The States of Alderney have proposed a raft of tax increases to turn a predicted £0.5million deficit into surplus.

The proposals from the Policy & Finance Committee include a 4% increase in Property Tax, a 5% increase in Water Rates, a 50% increase in vehicle import duty and an increase in freehold document duty.

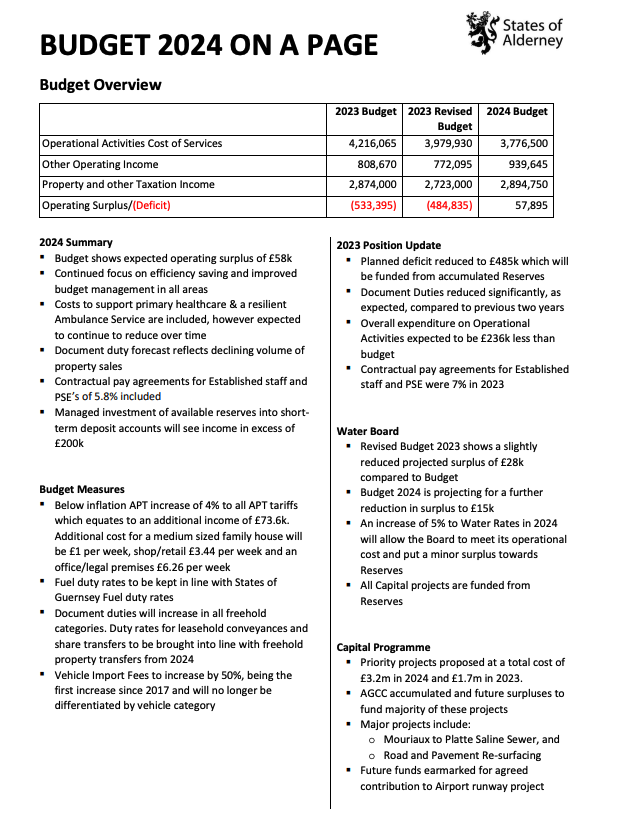

A deficit in the revenue budget for 2023 was forecast to be £533,000, but it’s claimed that by next year this could be totally wiped out by the end of 2024 and leave the government with an operating surplus of £57,895.

“Every department of the Civil Service and the States Members have worked hard to manage the deficit responsibly and thanks to this teamwork, we are on track to turn it from deficit to surplus next year,” said the P&F Chair, Nigel Vooght.

“No one said it would be easy and while we fully expected this would take us down the route of increasing taxes while making efficiency savings across the board, we have been able to keep such tax increases well below the rate of inflation. Tax increases are never welcome, but many will breathe a sigh of relief that they are not as high as we might have expected in the current economic climate.

“We have grappled with the huge cost of taking primary care and the ambulance service under our wing and with this proposed budget, we have found a way. This has been achieved by a combination of belt-tightening and finding new revenue streams, together with the necessity of raising taxes, albeit by a lesser amount than might have been expected.”

The States of Alderney Treasury has published their ‘budget on a page’ below:

Comments

Comments on this story express the views of the commentator only, not Bailiwick Publishing. We are unable to guarantee the accuracy of any of those comments.