The future of taxation lies in the balance, with the States unable to complete debate last week on proposals that would set the ball rolling on the potential introduction of GST.

The Assembly has spent two days mulling over whether to give Policy and Resources the green light to investigate the feasibility of three options for tax reform, with a policy letter of substance to be brought back to the States no later than July 2022.

Goods and Services Tax is one of those options, the big-ticket topic, but it "isn’t fair or right" to look at this situation in black and white, it was said many times during a prolonged debate.

The island will see a General Revenue funding gap, between what the States can draw in through revenue and what they will need to fund - £54m by 2025 - as the island's demographic crisis reaches a head.

Additionally, an increased need to fund the Guernsey Insurance and Long-Term Care funds will add another £33m to that figure.

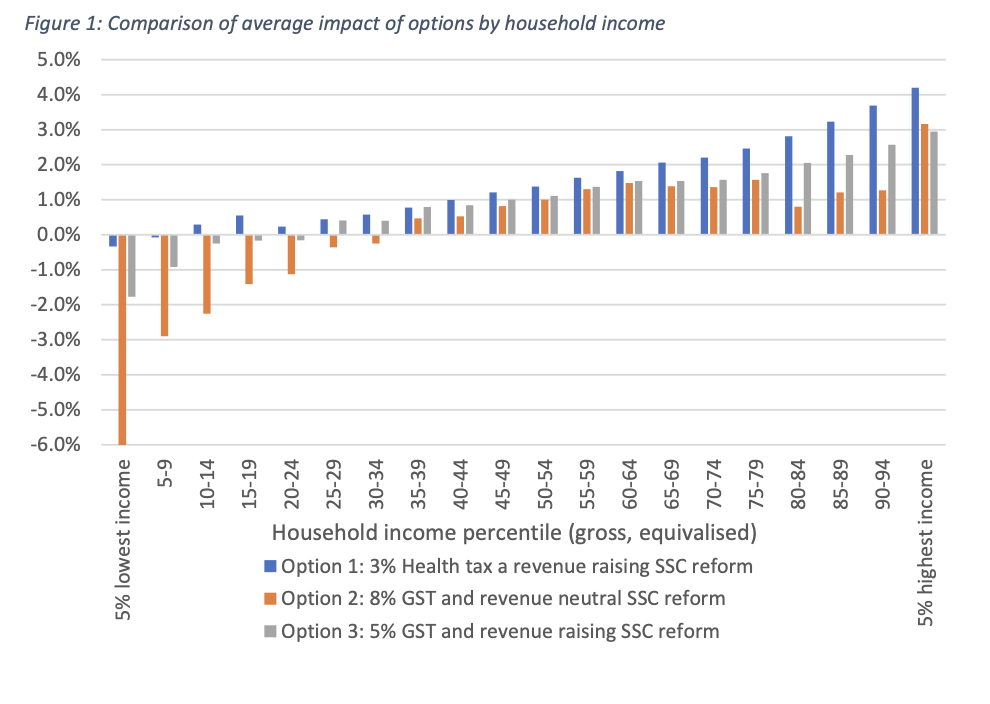

According to P&R’s steering committee, the answer could be one of three options: the introduction of Guernsey’s first Goods and Services Tax or the introduction of a 3% 'health' tax, or a combination of the two - with an emphasis on the viability of GST and its need for further investigation.

Pictured: The impact of GST would be mitigated by a potential restructure of social security contributions, says P&R.

“Trying to sell the message that we have to raise taxes is one of the most difficult things to do,” said Deputy Peter Roffey, the President of Employment & Social Security, and a political member of P&R's Tax Review Steering Committee.

Having argued against GST in the past, Deputy Roffey had come round to the idea due to P&R proposing it be balanced with a restructure of the social security system.

“My long-standing objection has always been predicated on the impact it would have on those modest incomes.

"Now I have a choice, increase Social Security contributions under the present system which would hit those at the bottom really hard, or actually bring in a package that would help modest earners,” he said, alluding to a proposed, income tax-style allowance.

“The two forms of GST proposed here are not regressive – these packages are actually beneficial for those further down the income scale,” he said.

