An economic expert has warned "misguided policies" which caused the 2008 financial crash are still causing damage across the world with a couple of years of "economic pain" ahead of us.

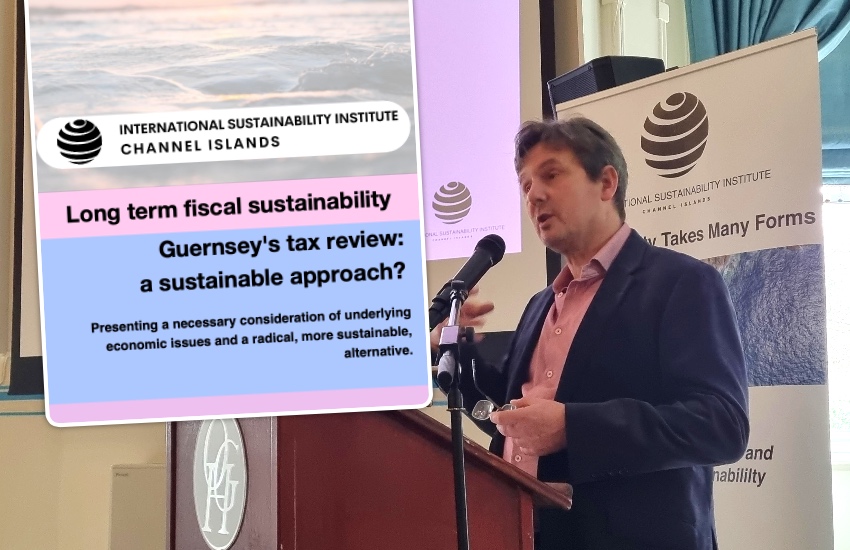

Dr Andy Sloan is based in Guernsey, from where he is running the International Sustainability Institute.

He previously worked for the States as the island's Chief Economist and both the island's promotional and regulatory financial bodies - We Are Guernsey and the Guernsey Financial Services Commission.

His past responsibilities have included coordinating the development of the island's financial services strategy, managing the island's financial stability and advising on economic policies.

Recently he published his own paper in opposition to the official Policy and Resources plans for the island's Tax Review. Ultimately his proposals for resetting corporate tax policies, cutting income tax rates and introducing a goods and services tax were not supported politically but he said he had received positive feedback regarding ideas which could be pursued further.

Pictured: Dr Andy Sloan presented his ideas for corporate tax reform ahead of the States debating the Tax Review in January and February of this year.

In light of the recent sale of Credit Suisse to UBS, the collapse of Silicon Valley Bank, and other high profile problems within the global finance sector, Dr Sloan said they can all be traced back to the same global monetary policies which were in play prior to the global financial crash of 2008.

Those policies - including quantitative easing and loaning money to banks in the form of bonds against debts - have created embedded environments where many financial institutions are no longer viable. He predicted more will fail as the same policies which have caused the problems continue to be seen by many as part of a solution. A view he does not agree with.

Likening the global economy to an illness, Dr Sloan said that "the medicine which is being applied" (the policies being implemented to improve the economy) "is not working". He said the economy is not getting bigger, and people are not getting wealthier, and in reality the global economic position means that overall everyone is getting poorer.

He said this global picture is replicated locally in Guernsey and other off-shore jurisdictions too, with people getting poorer and the previously dominant financial sector shrinking in profitability while costing more and more to run each year.

That is why he believes the offshore centres need to stand up for themselves now more than ever.

Pictured: Credit Suisse in Guernsey employs an estimated 160 people. The company is merging with UBS following numerous strategical problems affecting the Swiss bank.

Dr Sloan said the growth in compliance and regulations since 2008 mean that the sector continues to employ a healthy number of people locally, but the profits made by the finance sector are not as great as they were, meaning that the increased expense in running the sector could be seen as a ticking time bomb for some.

"...(there are) changes we can effect," he said. "We've been allowing our cost base to increase, selling less and costing more to produce. We're using the same revenue but spread over more people and with our demographic ageing. We have to fix the productivity problem - it's got to be done locally."

Speaking more broadly and looking again at the global economic picture, Dr Sloan said the situation is similarly negative.

"...the global capitalist system has not been producing the goods," he said. "We have to hope for a reinvigoration of the capitalist financial model that did work well prior to the 2008 crash - it created amazing improvements in standards of living. It can be done sustainably," he added alluding to his personal interest in green finance and a sector he thinks the island, and wider global economy must capitalise on.

"Within that we must make the case that the offshore finance sector is not the problem, with the broader capitalist system," he urged. "The institute has a role in doing that, by presenting that case for the free flow of capital into real productive investments and not just into financial assets as part of a component of raising global economic growth.

"We (the offshore sector) have to stand up for ourselves - we've not done that for the last 15 years. (we've been) agreeing to more rules and measures rather than standing firm and saying what we're doing is pretty useful to global GDP."

Comments

Comments on this story express the views of the commentator only, not Bailiwick Publishing. We are unable to guarantee the accuracy of any of those comments.