People living in social rental and partial ownership housing experienced the highest overall increase in the cost of goods and services over the year up to June 2023.

Measured inflation for that period was 7.3%, which reflects the rate of increase in the prices of a general basket of staple goods such as food and hygiene products, as well as the cost of utilities and mortgage interest.

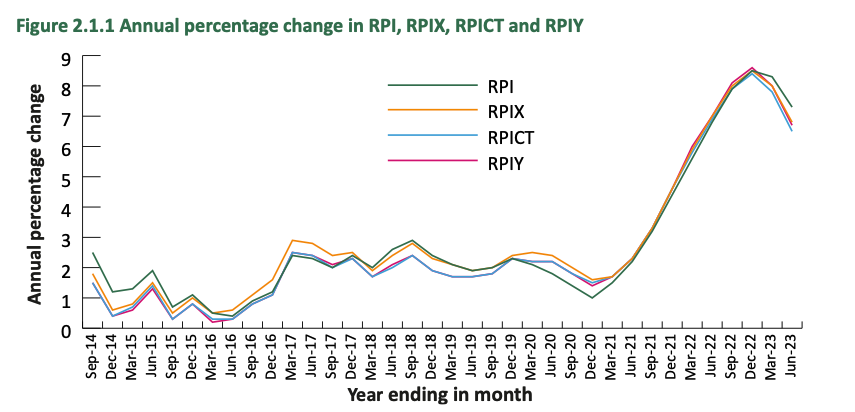

Prices didn’t increase as fast as they had been in the year up to March 2023 but they remain at decades-long highs.

Naturally all households experienced increased prices but those in what is called Affordable Housing bore the biggest brunt with an 8% increase – nearly 1% higher than the average for all households – mostly due to the rising cost of essential staples.

Meanwhile those in private rental accommodation saw the lowest overall increase at 5.8%, lower than the overall household average.

Food, leisure and housing costs were again subject to the largest price increases among all items between June 2022 and 2023.

Most recently, supermarket prices for soft drinks, tea bags, baby food and fresh fish increased. Some items such as butter and rice reduced in price, as well as fresh fruit due to seasonality.

Mortgage interest payments also increased, as did trade costs, some DIY items and home insurance premiums.

Pictured: The rate of price increases has begun to fall but it remains above the 3% rate experienced locally for many years.

The States forecast that “the upward pressure on food prices is expected to ease in coming quarters as the fall in food commodity prices works through supply chains”.

The central planning assumption is that RPIX, a measure of inflation which excludes mortgage interest payments, will fall during 2024.

RPI is expected to be higher into 2024 however, with higher interest rates certain to increase the cost of mortgage interest payments and as borrowers move onto higher rate loans.

The States began publishing details of the effect on inflation on different types of households in October 2022 which includes different economic and social data.

These include levels of income, number of dependents, retirees and people with disabilities, as well as whether there are outstanding mortgages and those living in the public housing sector.

The quarterly inflation bulletin is available HERE.

Comments

Comments on this story express the views of the commentator only, not Bailiwick Publishing. We are unable to guarantee the accuracy of any of those comments.