Most major projects have been put on ice and no fundamental changes to the tax or social security system have been agreed, but States members backed funding for the hospital modernisation project – however P&R have indicated it wants an early general election next year.

The long-running debate on schools vs the hospital has resulted in a big defeat for Education, with the Les Ozouets post-16 campus to lose its funding this political term. The project is unlikely to proceed in any meaningful way until at least the summer of 2025.

The latest estimate for phase two of the hospital project is £120m, and it’s expected to be completed by using up to £90m from the health reserve and through new borrowing.

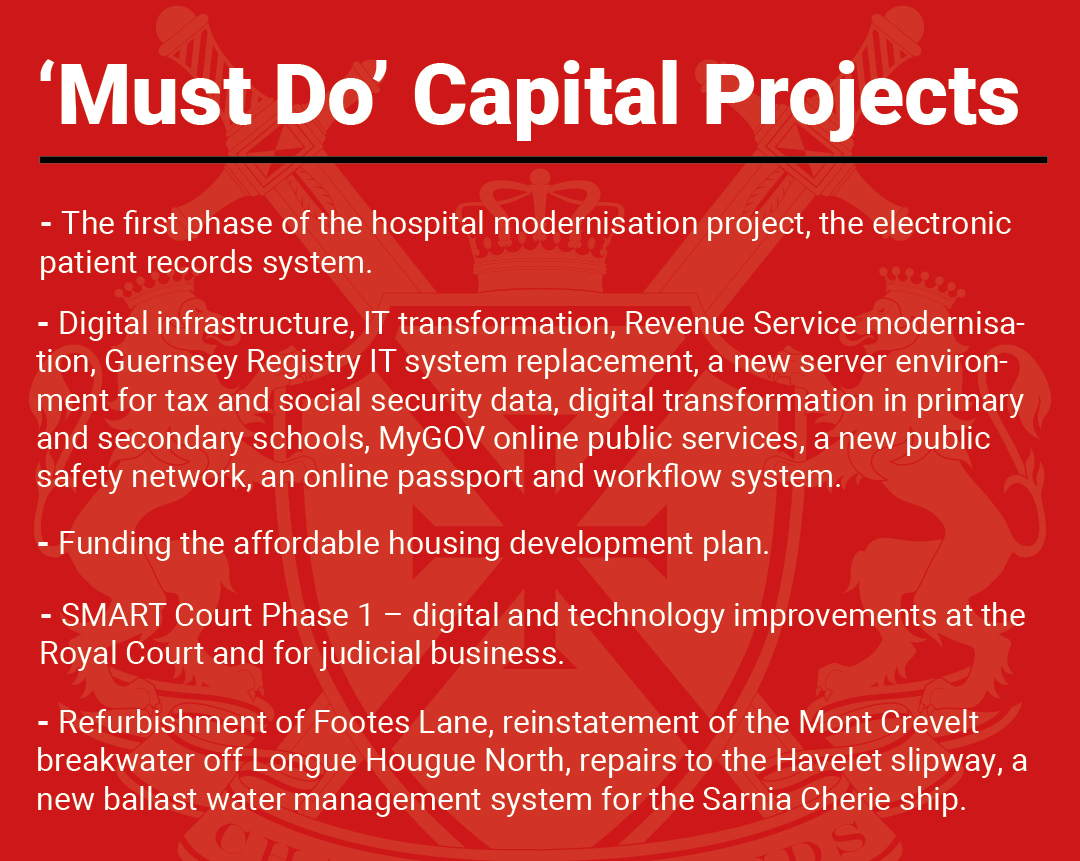

Additional capital projects, including 17 considered too late to stop as they are already underway, such as the Alderney Airport expansion, flood defences and housing at the Bridge, and six others will go ahead at a total cost of £340m. £30m-worth of inflation-linked contingency to these projects has also been agreed.

But all other major items of spending such as Les Ozouets, what to do with future inert waste and upgrading the States’ accounting system will have to wait years to be activated again.

Policy & Resources were again thwarted in its attempts to bring in GST, cut income tax, and reform the social security contribution system to plug the projected £100m fiscal deficit and fund a longer list of capital projects this term, including many of the projects named above. The package was rejected 15-24.

Deputies did however back increases to transport taxes to raise £10m, international corporation taxes to raise £10m, a corporate levy to raise £5m, all each year. Meanwhile, £10m worth of savings per year will delivered by the end of 2028.

The next Policy & Resources Committee will have to present a further review of the taxation system in September 2026, outlining whether more tax increases should be adopted to put the island on a sound financial footing.

