Jersey's financial regulator has barred an adviser, who misled a group of elderly, vulnerable and financially inexperienced clients across the Channel Islands and further afield, in order to obtain millions of their cash, from working in the industry again.

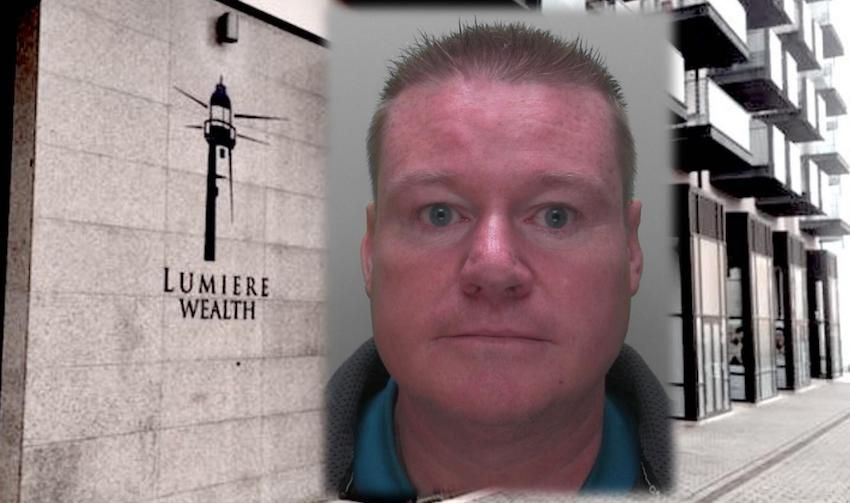

Christopher Paul Byrne, former Managing Director of Lumiere Wealth Limited, was convicted in Jersey in 2018 of offences relating to his conduct as a financial adviser and sentenced to a seven-year custodial sentence.

Byrne was found guilty of a total of 16 counts of financial misconduct. The offences involved practicing as an advisor when he wasn't authorised, providing false information to the regulator, and misleading his clients, which included a an elderly French couple, a pensioner and a retired teacher.

As well as jailing him for seven years in November 2018, Jersey's Royal Court also ruled that Byrne should be disqualified from managing a company for a period of 12 years.

A statement issued by the JFSC last week says Mr Byrne held a trusted position as a financial adviser but fraudulently provided clients with unsuitable and misleading advice, and dishonestly facilitated a loan from a vulnerable client for his own personal benefit.

Pictured: Lumiere Wealth, Mr Byne's former firm.

Kerry Petulla, the JFSC's Executive Director of Enforcement, said that the role of financial adviser required independence and unbiased advice free from the influence of product providers.

"Mr Byrne, like all advisers, was required to have the highest regard for his clients but our investigation revealed that he prioritised his own and the company's financial interests over the clients' interests, resulting in unrecoverable client losses of approximately £12m," she said.

"We have concluded Mr Byrne misled clients and the JFSC, and his actions were dishonest, and he lacks integrity. Mr Byrne's conduct poses a significant risk to the JFSC's guiding principles and objectives and therefore it is necessary to restrict his employment in Jersey's financial services industry."

The JFSC statement adds that any person or business allowing Mr Byrne to perform a function, engage in employment or hold a position within or related to the Jersey financial services industry is committing an offence.

Read the full statement from the JFSC here.

Lumiere was placed into voluntary liquidation in Guernsey in 2017.

Byrne's sentencing by the Jersey Royal Court had to be postponed when, in Autumn 2018, he agreed to help Guernsey Police with enquiries into matters relating to Lumiere and its clients, and the collapse of Providence - a company confirmed to be a Ponzi scheme.

Providence was a major stakeholder in Lumiere and Byrne had been involved in an agreement which saw Lumiere shares transferred to his personal accounts. He was said to be paid £3,000 for ever £350,000 the fund increased by a set target.

Comments

Comments on this story express the views of the commentator only, not Bailiwick Publishing. We are unable to guarantee the accuracy of any of those comments.