The States' pension pot and other benefits will run dry in the next 20 years unless government takes action to resolve a crisis that has been "kicked down the road" for more than a decade.

Actuarial reviews of the Long Term Care Insurance Fund and the Guernsey Insurance Fund have been published by Employment & Social Security along with a dire warning of the impact if the States takes no action.

The Guernsey Insurance Fund, which provides financial assistance during old age, unemployment, bereavement, incapacity, maternity, and death, had a balance equivalent to 4.7 times annual expenditure in 2019. At current rates, the Government Actuary, Martin Clarke FIA, has calculated that it will be exhausted by 2039.

The Long-term Care Fund, which is designed to assist with the costs of care in private nursing and residential homes, had a balance equivalent to 4.1 times annual expenditure in 2019. If the current rates of contribution are maintained, it is projected that the balance will fall to zero in 2053.

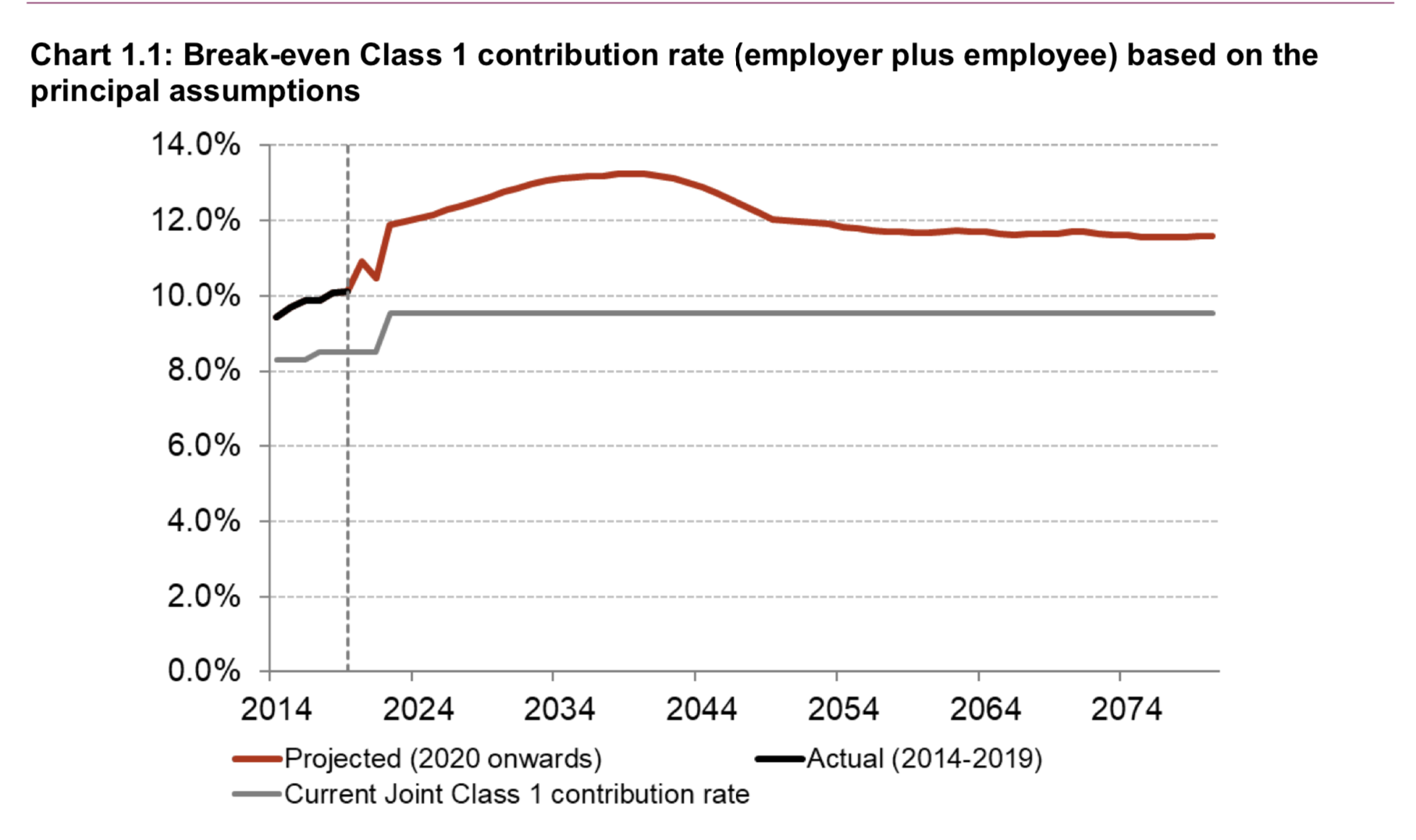

Pictured: The break-even contribution rate is projected to remain above the currently anticipated rate of contributions throughout the projection period. This means that contribution income is not sufficient to cover expenditure from the Fund. The existing balance held by the Fund can used to help finance this shortfall. However, once the balance is exhausted, the rate of contributions would need to rise to at least the break-even rate in order to cover expenditure" - Government Actuary Martin Clarke.

"The committee and its predecessors have been warning about this developing situation for more than a decade but no States has yet been persuaded to take the required actions," said ESS President Peter Roffey.

"The time for action is now, and we are happy to work with the Policy & Resources Committee as part of the Tax Review to see if there are alternative ways to achieve what is needed.

“This Assembly must take the remedial action required now, rather than kicking the can down the road again. Our committee has no intention of letting these funds run dry, and I look forward to the debate where we finally resolve this issue.”

Based on the actuarial review of the Guernsey Insurance Fund, it has been calculated that Class 1 contribution rates will need to increase to 11.3% from January 2022 to target a balance of twice annual expenditure in 2080. Currently, 8.5% of the total Class 1 contribution rate of 13.2% goes to this fund.

However, this will increase to 9.55% from 2022 as part of a restructuring of health care funding to include NICE drugs, and a further increase of 1.75% is needed to put the fund on a sustainable footing.

Mr Clarke has calculated that an increase of 0.4% to the Class 1 contribution rate (currently 1.8% of the combined employer/employee Class 1 contribution rate) would move the Long-term Care Insurance Fund onto a sustainable footing based on current eligibility criteria. However, in August last year, the States agreed, in principle, that the fund benefits should be extended to cover care provided at home, with detailed implementation plans to be developed by June 2022.

Comments

Comments on this story express the views of the commentator only, not Bailiwick Publishing. We are unable to guarantee the accuracy of any of those comments.