Property buyers have saved more than £13m. in legal fees since fixed conveyancing charges were scrapped a decade ago, according to new research.

They were set at 0.75% of the realty value, until encouragement by the Regulator led to the Guernsey Bar removing the rule that set the fee and allowed competition on price - it happened some six years after Jersey.

Since then legal costs as a percentage of the property value has fallen almost every year.

The Guernsey Competition and Regulatory Authority has released a report it commissioned from Critical Economics about the impact of the change.

It revealed that “a small number” of law firms still charge a percentage of the property purchase price, although less than 0.75%, but the majority now charge a set amount for standard conveyancing

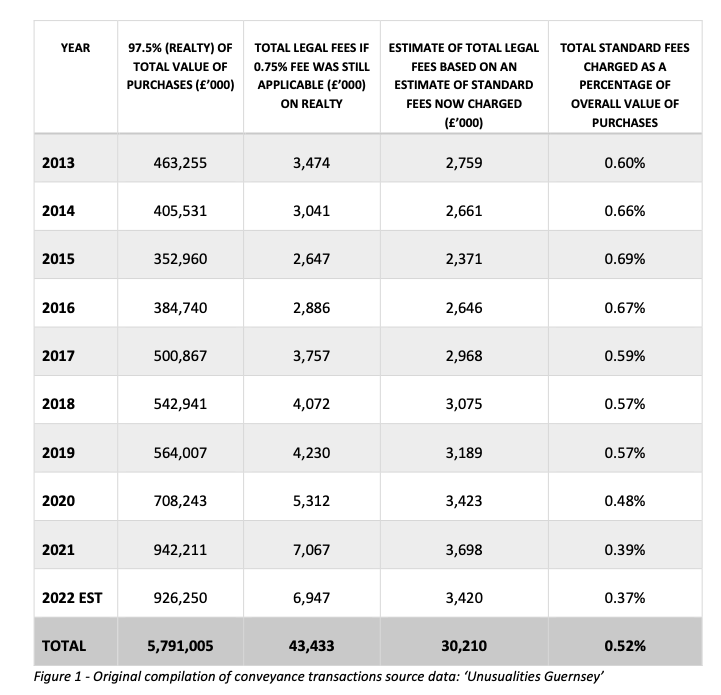

During the last decade, total realty property transactions amounted to £5.8bn, on which conveyancing legal fees amounted to £30.2m or an average fee of 0.52%. This percentage has dropped to an average of 0.38% in the last couple of years due to the rapid increase in property prices.

If the pre-2013 fixed fee of 0.75% on total realty property sales had been charged during this ten-year period, then legal fees would have amounted to £43.4m.

About 60% of the saving, £7.7m., related to the local market.

Michael Byrne, CEO of the GCRA said: “This is an example of where an industry voluntarily elected to address a potentially anti-competitive practice as a consequence of encouragement by the competition law regulator. The tangible benefit to consumers is clear to see, with a sustained and real reduction in costs over a prolonged period, in a significant market for Guernsey."

Critical Economics conclude that “undoubtedly, the cessation of a fixed percentage legal fee in the local conveyancing market has been very beneficial to the property market. This reflects what was experienced in Jersey following the implementation of a similar course of action in 2006".

Comments

Comments on this story express the views of the commentator only, not Bailiwick Publishing. We are unable to guarantee the accuracy of any of those comments.