Pictured: The States and the island have been thrown into uncertainty tonight with plans from P&R to force through an early general election.

Deputy Mark Helyar, Policy & Resources’ treasury-lead opened debate insisting those who had been tasked with investigating changes to the tax system over two years had left no stones unturned.

“What did we find out from deputies, from experts, and from the public on our journey to this debate? Firstly, our investment returns are in large the only income source protecting us from an operational deficit. If we spend them, we will not only lose that investment income, but will not be able to maintain a longer duration portfolio which is more likely to attract higher returns and grow larger and sustainable long-term returns,” he said.

“Protecting our reserves is therefore a vitally important part of the proposals before the States in this policy letter and is at the heart of all proposals. This is not only key to maintaining and hopefully improving our reserve position, but to provide a cushion against economic or other threats. We must remember that our rainy-day fund, now known as the core investment reserve, is over £450m short of funds. We should if we can be topping that up whenever we can.

“The ultimate conclusion is that we are not collecting enough tax from our economy to keep pace either with the growing demographic issues or even just to keep pace with the rest of the OECD.

“We live in very uncertain times with war looming in the Middle East, and much talk of economic recession as a result of a decade of printing money by developed economies. We need to be ready to protect the island's economy if we need to do so, and the cupboard is far emptier than I would personally like to see.”

Pictured: The list of States projects considered too late to stop.

The new taxes and savings that were agreed would go some way to cushion the blow of the core list of projects: “If we leave only having agreed those things, then we will have started to generate some revenue headroom, which can only help to assist with even some of our smaller projects”.

But as the hospital and some other projects were crammed into the final agreed list for this States, there are big questions over how to service debt incurred from increased capital spending, borrowing, and pillaging of the health reserves.

Deputy Helyar argued that those who try to paint the proposals as being inefficient by recycling some of the money raised through GST to fund more progressive elements for the lowest paid, such as the income tax cut, were “perverse”

“We are very likely to hear some repeated nonsense in this debate that returning public money to the public is a cost with GST. Reducing the tax and social security liabilities of the poorest workers in our society is absolutely not a cost,” he said.

“Returning tax to the poorest while charging the wealthy more through management of allowances and a consumption tax is not a cost. There is no such thing as government money. There is only public money.

“I don't want to see people suffering, or worse as a result of inadequate hospital facilities. But neither do I wish to see our youth on which so much depends being taught in facilities with no heating and leaking roofs. It was thus our mission to try and ensure proper regard was had to both of the largest projects in our portfolio in the knowledge that a fight to the death over one or the other would only result in a negative outcome for either schoolchildren or patients, or perhaps a fudge we can’t afford in the longer term.”

He accepted there would’ve been some pain if GST and high levels of borrowing were actioned but said that in the short-term was preferable to straddling “our children and grandchildren with the burden.

Pictured: Deputy Mark Helyar was unsuccessful in convincing a majority of deputies to back major tax reforms.

Deputy Marc Leadbeater said P&R’s “steadfastness” in bringing back near identical proposals has given the public the impression they are refusing to explore other options. He also criticised them “belittling” other members who wouldn’t lend their support to the package.

Some deputies were concerned that proposals on the tax system and capital expenditure had been tied together, complicating the debate. Deputy Peter Roffey, who helped shaped P&R’s package, said this had taken the focus away from the “main driver” of debate which was spiraling costs on pensions and healthcare due to an older population.

But he rejected claims those at the top had discounted other avenues of raising or saving cash: “We would have to be the biggest masochists on the face of the earth… why would we do it if we hadn’t looked at everything conceivable?”

Guernsey was on a dangerous path if it continued to rely so heavily on the income of an ever-shrinking working population to fund essential public services, he added.

He insisted those with “the broadest shoulders” would bear the “biggest costs” under the reforms, and the mitigations were “redistributive in the extreme” to support middle and lower earners.

Deputy Roffey however accepted consensus was almost impossible to find on this issue from current politicians and said there is “not much point” in them “having another go at it”.

He had been a deputy on and off since 1982 and said the Assembly “doesn’t seem to have the resolution anymore… we will have to leave it to the next lot, and good luck to them”.

Deputy Peter Ferbrache, President of P&R, has tonight indicated that an early general election will be sought for next year. However, that requires support from a majority of deputies and it's unclear if this attempt will succeed.

Comments

Comments on this story express the views of the commentator only, not Bailiwick Publishing. We are unable to guarantee the accuracy of any of those comments.