Property purchase and rental prices are both still stuck far higher than they were five years ago - despite some recent fluctuations in the housing market.

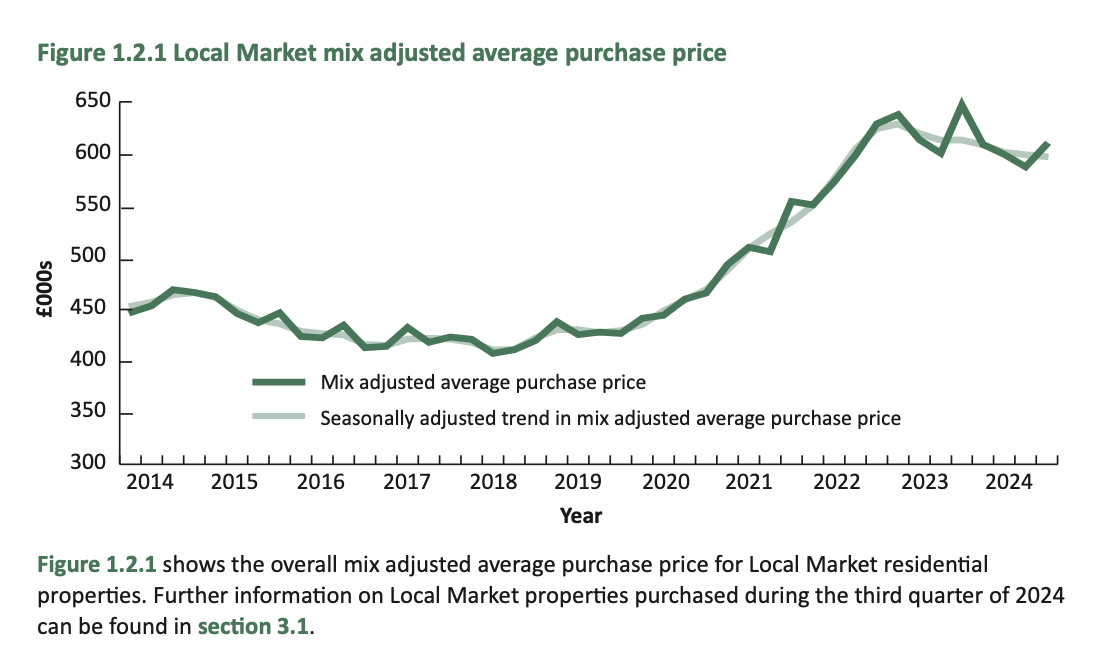

The latest data - published by the States this week - shows that the mix adjusted average purchase price for Local Market properties sold during during the third quarter of 2024 was £609,723.

That is 3.8% higher than houses were selling for earlier this year, but it is down 5.9% lower than the same time a year ago.

Overall though, house prices are 40% higher than 5 years ago - using a four quarter average to determine the stats.

