Pensioners and others needing support face paying £10,000 to access long-term care beds and much higher weekly fees as part of a package of proposals to prevent the sector from reaching crisis point.

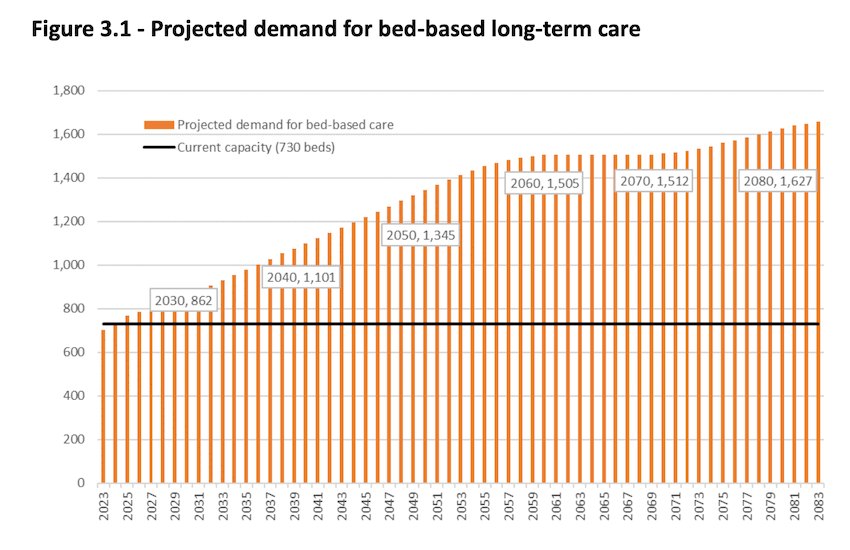

Already there are concerns that demand for beds is outstripping supply, but the current way of paying for care is not providing enough money for the sector to expand with suggestions that four new care homes are needed within the next five years.

However, Employment & Social Security's proposals, which also include upping the residency requirement to qualify for support from the long-term care insurance fund from five to ten years, are not enough to ensure financial stability for the pot of money the public pay into and further urgent action will be needed next term.

Under its plans, which need States approval, the co-payment which individuals contribute each week will ratchet up over the next five years. For a standard bed that will be from £342 to £514 a week plus by a likely 'inflation plus 1%' hike. Annually, that means a rise from £17,784 to £26,728 in that time excluding inflation.

From 2027, a new user care cost contribution would come in at £10,000 for those with capital assets, excluding their home, of more than £15,000. A financial assessment will be carried out to determine who can afford it.

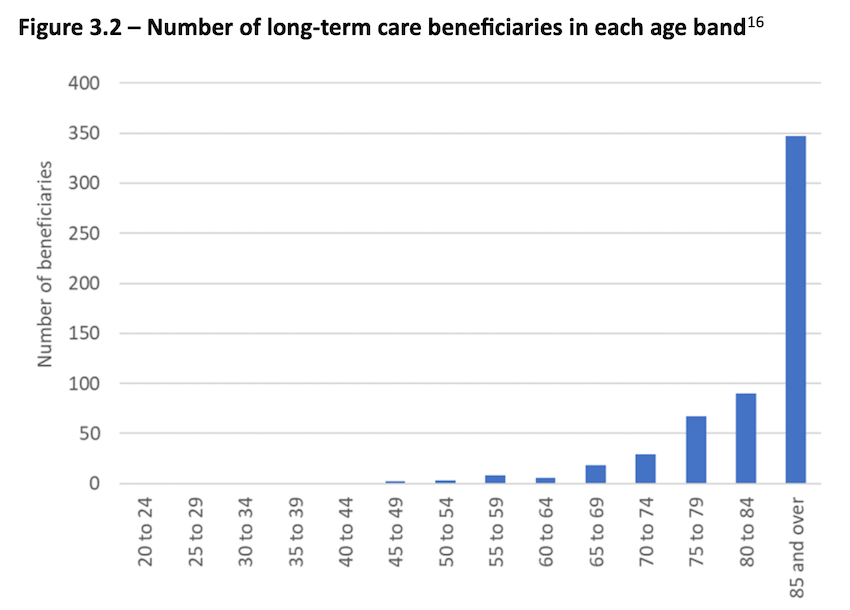

The vast majority of people who need long-term care are aged over 85. There were 1,874 in that age bracket in 2023, while in the next three decades there are projected to be 4,275.

ESS President Peter Roffey has acknowledged that the proposals do not resolve all the issues faced and he suspected that the £10,000 contribution will be raised further by the next Assembly to help.

He said that without a proper business model that allowed investment, the care sector would not expand, although there were no guarantees that their proposals would stimulate growth.

"We are 10 years too late here, I completely fess up, this is absolutely the 11th hour and beyond the 11th hour. It should have been done earlier, but it would make no logic to say "woe is us, we didn't start early enough so let's not now," we need to try and address this situation as best we possibly can," said Deputy Roffey.

ESS has looked at more active intervention and commissioning beds.

"But to be honest, we're actually wasting our time in that respect with the current situation, because, I'm not saying that nobody will ever expand, they may want to, it may suit their circumstances at the moment, but the business model is not there for a general expansion. After this, we will be as a parallel piece of work engaging, as we already are, with the care homes to try and drive that expansion."

Pictured: Deputy Peter Roffey explains the impact of Employment & Social Security's plans on the long-term care insurance fund.

Some deputies are expected to try and push the 10 years residency figure, which would move Guernsey in line with Jersey, out further.

ESS wanted to bring proposals that were drawn up by it, Health & Social Care and the former Policy & Resources Committee that would have not just addressed capacity in the care sector but also made the funding sustainable in the long-term.

The current plans are projected to see the Fund exhausted as early as 2062 - 23 years earlier than currently projected.

"We couldn't carry all of our colleagues with us. Some of them wanted everything done in the next Assembly, so we are only making a start."

Those proposals could have been including a person's home in the capital assessment and having a higher user care cost contribution.

Among the issues that remain unresolved are how to fund care in people's own homes and complex needs.

As part of its work, ESS ruled out another hike in social security contributions.

"We feel we pushed that solution, the increasing contribution rates constantly, as far as it can go, we think the burden on the working population has reached a point that it no longer is an answer to do that," said Deputy Roffey.

"So we're asking for more from those who can afford it. And we're doing that in two ways. One is increasing the co-payment, which is actually in line with States policy.

"States policy for about the last decade has been the co-payment should cover the non-care costs, the food, the accommodation, everything like that. We've never actually fully implemented it. But it is quite and increase and that will be unpopular.

"And the £10,000 contribution towards care costs, which I would describe as an insurance premium. That won't be popular either, because people are used to the scheme paying everything. But I think we came to the conclusion we just can't keep leaving this any further. We are on the edge of the abyss here. We've got to start taking some measures, even though these measures won't fully address it and more would need to be done in the next Assembly."

The long-term care insurance scheme was launched in 2003 to help contribute towards care home fees and is funded by a portion of everyone's social security contributions and investment returns.

Demand for long-term care beds is projected to increase significantly, with an additional 132 needed by 2030. It will rise from 730 now to 1,101 in 2040.

In 2023, costs for bed-based care ranged from £60,000-£85,000 a year taking all potential charges into account.

Providing this at the PEH costs around £35,000-£40,000 a year more per person, predominantly because operational overheads are higher.

Comments

Comments on this story express the views of the commentator only, not Bailiwick Publishing. We are unable to guarantee the accuracy of any of those comments.