Last month, a consortium of International Financial Institutions (IFIs) agreed a substantial action plan to tackle growing concerns with food security in the wake of the Ukraine-Russia war and pressures on global supply chains.

Amongst them are institutions such as the World Bank, the International Monetary Fund, and the African Development Bank. In a joint paper they said that “global commodity prices and market uncertainty have increased dramatically, creating significant risks to food and nutrition security on top of pre-existing vulnerabilities in many countries.

“Some countries are now facing physical shortages of food, and many more are experiencing higher food, fuel, and fertilizer prices. More people are hungry and experiencing food insecurity, and more people are at risk of falling into poverty.”

IFIs have now pledged billions in support of vulnerable people, food production, ensuring adequate and equitable fertilizer supplies and establishing “climate-resilient agriculture”.

Given this targeted, top-down support, Express looks at initiatives being driven from the bottom-up through sustainable finance efforts in Guernsey.

Pictured: Ports on Ukraine's south coast have been unable to export staple foods such as wheat since being invaded by Russia earlier this year.

Guernsey Finance, the agency who promote the local financial services sector internationally, provided Express with several case studies of how firms are supporting sustainable investing in agriculture.

Bellerive Trust has been impact investing in numerous central African countries to support and develop agribusiness.

It says that its project has taken in “more than 10,000 hectares of farming land, which, aside from its agricultural potential, also benefits from the capacity to generate renewable energy from sunlight, creating multiple income streams for stakeholders”.

The project hopes to “offer a sustainable income yield, local economic growth, and enhancements for local quality of life, while reducing food imports and increasing domestic nutritional self-sufficiency”.

Bellerive claim there is already evidence of economic and environmental improvements for residents and believes it could “spur innovation” as the countries continue to develop.

Pictured: Cibus invest in various technological innovations aiming to assist the global food supply.

Cibus Fund I and II are both designated as Guernsey Green Funds and focus on sustainable food and agricultural investments. Carey Olsen act as its legal adviser, whilst Vistra provide administration services.

Their website states: “Agrifood Tech has the potential for unprecedented positive impact. Together we can reform the food value chain to ensure global food security for generations to come, whilst preserving precious ecosystems and generating outsized financial returns.

“Our core belief is that sustainability and commercial prosperity in the food and farming sector are inextricably linked.”

Most recently, Cibus acquired a majority stake in an Australian vegetable seedlings company – Withcott Seedlings – who have the capacity to grow upwards of 350 million seedlings per year.

Cibus aims to deploy automation and robotics to improve efficiencies such as planting, propagating, and watering.

It previously invested in ISO Group who develop robotics specifically for indoor farming which help to enhance crop yields and product quality. One of its machines can plant and harvest up to 12,000 bulbs per hour.

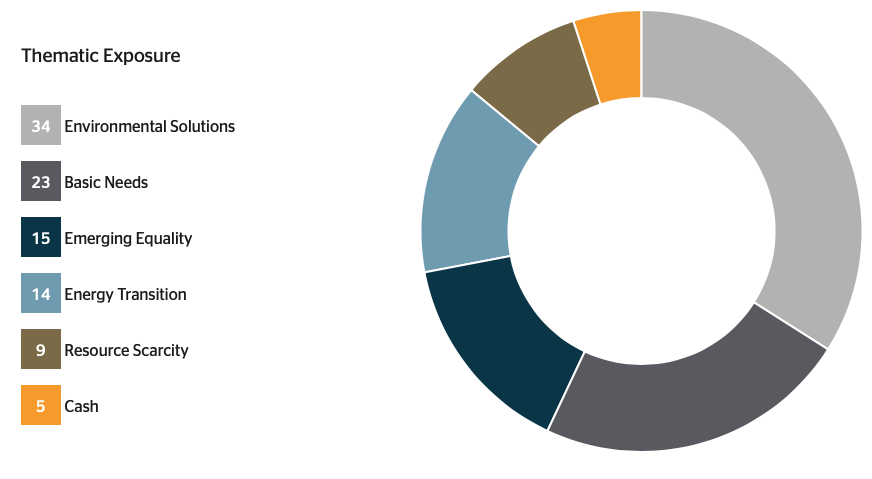

Pictured: The asset weighting of Ravenscroft's Global Solutions Fund.

Local investment services group Ravenscroft provides a Global Solutions Fund, which has a size of £17.8m. 57% of assets are designated towards environmental solutions and basic needs.

The fund’s April report highlighted that “food security is now more important than ever, and investment is needed in our global food system.

“The fund invests in companies that improve the sustainability of access to and quality of food and food production necessary for health and growth.

“It has exposure to some incredible and innovative companies that provide solutions to the multiple food system challenges: improving the productivity and sustainability of food production, increasing the efficiency in nutrition processing, transportation, packaging and storage to reduce food waste, and maximising the nutritional content of the food we eat to reduce the disease and malnutrition burden caused by our current diets.”

Its top performing underlying fund in April was Pictet Nutrition. It seeks to improve farming productivity, efficiency throughout the supply chain, and the nutritional profile of food through its nutrition strategy.

Pictet says it focuses on innovative companies working to secure the global food supply, rather than investing and speculating on commodities themselves. It returned 0.7% under Ravenscroft’s Global Solutions Fund.

Pictured: Guernsey hopes to be continually recognised as a global leader of sustainable finance through appropriate regulatory considerations.

On the regulatory side, Guernsey’s Financial Services Commission (GFSC) has been actively promoting green initiatives. It was instrumental in establishing the Guernsey Green Fund, the world’s first regulated investment fund for environmental purposes.

Most recently, it proposed another world first - the Natural Capital Fund regime – which plans to channel investments into biodiversity and nature-based solutions designed to limit the effects of climate change.

Stephanie Glover, Head of Sustainable Finance at WE ARE GUERNSEY said: “The proposed Natural Capital Fund regime will drive investment into these solutions, and help investors be confident that their investments are going to projects that will protect the natural environment, avoid and capture carbon emissions.”

At the same time, it published a paper offering guidance to prevent against greenwashing by organisations.

GFSC has recently become members of the Taskforce on Nature-related Financial Disclosure in order to further cement Guernsey’s position as a credible centre for sustainable finance initiatives.

Comments

Comments on this story express the views of the commentator only, not Bailiwick Publishing. We are unable to guarantee the accuracy of any of those comments.