Average monthly rent for all categories of properties is continuing to climb, while the average purchase price for properties has fallen from the stratospheric heights reached at the end of 2022.

Average purchase prices for homes in April, May, and June of this year were 2.1% lower than the first quarter at £600,836 but still far higher than five years ago.

Three-bedroom houses and two-bedroom bungalows made up the bulk of transactions, with nearly 95% of all transactions, 175 in that period, being properties more than three years old.

There were 62 more transactions in that period compared to the start of the year, but this was less than double the sales in the second quarter of 2022.

Final sale price was found to be nearly 7% lower than first and last advertised price for a property compared with just under 3% the previous year.

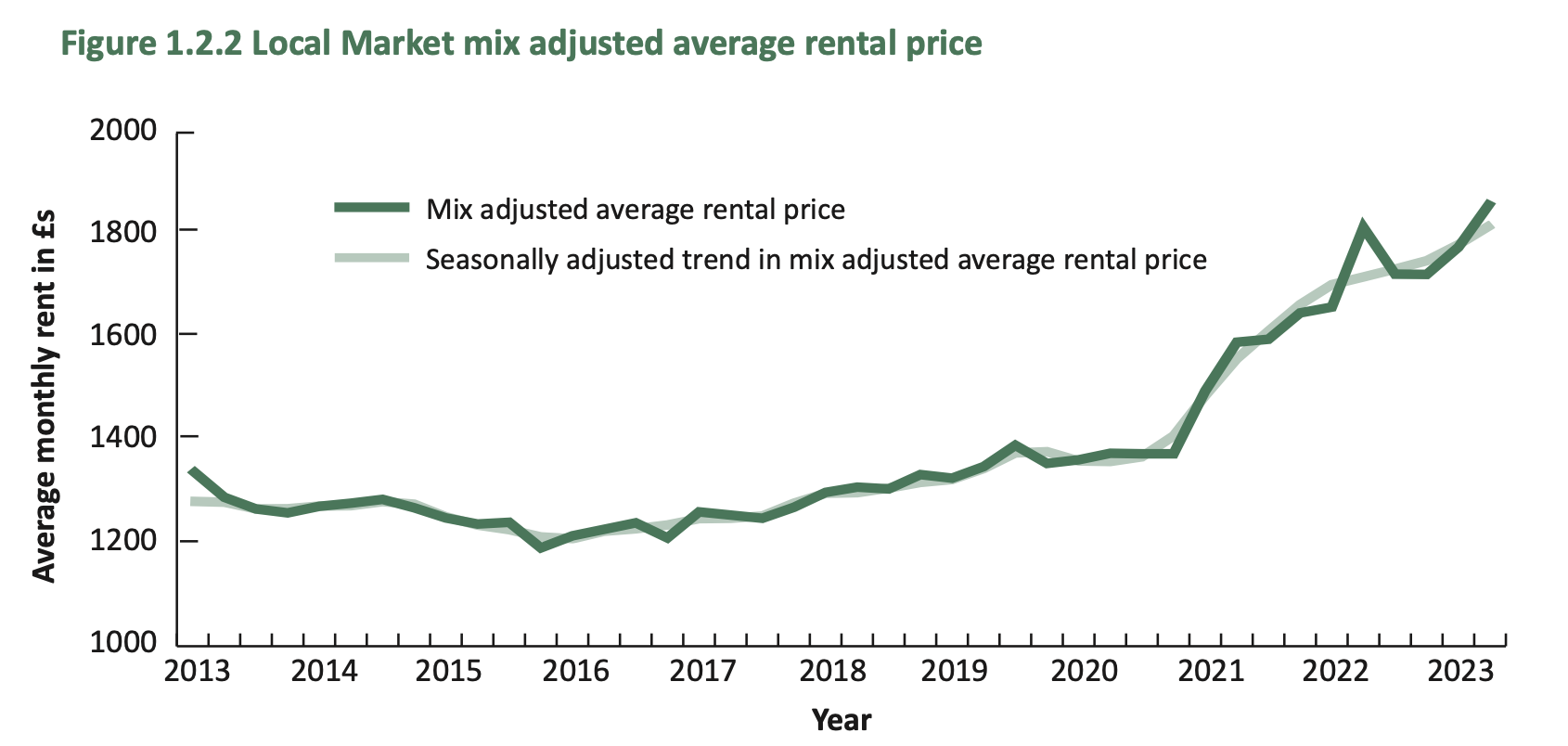

Meanwhile average rental prices hit their highest ever levels surpassing £1,860 per month, continuing a soaring price trend since 2018 with costs now 42.3% higher than then.

That’s a quarterly percentage change of 4.8%, which lettings professionals have noted as coming as a surprise since prices appeared to be stabilising at the end of last year.

Competition for these properties, where there is limited stock due to myriad factors, is expected to increase as the island experiences higher levels of inward migration and some are priced out of the private market.

Pictured: Trends in the rental market.

Nick Paluch, Director in Savills Guernsey’s residential sales team, said a slowdown in the local market is not surprising given the market reaching a peak in 2022.

Realistic pricing for both sellers and buyers is key to maintaining momentum in sales which have also slowed due to reduced urgency compared to the covid year, he added.

“Rising interest rates and the increasing cost of living continue to make life challenging for those buying and selling. The good news is that there are still a robust number of people who remain committed to a purchase in the Local Market – they are just having to adjust their budgets accordingly,” he said.

“We also expect more stock to come to the market in the upcoming months, which should give encouragement to those now starting their property search.”

Open Market sales remained strong when compared to the previous year and that shows the island “remains a very attractive destination” compared to nearby jurisdiction, Mr Paluch added.

Pictured: Annie Le Prevost of Savills says the rental market is proving challenging for both tenants and landlords.

The uptick in average rental prices is likely down to the types of property that have been let in the second quarter of the year rather than overall price increases, according to Savills’ residential letting manager Annie Le Prevost.

“It’s true that some landlords have had to increase their monthly asking price - higher rates of TRP, rising insurance quotes and the general expense of routine maintenance work for example, have all put upward pressure on prices. In addition, stock levels remain a challenge; the number of rental properties available simply does not satisfy demand,” she said.

The island is between a rock and a hard place as interest rates squeeze people out of investing in the buy-to-let market and ensuring difficulty for those trying to get out of renting, she added.

“There continues to be a large proportion of people relocating to Guernsey for work, so competition for rental properties will only continue.”

The States measure house prices by calculating the average cost of purchasing a property including both the building and land and moveable assets, such as fixtures.

Different types of properties are also weighted according to their composition and the number of bedrooms to reflect the profile of all owner occupied and buy-to-let units across the island.

Comments

Comments on this story express the views of the commentator only, not Bailiwick Publishing. We are unable to guarantee the accuracy of any of those comments.