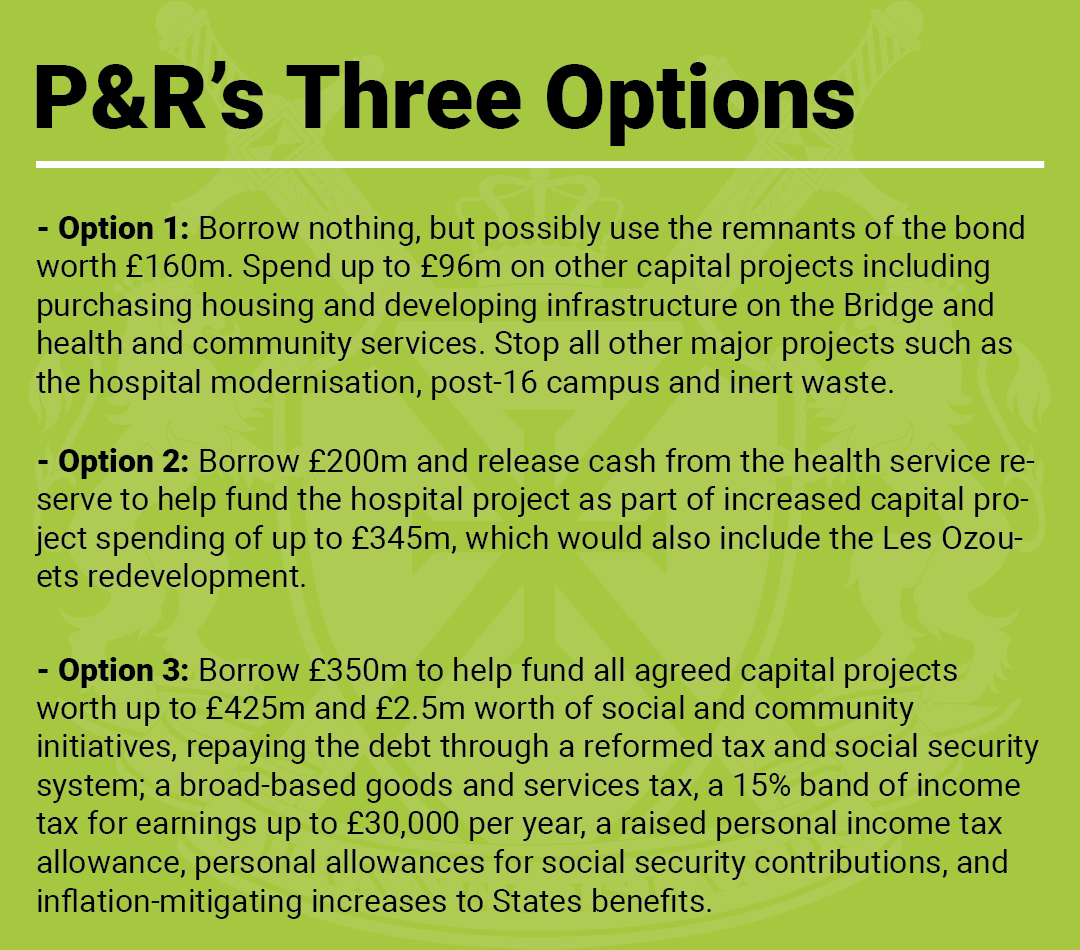

Pictured: P&Rs three options being presented to the States this week, but they could be heavily amended by deputies' challenges.

Steven Rouxel, finance lead for Chamber urged all politicians to “take note of this collective viewpoint” and address the full suite of options put before them in the Assembly this week.

“We need Government to set aside their differences and come together to agree a set of measures that will allow the much-needed investment in infrastructure and services.

"Guernsey's future depends on responsible, forward-thinking measures - and to fund our future, a whole host of changes are necessary, no single thing can fix this big problem."

The Chamber Executive are also encouraged by an attempt by some deputies to provide more childcare at younger ages to encourage more people into work. It said achieving “workforce parity” is fair and economically essential alongside other measures.

“A lack of talent is constraining our growth. Put simply: we need more people in the workforce, and the government needs more income. And by matching Sweden’s female labour force rates, we could see a 6% increase in GDP in Guernsey, amounting to £194 million annually,” Mr Rouxel added.

It’s estimated that around 8,000 non-employed people reside in Guernsey who could contribute to the economy. Women within this group are seen to be out of work at all ages, while a good chunk is women and men over the age of 50.

For a full digest of Guernsey’s economic woes and what politicians plan to do about it this week, click HERE.

Comments

Comments on this story express the views of the commentator only, not Bailiwick Publishing. We are unable to guarantee the accuracy of any of those comments.