Deputy Gavin St Pier continues to draw information from the current Policy & Resources Committee on the performance of its various investment portfolios and is concerned by some of his findings.

“In previous States’ terms, information was regularly provided by the responsible committees in respect of the portfolios’ performance,” he said. “That information flow has dried up this term, for no good reason. Until P&R voluntarily offer up this information again, if necessary, I will submit regular questions to ensure it is publicly available.”

Through three rule 14 questions the former President of P&R has asked the current President – Deputy Peter Ferbrache – if the quarterly investment performance of the portfolios overseen by SIB (States Investment Board) can be published, and whether they can also be compared to previously agreed targets.

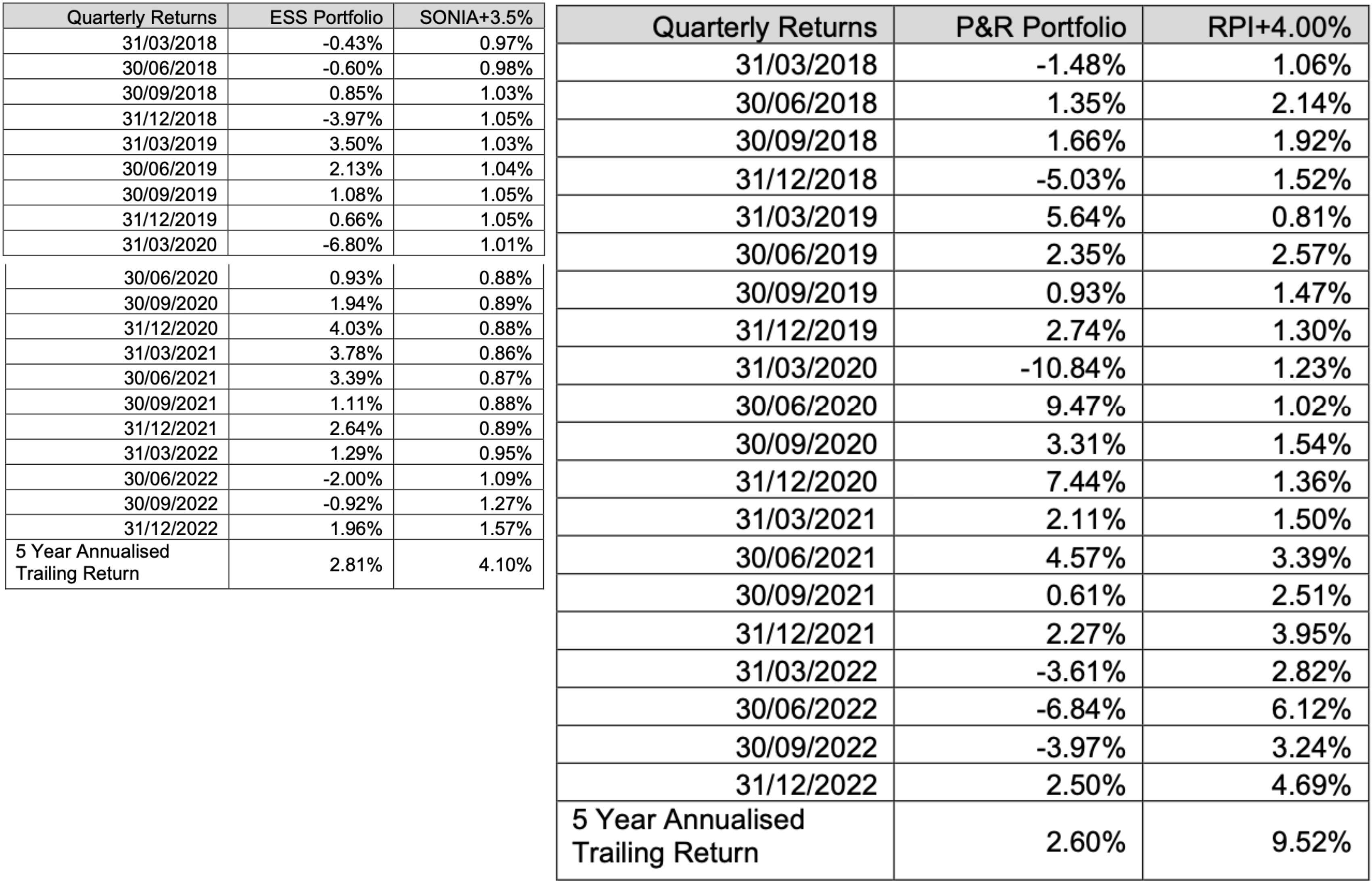

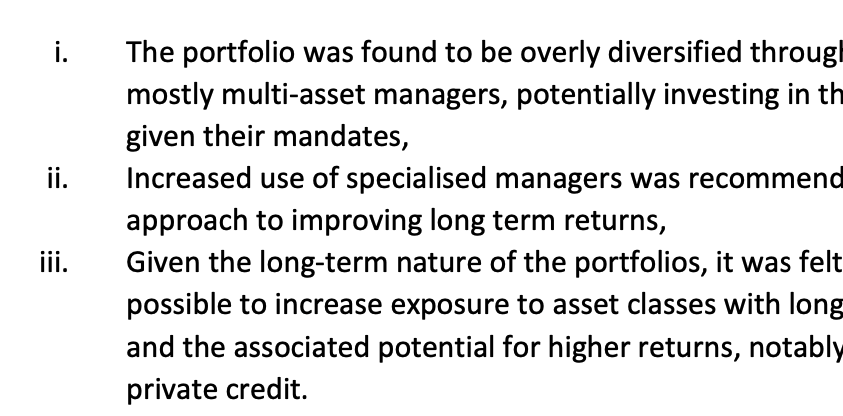

Pictured: Deputy St Pier commented on the released statistics: “The 5 year annualised trailing return at the end of 2022 for P&R’s portfolio was running at 6-8% a year but has now dropped to 2.6% a year, well behind the target of 9.52% a year. That diminished performance is concerning.”

Deputy St Pier also asked if there have been any changes to the portfolio management structure following the appointment of Cambridge Associates (CA) as advisers, and similarly, whether any changes have been made to the overall investment strategy of the States following the creation of SIB and installation of CA.

“Given the local expertise that we have here, I think it was a mistake to replace local investment advisers with off island consultants, Cambridge Associates,” said Deputy St Pier. “I fear that over time it will mean that the programme to use local investment managers will be dismantled. Quite apart from the terrible signal it sends that government is not backing the local finance sector when it has the chance, it also represents a significant loss of income to the sector.”

To Deputy St Pier’s second question - on potential changes to management structure - Deputy Ferbrache said, after the installation of CA, it was agreed that the Social Security fund would be pooled with other reserves and that the assets within the Public Servants Pension Scheme would be separated. This has led to the following changes to investment managers:

Deputy Ferbrache also said CA undertook a “comprehensive review” of existing managers and the overall strategy, and has since come to the following outcomes:

“The response refers to revised investment strategies having been agreed for the Public Servants Pension Scheme and all the other reserves, but fails to explain what changes have been made,” said Deputy St Pier, after reviewing the responses he received. “This needs to be better understood and will require further probing.”

“The response also advises that it is intended to invest in more private equity and private credit. This is no great surprise given the background of the new investment adviser, Cambridge Associates. These asset classes carry more risk and have less liquidity.

“In light of the changes being made, it is in the public interest that the investment performance of public reserves are kept under close scrutiny.”

Comments

Comments on this story express the views of the commentator only, not Bailiwick Publishing. We are unable to guarantee the accuracy of any of those comments.