A move to overhaul Guernsey's corporate tax regime to increase how much the sector contributes has been defeated.

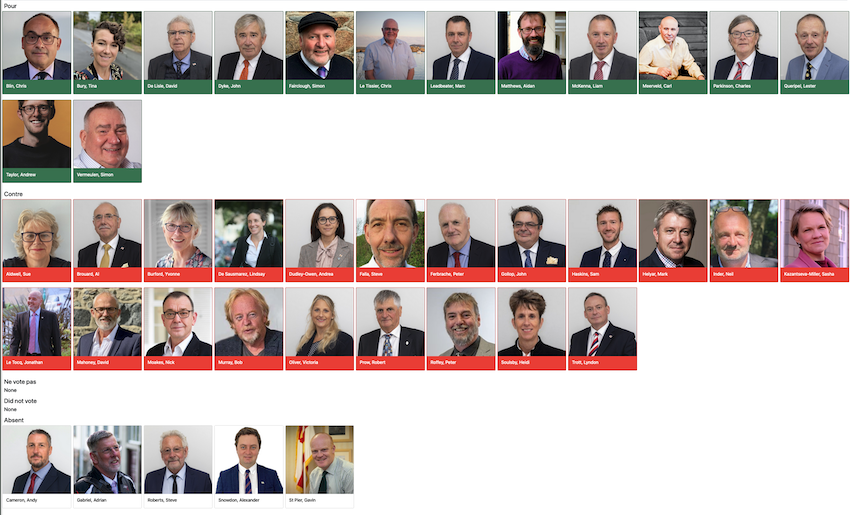

In the first big decision in the 2025 Budget debate, Deputy Charles Parkinson’s proposal which could have led to the replacement of zero-10 with a Territorial Corporate Income Tax Regime in 2026 to generate what he said would be tens of millions extra in revenue was thrown out by 21 votes to 14.

It was the third time he has tried and failed with the proposal, but there was broad agreement that the move would happen eventually when Guernsey's main competitors also changed.

"Zero 10 has not only undermined our corporate tax base, it has also undermined our personal tax base," said Deputy Parkinson.

"Unfortunately, many homeowners are using companies to shelter their incomes from income tax. So the burden falls more heavily on the middle class, who generally do not use and cannot use that sort of plan, and they rightly feel this is unfair.

"People in general in Guernsey, in my experience, don't mind paying 20% income tax. They think that's a fair rate, but when they know that there are multi millionaires who live in Guernsey and who do not pay any income tax at all. The public know that is not fair."

His amendment would have deleted the proposed increase in the income tax rate to 22%.

Addressing the fact this would lead to a deficit until other tax changes were made, Deputy Parkinson said he would support immediate cost savings, expressing support for a "Financial Transformation Programme 2" and arguing that economies can be made through AI which were not possible the last time that cost-cutting programme happened.

Deputy Parkinson says that the current corporate tax regime gives an unfair competitive advantage to businesses owned by non residents, and eventually they out compete the businesses owned by residents and drive them out of business.

He believed there were two camps in the Assembly.

People like him who believe the structural problems of zero-10 need to be addressed in the long-term and the States has to cut its cloth to fit in the meantime and those who believe that we needed to increase taxation on the middle classes and maintain the upward trajectory of public expenditure.

"I believe that the public are massively in support of our approach."

Several members spoke of how they would have supported the amendment if it was just for an investigation, but that they could not back it because of its suggestion the regime would be introduced from 2026.

Others spoke about the competitive need to wait until Jersey and the Isle of Man agreed to change their corporate tax regimes as well.

Deputy Sasha Kazantseva-Miller said: "We have absolutely zero information of what implications of this would be. It's unresearched, it's unquantified, it's undeliverable in the timeframes that it's proposing it would be. And I just can't take this risk to completely derail our current corporate tax system without putting anything else in place."

Policy & Resources President Lyndon Trott agreed with the view that Guernsey would have a territorial form of corporate income tax, but stressed that needed to be undertaken in lockstep with others and "it's not the revenue raiser some in this room believe it to be".

Change was unlikely to be before the end of this decade, he said.

"It doesn't matter how many times the same proposals are put forward, the arguments against such a unilateral move remain the same as they have on each previous account," he said.

"Establishing a territorial system would be politically and competitively risky and technically challenging. For that matter, industry has repeatedly stressed the importance of stability, as well as staying in lockstep with our neighbouring competitors.

"Now this is the industry who have laid down roots here, who have made their investments here, who are often chartered tax advisors."

He said that Deputy Parkinson was once a Treasury minister and had put together Budgets that had balanced the books.

"Yet he is not only putting forward a proposal rejected by this Assembly, he is also seeking to worsen the financial position of the States by £28m and to balance the books by using our precious reserves, all this for a tax which at best - and if you don't believe me, believe our international advisors - all this for a tax which at best might raise £10m to £15m pounds per annum."

Pictured: How they voted on the Parkinson corporate tax amendment.

Pictured top: Deputy Charles Parkinson walking to the Royal Court ahead of the States meeting.

Comments

Comments on this story express the views of the commentator only, not Bailiwick Publishing. We are unable to guarantee the accuracy of any of those comments.