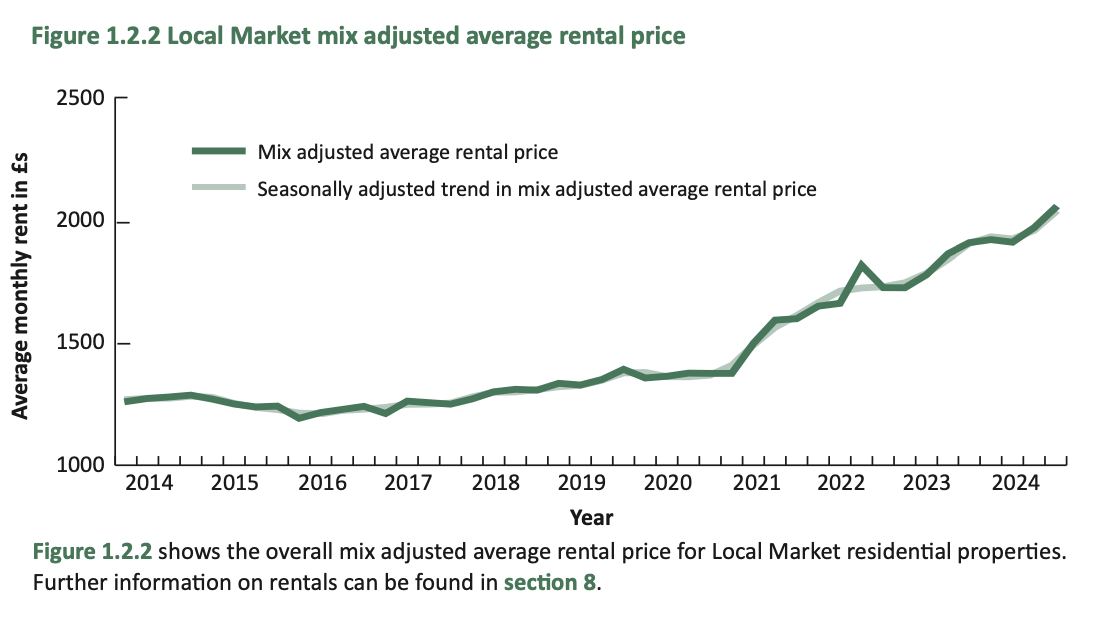

The mix adjusted average rental price for Local Market properties was £2,054 per calendar month between July and September this year. That is 4.2% higher than the previous quarter and 7.6% higher than the third quarter of 2023.

Rental prices are 47.5% higher than five years ago.

Pictured: Data from the the States Data and Analysis team.

The numbers are crunched by the States Data and Analysis team.

They use the 'mix adjusted price' which is a measure of the value of the properties sold during the quarter, not a reflection of the values of individual properties nor the change in the value of any one property over time. This caveat reflects the fact that many factors, including age, location and quality, determine the actual value of individual properties.

Of those properties bought and sold between July and September this year, there were 165 local market transactions - 20 more than the previous quarter, and 27 more than the third quarter of 2023.

While more properties have changed hands in recent months compared to the previous year, it is taking longer for houses to sell, with the four quarter rolling average time (between a Local Market property becoming available for purchase and its subsequent sale) increasing from 164 days last year to 221 days currently.

People are also accepting lower offers on their properties to sell them, having waited a bit longer on average for a buyer to make an offer with the latest data showing that the average final sale price has recently been, on average, 7.2% lower than the maximum advertised price.

This compares to 5.9% below asking price a year previously and 6.9% below asking price during the same period, in the third quarter, of 2019.

Pictured: Data from the the States Data and Analysis team.

Fewer new houses are being sold too with just 0.6% of Local Market purchases during the third quarter of 2024 having been built during the previous twelve months, compared to 7.2% in the third quarter of 2023.

Looking at the Open Market, 16 properties were sold between July and September this year with a raw median price (realty only) of £1,958,288, compared with £1,443,438 in the third quarter of 2023.

Stuart Leslie, Head of Residential Sales at Savills Guernsey, said the data for house sales suggests the markets are stabilising, but it remains sensitive.

“The property market has stabilised over the last three months or so," he said. "The start of the year began very much where 2023 left off, with the rise in the cost of living and increasing interest rates slowing activity. But as 2024 has progressed momentum has gathered pace.

“In the Local Market, lower monthly mortgage costs are beginning to feed through into improved confidence, prompting more sales. The more stable market has also given some clarity on values which has facilitated more accurate pricing and is why the gap between asking price and sale price has reduced.

“Proposed changes to the UK tax regime for ‘non doms’ meanwhile have also led to greater activity in the Open Market. Heavily trailed before Labour’s autumn budget, we have seen a marked uplift in enquires from potential buyers in readiness for a possible move as they question whether or not to remain in the UK.

“Looking ahead, the market will likely remain sensitive to short-term fluctuations in the cost of debt, so for those hoping to sell, realistic pricing will continue to be key. However in general we expect the impetus gained towards the end of this year to continue into 2025.”

Comments

Comments on this story express the views of the commentator only, not Bailiwick Publishing. We are unable to guarantee the accuracy of any of those comments.