Guernsey's rate of inflation has increased steadily throughout this year with the latest statistics showing it has more than doubled over the last twelve months.

The States released the latest figures this morning showing that the 'all items' Retail Price Indices was 7.9% over the year ending September 2022, 4.7 percentage points higher than it was over the year ending in September 2021.

This is also 1.1 points higher than it was over the year ending June 2022, and 2.1 points up from March.

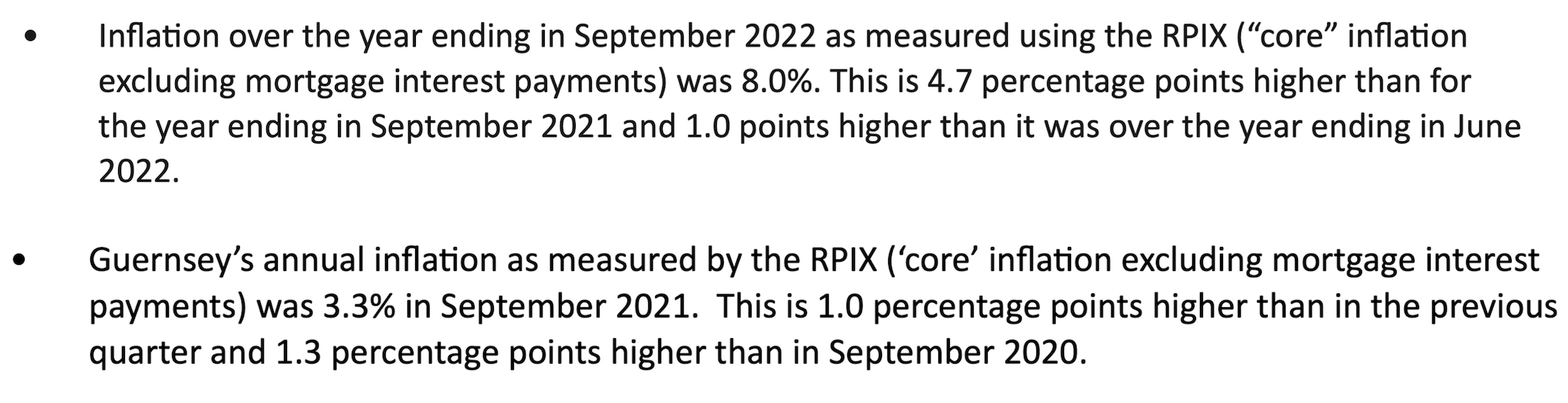

The RPIX (core inflation excluding mortgage interest payments) was 8.0% at the end of September - up from 3.3% a year ago.

Pictured: Guernsey's 2021 and 2022 RPIX figures.

