A slow recovery and shift in visitor types since the Covid-19 pandemic has been shown in latest statistics.

The Guernsey Quarterly Travel and Visitor Accommodation Bulletin for July, August and September has been released.

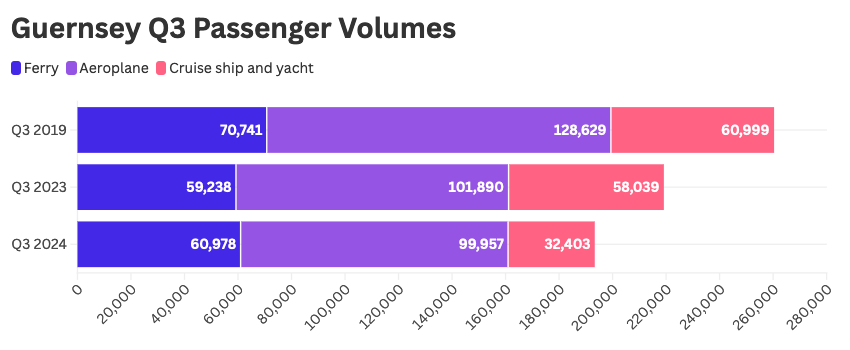

Passenger volumes saw a decrease across most transportation modes when compared to pre-pandemic levels, with 193,338 total departing passengers, a 12% decline from Q3 2023 and a 26% decrease from 2019.

This downturn compared to pre Covid was notable across aeroplane (22%), ferry (14%), and cruise ship and yacht departures (47%).

While leisure continues to be the main purpose for visiting Guernsey, constituting 61% (46,65) of all staying visitors' reasons for travel, there has been a significant shift in the numbers.

The leisure visitor sector in Q3 2024 saw a 33% decrease from Q3 2019, though it marked a slight increase from Q3 2023.

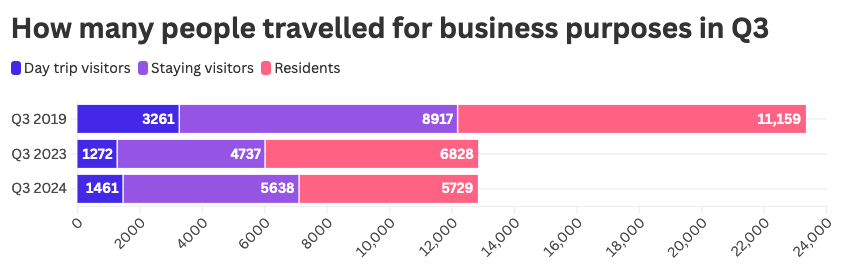

Business/work visits, although still below 2019 levels, increased by 19% from Q3 2023.

Pictured: There has been a slight uptick in people visiting Guernsey for business purposes in the last year. Resident travelling for business continues to fall and is almost half what it was in 2019.

Fewer people are opting for short leisure visits - day trippers in this category at 6,476 people for the quarter, showed a 55% reduction from Q3 2019 and a 43% decrease from Q3 2023.

The "other" category for day trips, which includes visitors in transit, on a school or sports trip, or visiting for medical reasons, saw a notable increase, up from 3,640 last year to 5,613 this quarter, suggesting a diversification in the reasons for short stays.

Accommodation data presented in the bulletin showcases a robust occupancy rate, with a peak of 84% in August 2024, a figure not reached in any year since 2019.

Visitors are becoming markedly less likely to recommend Guernsey to a friend or relative, citing travel delays, high costs and the lack of things to do.

Hannah Beacom, Chair of the Tourism Management Board said when you look at the bigger picture there are some positive takeaways, highlighting staying visitors (up by 2% on the same time last year), the occupancy statistic and an average stay of 5.4 nights.

"We also retained the number of UK visitors and increased our French visitors," she said.

"The number of departing visitors (excluding any cruise and yacht passengers) for Q3 2024 was 1% lower than Q3 2023 and, while July 2024 was down on the previous July, we must remember we hosted the Island Games in July 2023, which saw a boost to visitor numbers, which has likely contributed to a July drop, affecting the comparative figures for this Quarter overall."

She admitted that the bulletin does highlight the difficulties in Guernsey's daytrip market and the impact that has had on businesses focused on this sector, but said it was important to note that has been largely driven by the reduction in the number of large cruise ships visiting the island this year.

"Work is currently ongoing with cruise operators to entice those larger ships back; so while the numbers in this area do not paint a very positive picture, it is only a handful of changes that has caused the drop off.

"An increase in visitor numbers is now expected next year and the return of large cruise ship visits should be seen in 2026, so we expect to see a significant improvement in this part of the visitor market."

Referencing the drop off in visitors being likely to recommend Guernsey, she said that, ultimately, the net promoter score is still at 55, and is still considered excellent compared to industry benchmarks – as anything over 50 is.

"With the increase in comments regarding delays and cancellations in Q3 2024, we would hope that, once these issues are resolved, we will see our NPS go back up.

"We recognise the steps Aurigny have taken to improve resilience for the coming season and we support those, because as a sector we need to do everything possible to restore confidence to travellers and mitigate the impact of this year's disruption.

"Similarly, we look forward to a swift resolution to the ferry procurement process for Guernsey, and hope to see schedules released as quickly as possible.

"It is now high past the time that we stop comparing today figures to before Covid; the landscape is vastly different and we must now look forwards rather than back.

"Our occupancy in the accommodation sector remains strong, and we must remember that we cannot sell beds twice over, so we must now put our focus on reverting all beds to the visitor economy and reopening hotels currently in rebuild."

Comments

Comments on this story express the views of the commentator only, not Bailiwick Publishing. We are unable to guarantee the accuracy of any of those comments.