Fewer people asked Citizens Advice for help with money and debt related issues last year but the charity says that is likely down to other measures in place to help people as the cost of living continues to bite.

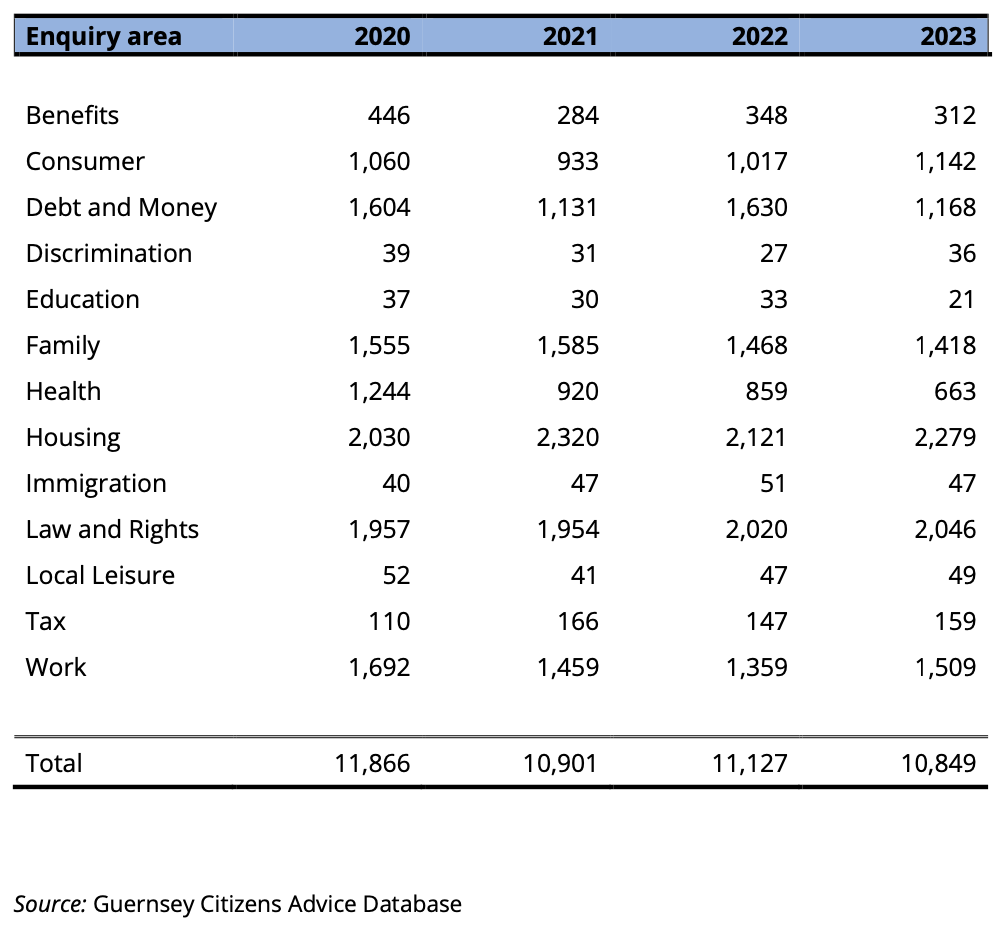

2023 saw a 28% reduction in the number of Debt & Money enquiries compared to 2022.

"We believe this could, in part, be due to the introduction of the Lending, Credit and Finance (Bailiwick of Guernsey) Law, 2022 which came in to force on 1 July 2023," said the charity.

That law was intended to protect customers who make use of consumer credit and home finance.

CAG says its 'Money Advice Service' continues to provide specialised casework offering individual budgeting advice, individual repayment plans and negotiation with creditors where it is needed. 46 people used this service last year - including 14 existing clients from the previous year and 32 new clients.

The overall number of enquiries relating to debt and money was 1,168, dealt with by CAG's generalist advisers including queries around banking services, insurance, pensions, credit, and liability for debt.

Pictured: The Citizens Advice Guernsey shop, run by the Friends of Citizens Advice contributed almost £75,000 to the charity's income last year.

CAG says the largest amounts of debt clients needed help with related to secured, and unsecured loans, with clients also asking for help with credit and store cards, tax bills, hire purchase, catalogues, and family loans.

The main underlying causes of indebtedness when recorded, was relationship breakdown or loss of partner (18%), health issues (14%), low income or pay with debts (10%), job loss or business failure (16%), poor budgeting (6%), and other reasons including, legal fees, gambling, income tax bill, being scammed and rent arrears (36%).

CAG says it expects enquiries around all of these areas to continue as the cost of living remains high.

"It is anticipated that with the cost-of-living crisis, this is going to impact further on those who are already struggling, as well as those who have just managed to survive thus far," said the Deputy CEO Annie Ashmead in the annual report.

"With that in mind, we will no doubt see an increase in the need for our dedicated Money Advice service over the coming year."

The charity has three money advisers and two trainee money advisers, both of whom now have clients of their own.

CAG says they are usually available to see clients during one session each week, but many came in more often to keep on top of their caseload.

Pictured: Data from the CAG Annual Report.

Aside from money and debt worries, CAG says the number of enquiries for each area remains broadly similar to previous years.

Housing remains the most enquired about topic, with Law and Rights the second most popular.

CAG also dealt with enquiries around work, employment rights, discrimination, and immigration.

Islanders urged to seek help for debt management

Comments

Comments on this story express the views of the commentator only, not Bailiwick Publishing. We are unable to guarantee the accuracy of any of those comments.