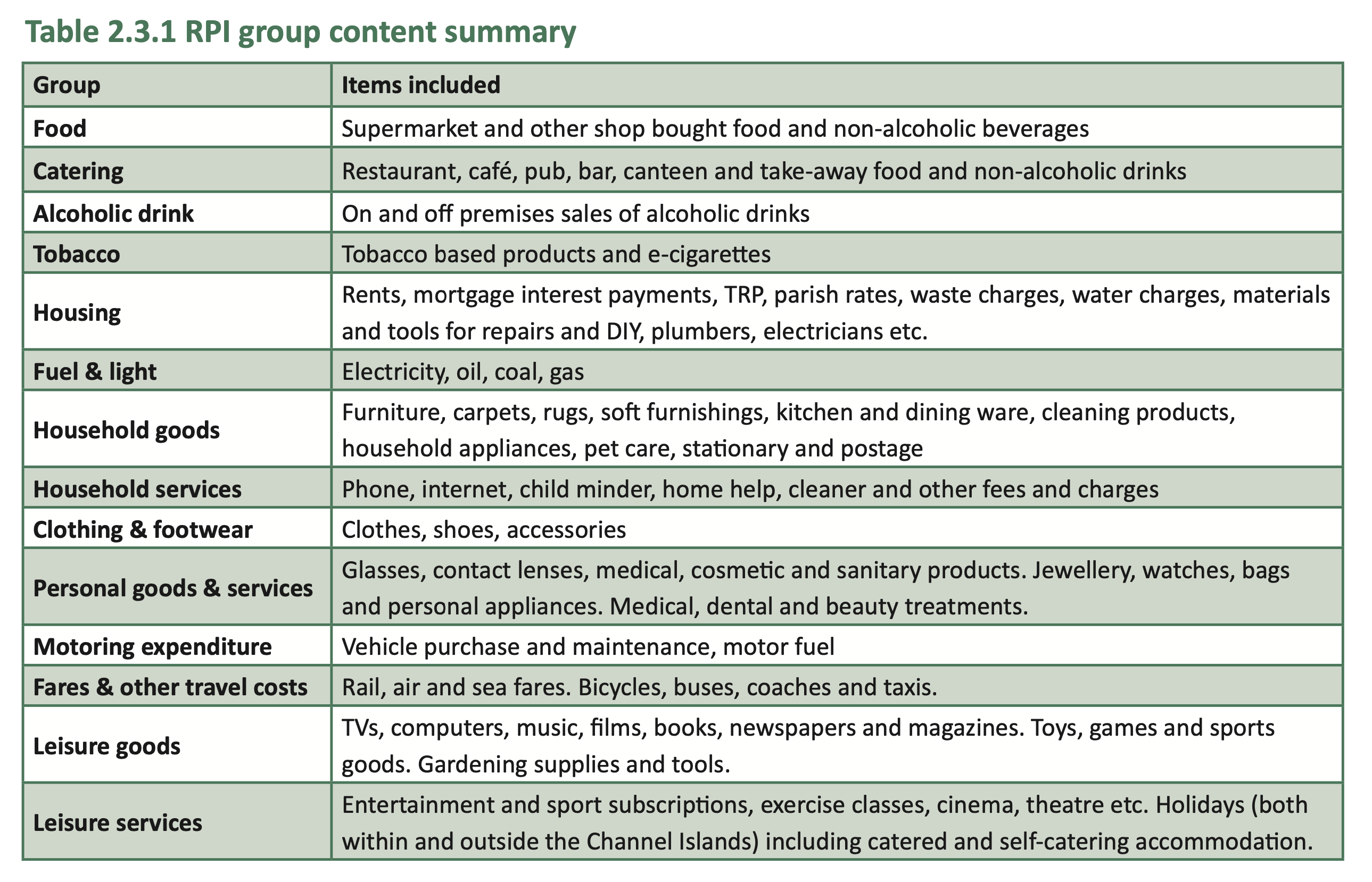

The States calculate RPIs based on the cost of nearly 600 individual items from the average changes in prices of around 2,000 goods and services.

The changes are weighted and used to update 14 group indices and the overall index. These are then split into the (all items) RPI and the RPIX which excludes mortgage interest payments (from within the Housing group).

The latest inflation statistics have also included for the first time a Household Cost Indices (HCIs) alongside the usual RPIs. These have been included to "aid in the understanding of the differences in rates of price inflation being experienced by different types of household".

The HCI measures will equally represent low-income and low-spend households alongside those with higher incomes that spend more, with the intention of making a good comparison between different spending patterns and different experiences of inflation.

One way this will reflect differences in lifestyle is how some shoppers may change food brands for cheaper options when there are large changes in prices.

Pictured: Different groups of goods and services within the RPI calculator.

Of the 14 groups included in the way inflation is calculated (pictured above) all have shown annual increases for the year ending September 2022.

The Fuel and light group saw the largest annual increase at 26.0%. That contributed 1.2ppts to the overall percentage change in the RPI and 1.3ppts to the overall percentage change in the RPIX, RPICT (inflation excluding mortgage interest payments and assuming constant taxes) and RPIY (inflation excluding mortgage interest payments and indirect taxes).

Other increases across the Motoring (up 12.3%), Leisure services (up 11.0%) and Food (up 9.6%) groups added to the pressures felt by bill payers.

The new method of calculating the HCIs suggested that those living in social rented accommodation or partial ownership have seen the lowest overall increase in inflation based on their spending habits.

Spending on staple goods and services, which includes basic foodstuffs, non-alcoholic drinks, utilities, phone and computer connectivity, child care, clothes and shoes, and others, increased by 5.3% on average for Social renter and partial owner households, contributing 3.9 percentage points to the 5.7% increase in their index.

Owner occupier households without mortgages saw the highest overall increase in inflation based on the HCIs at 8.6%.

Inflation latest due out today

Survey finds half struggle to meet living costs

Annual inflation highest since 2008

Comments

Comments on this story express the views of the commentator only, not Bailiwick Publishing. We are unable to guarantee the accuracy of any of those comments.