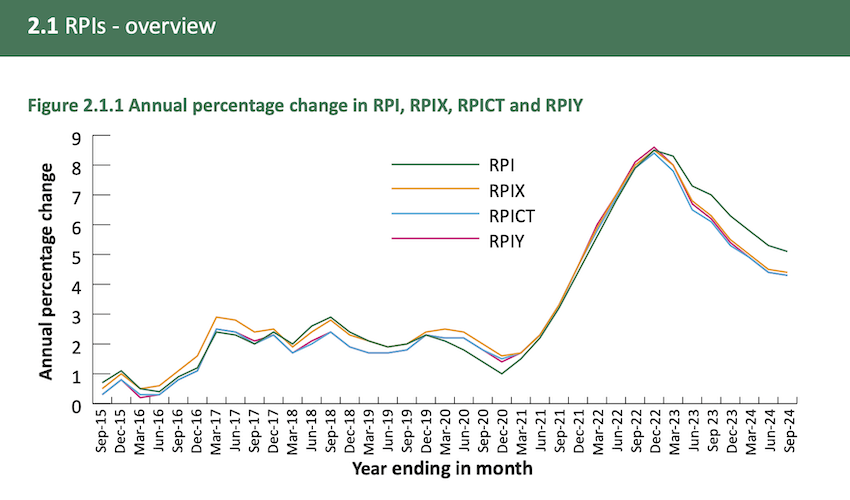

Guernsey's rate of inflation has slowed again - standing at 5.1% at the end of September, down 1.9% than a year before and 0.2% lower than earlier in the year.

5.1% is the 'all items' RPI inflation figure.

Excluding mortgages from the equation drops the RPIX down to 4.4% - down from 6.3% a year ago, and down from 4.5% at the end of June this year.

The Bank of England says "inflation is the term we use to describe rising prices. How quickly prices go up is called the rate of inflation."

This definition is echoed by every major financial institution across the world, with the International Monetary Fund saying "inflation measures how much more expensive a set of goods and services has become over a certain period, usually a year".

Inflation is measured by government agencies around the world conducting a variety of household surveys expenditure. This is commonly done through monitoring the cost of a basket of popular items bought during a weekly household shop. Any rise and fall in the price of the goods within that basket is used to track the rate of inflation.

While Guernsey's 'all items' RPI is 5.1% and the RPIX is 4.4%, there are actually four different measurements used by statisticians with RPICT (rate of inflation excluding mortgage interest payments and the effect of changes to indirect taxes) and RPIY (the rate of inflation excluding mortgage interest payments and indirect taxes).

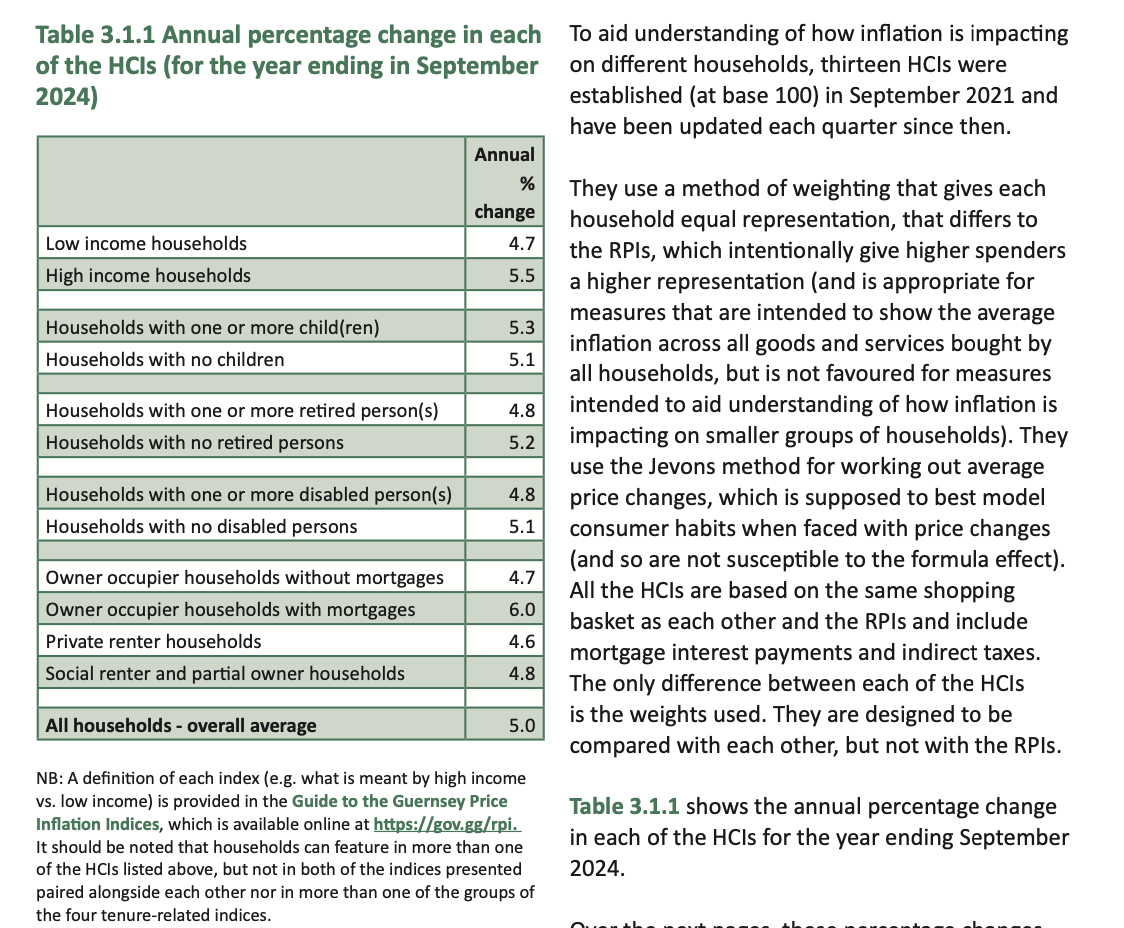

To further help understanding of the differences in rates of price inflation experienced by different types of household in Guernsey, the States uses thirteen different Household Cost Indices measures developed especially for Guernsey, following a method designed by the UK Office for National Statistics (UK ONS).

These are:

Low income vs. high income householdsHouseholds containing one or more child(ren) vs. households with noneHouseholds containing one or more retired person vs. households with noneHouseholds containing one or more person with a disability or long term illness that limits their activities vs. households with noneOwner occupier households without mortgage vs. Owner occupier households with mortgagevs. Private renter households vs. Social renter and partial owner householdsOverall HCI (for reference)

Of the 13 HCIs, the sector with the lowest overall increase in the rate of inflation was private renter households.

People in that category are experiencing a 4.6% rate of inflation, which is just 0.4% below the increase in the overall average HCI.

In Jersey, the most recent data available is from July, when the rate of inflation was 5%. That was down 0.7% from earlier in the year.

In the UK, the latest data shows the rate of inflation has slowed to 1.7% this month.

To read Guernsey's latest inflation bulletin in full, click HERE.

OPINION: Inflation still 'high in comparison with pre-pandemic levels'

Bid for minimum wage increase to mirror inflation

Comments

Comments on this story express the views of the commentator only, not Bailiwick Publishing. We are unable to guarantee the accuracy of any of those comments.