Pictured: “There is no mechanism at the disposal of this assembly to permanently link the beneficial protections promised and the effects of GST on lower income households, and that concerns me,” said Deputy Burford.

One issue was raised consistently throughout; a lack of understanding of the major issues at hand.

“Under the existing propositions I guarantee that post-debate some of the media coverage will be along the lines of ‘GST how they voted; for or against’ and there will be no nuance," said Scrutiny President Deputy Yvonne Burford.

"Because of that, some members will be reluctant to lend P&R their vote, that I’m afraid is entirely the fault of the senior committee."

“The correct course of events would have been a public campaign of roadshows, workshops, engagement with sector of society, to broaden the public understanding – all before a policy letter was presented to this assembly. Instead, we have something like the ‘decide, announce, defend’ model that is very rarely successful,” she said.

Her thoughts were echoed by Deputy Andrea Dudley-Owen, who lamented a lack of constructive public engagement in the issue.

“This term the public seems to be engaging less with the government, the complexities of changing the tax system need to be pushed into the public consciousness,” she said.

P&R said it will seek further public consultation if its proposals get voted through next week.

Pictured: “Have the backbone to tell it how it is and explain to the public that raising taxes is unavoidable,” Deputy Roffey told his colleagues, saying that "prudence must trump popularity".

Whether there could be alternative sources of income, and their investigation over P&R’s proposed options on tax reform, was a consistent theme throughout.

Deputy Charles Parkinson launched a scathing attack after not being offered the option of voting on corporate tax instead.

He referred to Treasury Lead for P&R, Deputy Mark Helyar’s opening speech, where it was said that any reform of corporate tax could adversely affect the finance sector.

“These remarks tell me two things; firstly, he does not understand corporate tax, and secondly he has done no serious work on the amount corporate tax could potentially raise,” he said.

“I will not be voting for proposition 4 or anything like it until the corporate tax situation has been sorted out – the people of Guernsey have suffered enough,” he said, citing Zero Ten.

Deputy Aidan Matthews said P&R’s proposal puts the cart before the horse and suggested we could raise revenue by also tackling the island’s housing crisis.

“Scrap stamp duty altogether and replace it with an annual property tax that is proportionate to the property value. Stamp duty simply makes the housing market less liquid, scrapping it would break this up and help people getting onto the first rungs of the ladder.

"We have a housing crisis, we are debating tax changes created largely as a result of too few young people and families on the island – our tax policy should tackle the cause of the problem not just react to it,” he said.

Pictured: “We cannot continue with the status quo,” said Deputy Bob Murray.

The contentious point of the debate was in relation to proposition 4, to agree that to meaningfully diversify the tax base, GST is required.

Several members of the Assembly were vehemently opposed to GST, including Deputies Fairclough, Aldwell, De Lisle, and Murray. However, Deputy Heidi Soulsby urged members to not “strangle GST at birth”.

“If I don’t like the result of further investigations next summer, I’ll reject it then,” she said.

Deputy Al Brouard agreed: “I will vote for all propositions and reserve my final decision for next year.”

One of the biggest advocates for GST remained Deputy Gavin St Pier, who detailed at length why he was “strongly and enthusiastically” in favour of it.

“In a tax system such as ours which is already off-the-scale by any comparisons to any other jurisdictions in relying on the taxation of personal incomes, GST diversifies and so helps stabilise the tax base.

Pictured: “I cannot think of anyone better to make sure that any stone is not left unturned,” said Deputy Brouard of Deputy Helyar.

Deputy St Pier continued: “Why? Because consumption is more stable than income – at a macroeconomic level, not a household level – it is less impacted by a rise and fall in incomes as consumers draw down from or increase their savings to maintain their consumption levels as their incomes fluctuates,” he said.

The debate ended with eleven deputies still left to talk, not all of whom were available to stay beyond 17:30 because of family commitments. The Bailiff decided to defer debate until the next available date - 13 October.

Comments

Comments on this story express the views of the commentator only, not Bailiwick Publishing. We are unable to guarantee the accuracy of any of those comments.